Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 03, 2022

Shipping market outlook - Container vs Dry bulk: Q2 2022 update

Shipping market outlook - Container vs Dry bulk : Q2 2022 update

Download the complimentary summary reports

English | Chinese | Japanese | Korean

As of writing (30 May 2022), Capesize rates dropped significantly and negatively impacted sentiments of smaller vessels. With an unexpected drop in freight rates, many long-position players either in FFA or physical have no options but to cover their position in the FFA market or secure cargo to near-term position, triggering more downside pressure in the short-term. However, regardless of the short-term sentiment-FFA driven rates movement, we believe that the fundamental supply and demand balance will eventually determine the market.

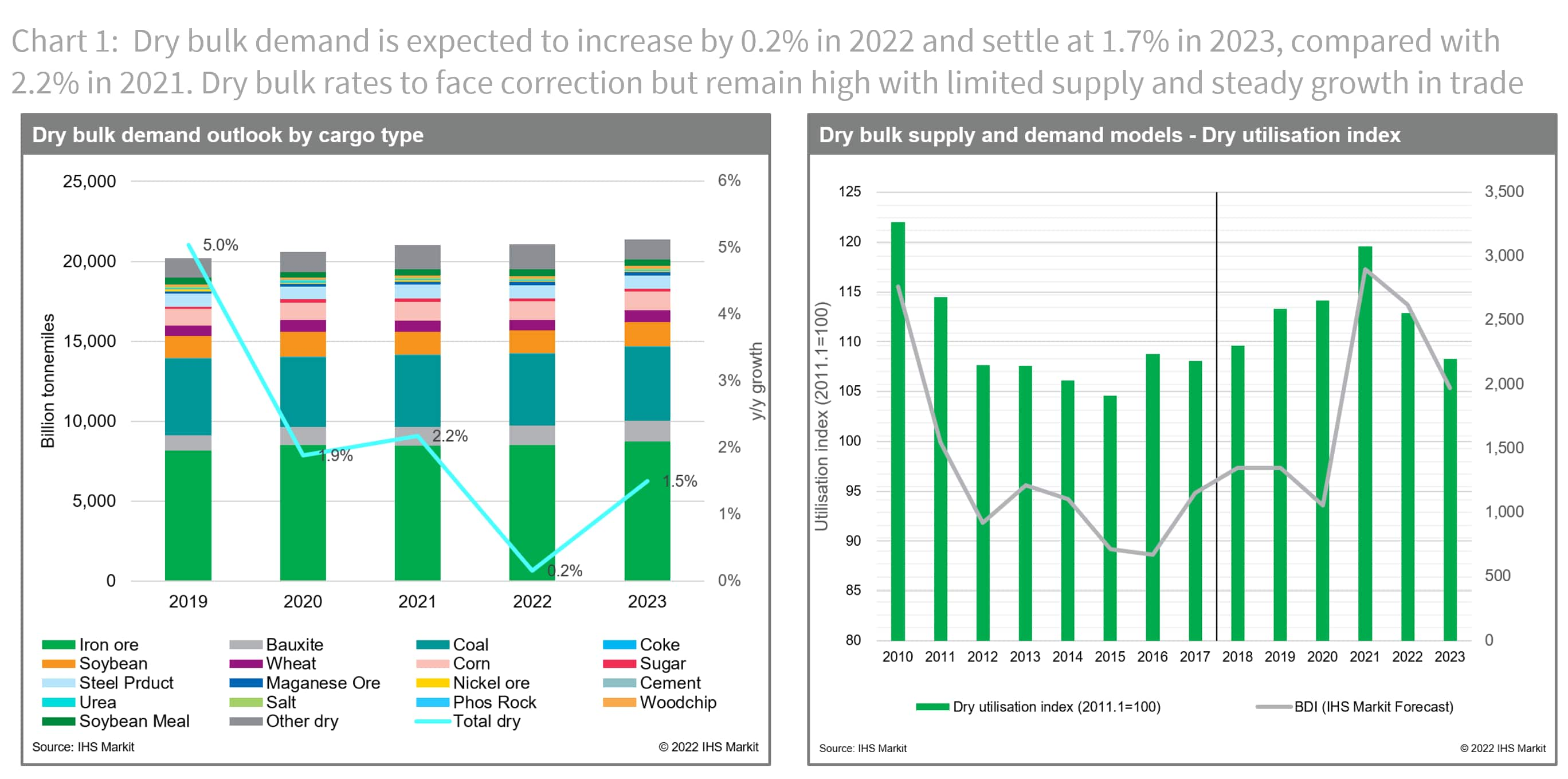

S&P Global Market Intelligence forecasts dry bulk rates to remain stable in the coming years with limited supply and stable growth in trade—more bullish in the near-term and bearish for medium-term. Dry bulk demand growth is expected to decrease to 0.2% in 2022 and settle at 1.7% in 2023, compared with 2.2% in 2021, while dry bulk fleet growth will slow to 2.8% in 2022, 2.2% in 2023, and 2.4% in 2024, compared with 3.4% in 2021.

