Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 02, 2024

Shipping delays impact global supply chains and exports

Global Manufacturing PMI, sponsored by J.P.Morgan and compiled by S&P Global Market Intelligence showed worldwide supply chains to have been increasingly adversely affected by shipping delays in July. Shipping delays also led to reduced global export orders. Moreover, the effect of higher shipping rates on production costs intensified, and will remain a factor to be monitored in the coming months.

Increased shipping delays

Geopolitical events and climate changes have added to disruptions to global shipping, which manufacturers are now reporting to be causing increasing delays in the supply of inputs to factories.

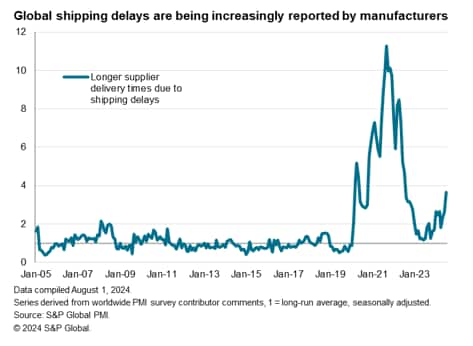

PMI survey data compiled by S&P Global includes the collection of anecdotal reporting from companies on causes of changes to key business metrics. This qualitative evidence can be analysed to produce data series which illustrate how different factors have affected business conditions over time. These are known as the PMI Comment Trackers. The data are presented in terms of the variance from long-run averages, which are scaled to a value of 1.0.

During the height of the pandemic the degree to which shipping delays were causing longer supplier delivery times reached nearly 12 times the long-run average. However, by early-2023 the number of shipping-related delays were nearly back to normal, as defined by the long-run average. However, 2024 has seen various factors disrupt shipping. These have included low water levels of the Panama Canal, which have restricted vessel volumes, and - more pervasively - Houthi rebel attacks on ships in the Red Sea, which have caused ships to divert around Africa instead of transporting goods into Europe via the Suez Canal. This has extended shipment times by up to two weeks.

The impact of these shipping delays has varied so far during 2024, but has picked up markedly in July, and is now running in at nearly four times the long run average. While this is still well below the peak impact seen during the pandemic, it represents an impact on supplier delivery times of the likes not seen by the PMI surveys in the 15 years of data available prior to the pandemic.

Export losses

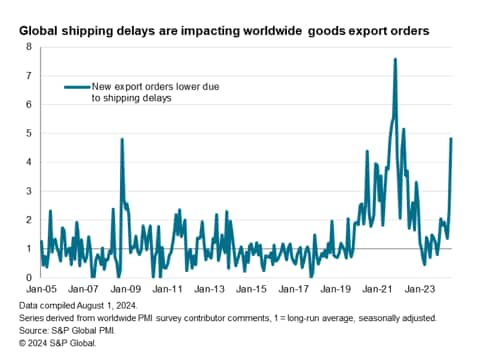

It's not just supplier delivery times that are lengthening due to shipping issues. The number of manufacturers reporting that new export orders have fallen in July also due to shipping delays has risen to nearly five times the long-run average. This compares favorably with a brief peak of just over 7.5 times the long run average at the height of the pandemic, but is clearly very elevated by historical standards. As such, the data point to shipping delays having had an increasingly detrimental impact on global trade and economic growth at the start of the third quarter.

Accordingly, the export losses caused by shipping delays contributed to a slight fall in global new export order volumes for a second month running in July.

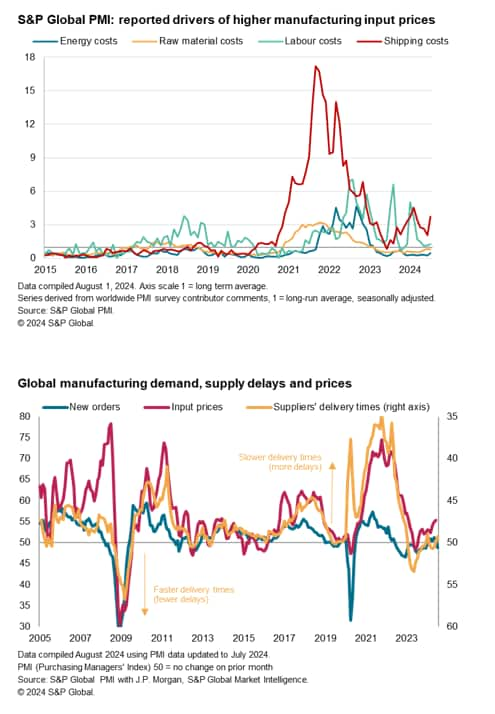

Higher shipping rates feed through to higher production costs

Higher shipping rates are also feeding through to higher manufacturing production costs to a degree not seen since February, albeit to a much lesser extent than seen during the pandemic.

Furthermore, other factors such as energy costs and broader raw material prices are having an inflationary impact below their long-run averages amid weak demand, and labour cost inflation is now having an impact only modestly above the long-run trend. The overall inflationary impact from shipping therefore remains modest at the moment, and global factory input cost inflation dipped very slightly in July, albeit running the second-highest seen over the past 17 months. However, this will be a factor to monitor in the coming months as central banks seek assurances that inflation pressures are moderating to sustainably low rates.

Supply chain variances

The degree to which supply chains are being stretched varied considerably around the world. In the eurozone, for example, suppliers' delivery times quickened on average in July, bucking a global trend of slower lead-times. But even within the eurozone, faster delivery times in Germany and Austria contrasted with slower deliveries in Greece, Spain and the Netherlands, and to lesser extents Italy and France.

Besides Myanmar, the highest degree of supply chain lengthening was seen in Australia, though with substantial incidences of delays also recorded in Taiwan, Mexico, Russia, Brazil and the UK, as well as Canada South Korea.

Few delivery issues were reported on average in the US and Japan.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshipping-delays-impact-global-supply-chains-and-exports-Jul24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshipping-delays-impact-global-supply-chains-and-exports-Jul24.html&text=Shipping+delays+impact+global+supply+chains+and+exports+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshipping-delays-impact-global-supply-chains-and-exports-Jul24.html","enabled":true},{"name":"email","url":"?subject=Shipping delays impact global supply chains and exports | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshipping-delays-impact-global-supply-chains-and-exports-Jul24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shipping+delays+impact+global+supply+chains+and+exports+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshipping-delays-impact-global-supply-chains-and-exports-Jul24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}