Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 29, 2022

Seeking refuge in high forecasted dividends

Research Signals - July 2022

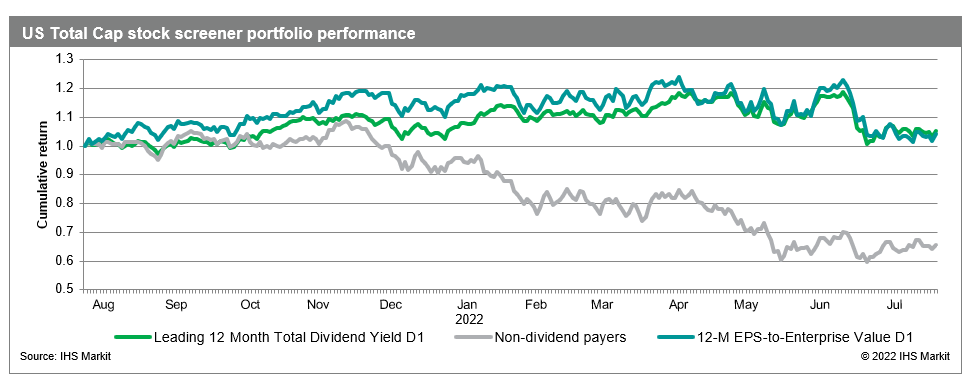

Since the start of the year, stocks have been challenged from several fronts including high inflation and central bank rate increases, alongside supply chain disruptions exacerbated by the war in Ukraine and renewed COVID restrictions in China. Almost every sector has sold off and, what is more, investors have not been able to turn to other asset classes such as bonds or cryptocurrencies to hedge their losses. So, what has been working in 2022? In this report we highlight strong performance associated with Leading 12 Month Total Dividend Yield from our proprietary Dividend Forecast factor suite.

- With dividend payments surging in the first half of the year, fueling our Dividend Forecasting team's expectation for 6.5% growth in global aggregate dividends in 2022, retail and institutional investors have gravitated to high dividend paying stocks

- The highest dividend yield firms outperformed non-dividend payers by significant double-digit margins across global regions over the past year and, in 2022, this signal surpassed other value indicators based on earnings estimate, particularly in Europe and Pacific regions

- Firms which passed our screen for attractive forecasted dividend yield include US-based Devon Energy and Energy Transfer LP and European banks Danske Bank and Natwest Group, while Danish shipping company A.P. Moller Maersk and American multinational beverage corporation The Coca-Cola Company are examples of firms with significant cash flow generation and an ability to maintain margins in a rising cost environment

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fseeking-refuge-in-high-forecasted-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fseeking-refuge-in-high-forecasted-dividends.html&text=Seeking+refuge+in+high+forecasted+dividends+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fseeking-refuge-in-high-forecasted-dividends.html","enabled":true},{"name":"email","url":"?subject=Seeking refuge in high forecasted dividends | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fseeking-refuge-in-high-forecasted-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Seeking+refuge+in+high+forecasted+dividends+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fseeking-refuge-in-high-forecasted-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}