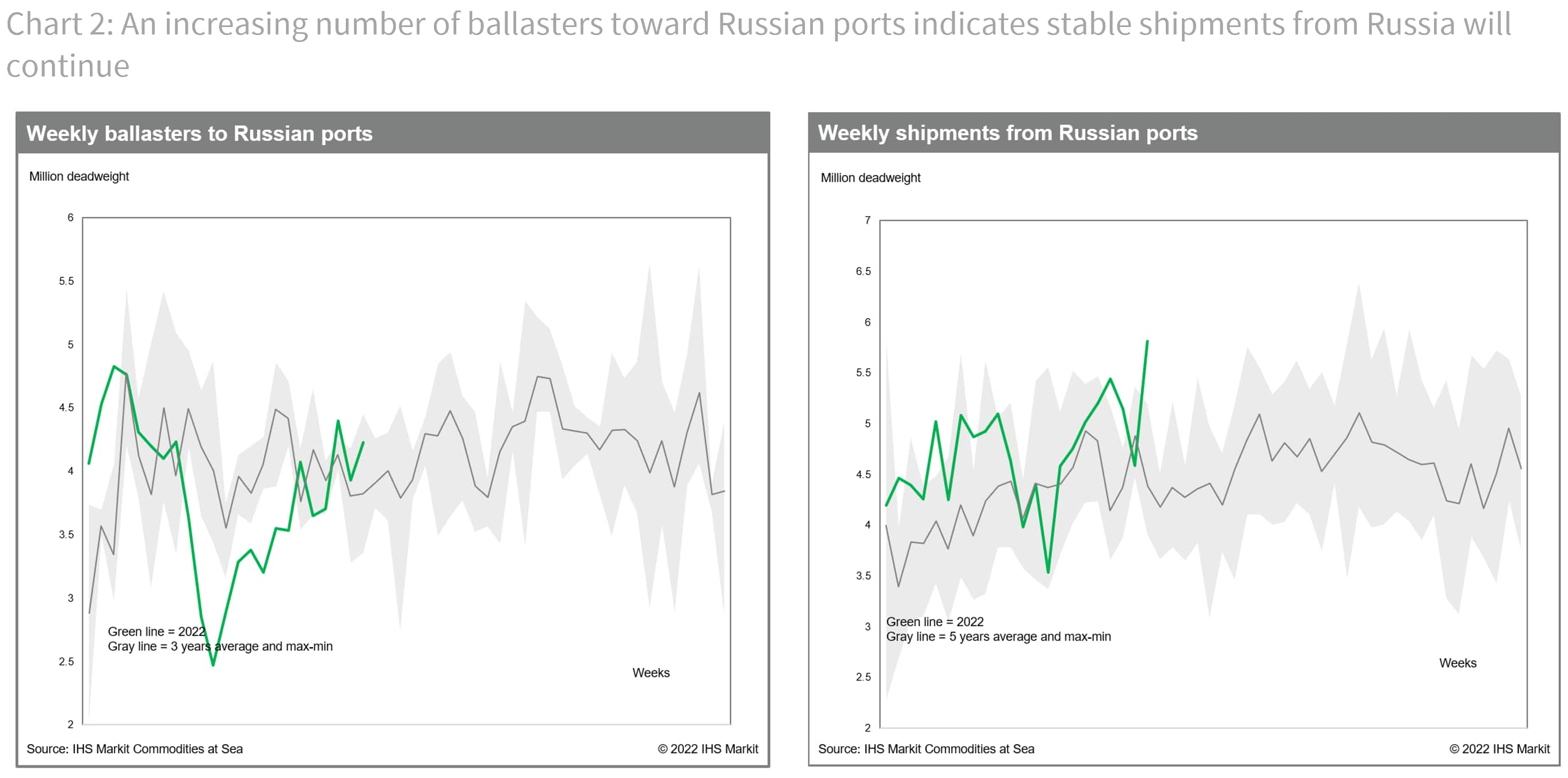

With Commodities at Sea from S&P Global Market Intelligence, we continue to witness the strength in Russian cargo shipments; increasing number of ballasters towards Russian ports indicate the stable shipments out of Russia will continue before several sanctions, including the European import ban, which starts in the third quarter. Furthermore, European demand for Australian coal to prepare for the consequences of Russian coal import ban, as well as stable minor bulk shipments, including steel out of the Pacific Basin, is expected to support backhaul routes in the near-term.

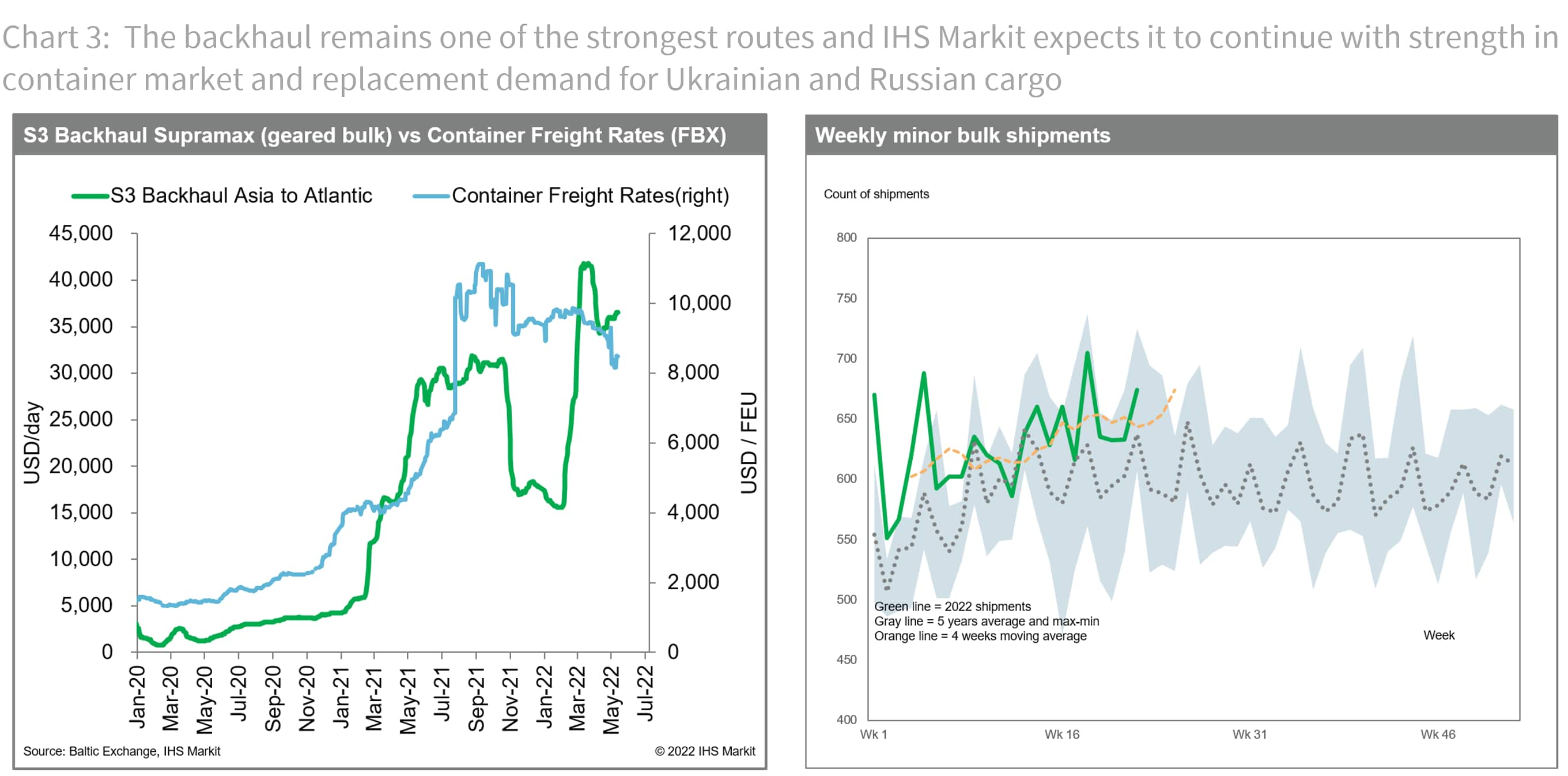

The backhaul remains one of the strongest routes and we expect it to continue with strength in the container market and replacement demand for Ukrainian and Russian cargo. We have consistently argued that as long as container rates remain high enough to capture part of general bulkers and open hatch cargo vessels in the container sector commercially, geared bulker rates are expected to be supported, specifically for backhaul routes. General cargo (breakbulk) vessels that have shared similar terminal and cargo with geared bulkers (Supramax and Handysize) have shifted to the container-linked market because of extremely high freight rates for container ships this year; container cargo has been spilling over to general cargo ships (breakbulk/MPV/HL), while minor bulk cargo usually carried by container or general cargo vessels have shifted to geared bulkers. Furthermore, with general cargo ships mostly picking up container-related cargoes, there has been much less competition from general cargo vessels for Supramax/Handysize minor bulk routes. These higher demand and lesser supply balance have boosted geared bulkers' backhaul rates even higher.

However, we remain cautious towards the end of the year as we have observed several downside risks from the later part of the third quarter of 2022 compared with the same period in 2021. Specifically, we are tracking the mainland Chinese coal market very carefully since stronger domestic coal production in mainland China may eventually limit mainland Chinese coal import demand, which was one of the main drivers for the strength in the third quarter of 2021. Furthermore, we do not expect extremely high congestion again in the coming quarters as the result of the easing of COVID-19 restriction. Also, the softening of the container trade growth, along with high inflation, will be a major risk towards the end of the year when the third quarter peak season is over.

See the list of risk factors below.

• Softening container market with changing consumer pattern, as

well as weaker purchasing power that will impact smaller segments'

minor bulk demand

• Higher efficiency or productivity of vessels with reduced

congestion and higher speed

• Lower Russian coal demand after the European and Japanese coal

import ban, stronger domestic coal production in mainland

China

• Limited wheat export volume during the Black Sea grain season

DOWNLOAD THE FULL REPORT FOR DEEPER ANALYSIS COVERING STEEL, IRON ORE, COAL, GRAIN, AND FREIGHT

In this context, S&P Global Market Intelligence Freight Rate Forecast models predicts Baltic Dry Index (BDI) to increase in the early third quarter compared with the second quarter with the restocking demand from Europe before the Russian coal imports ban and seasonal recovery in shipments as well as continued strength in commodity prices. However, the dry bulk earning is expected to fall about 20-30% on the year to average about 2,500 - 3,000 points in second half 2022 with several downside risks, including the major supply-side impact from the Ukraine-Russia conflict and demand-side impact from weaker mainland Chinese economy and stronger domestic coal production and softening container market.

Specifically on the container market impact, we have consistently argued that as long as container freight rates remain high enough to capture part of general cargo vessels (multipurpose) and open hatch cargo vessels share in the container sector commercially, small geared bulker rates are expected to be supported, specifically for the backhaul routes. That is why our major assumption for dry bulk demand and supply has been heavily linked with the container market outlook.

Currently, we assume container freight rates will also face correction and decline by 20-30% to average about $6,000-7,000 per box (FEU) in the second half of 2022 from an average of about $9,000-10,000 per box (FEU) over the same period last year. The softening of container trade growth in response to high inflation rate, endemic consumer pattern, and supply side pressure with heavy investment in newbuildings, as well as reduced congestion with the easing of COVID-19 restrictions will be major downside risks in the second half of the year, specifically after the third-quarter peak season is over.

Another lockdown in mainland China, slower than expected economic growth with continued high inflation, and a lack of stimulus would be a major downside risk, while continued strength in container freight with high congestion and limited infrastructure, as well as lower-than-expected domestic coal production in mainland China and earlier-than-expected reopening of Ukrainian sea ports would be a major upside risk in our forecast.

For more insight subscribe to our complimentary commodity analytics newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshipping-market-outlook-container-vs-dry-bulk-q2-2022-update.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshipping-market-outlook-container-vs-dry-bulk-q2-2022-update.html&text=Shipping+market+outlook+-+Container+vs+Dry+bulk%3a+Q2+2022+update+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshipping-market-outlook-container-vs-dry-bulk-q2-2022-update.html","enabled":true},{"name":"email","url":"?subject=Shipping market outlook - Container vs Dry bulk: Q2 2022 update | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshipping-market-outlook-container-vs-dry-bulk-q2-2022-update.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shipping+market+outlook+-+Container+vs+Dry+bulk%3a+Q2+2022+update+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshipping-market-outlook-container-vs-dry-bulk-q2-2022-update.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}