Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 04, 2023

Short interest climbs higher across the Asia real estate management and development sector

DOWNLOAD PDF VERSION HERE

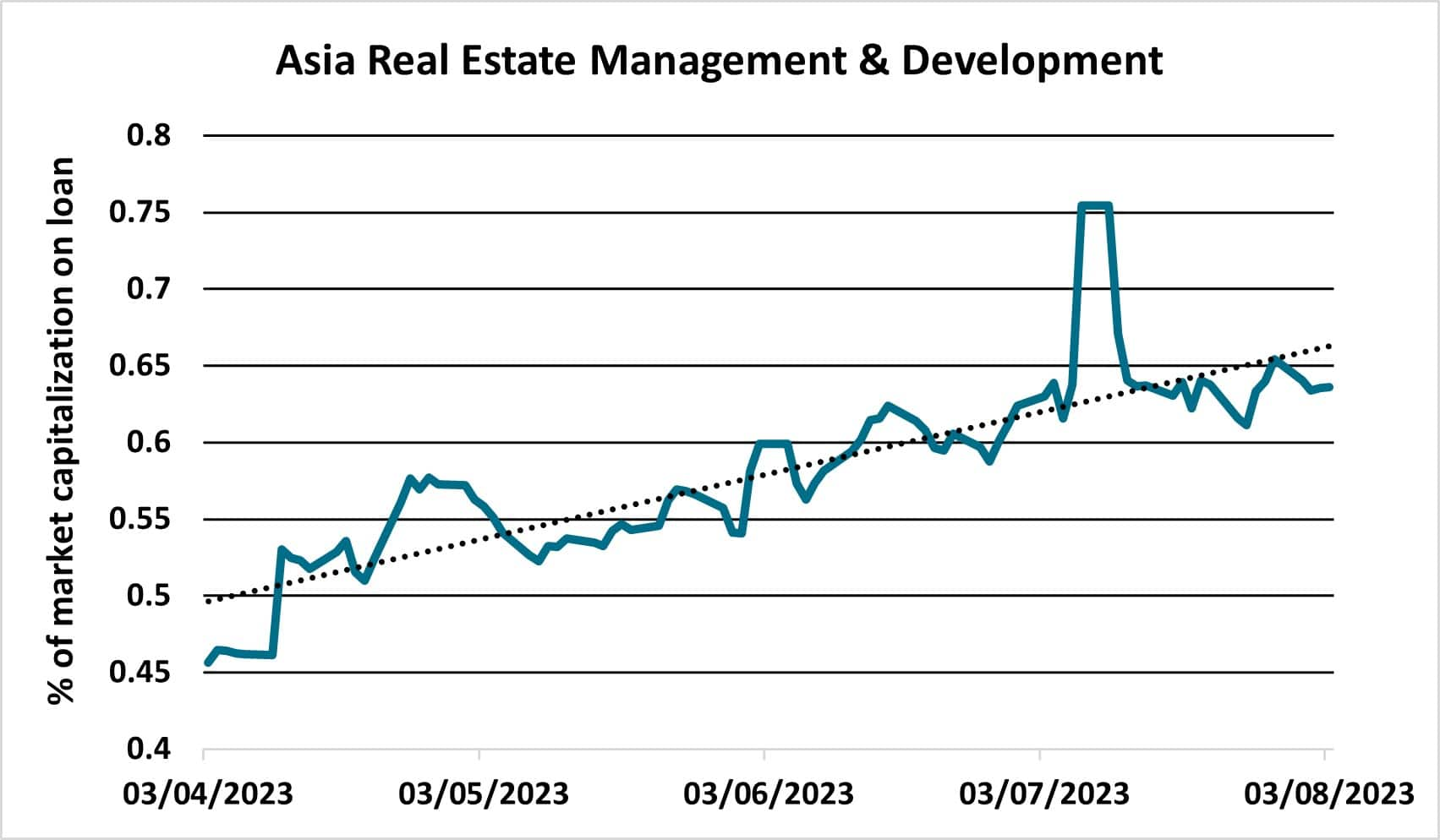

The percentage of market capitalization on loan across the Asia real estate management and development sector experiences strong increases as property companies in the region come under pressure.

Falling sales across Asia's real estate sector is causing short interest across the Asian real estate management and development sector to increase. The recent cancellation of a share placement by one of China's biggest property developers on August 1st underlined the risks facing property developers in the region. Recent data showing that new home sales by China's 100 biggest property developers fell by 33% in July when compared YoY has sparked a renewed interest in the borrowing of shares issued by Asian property developers.

Historically, China has depended upon its property industry to help fuel its economic growth, accounting for approximately a quarter of the country's economic output. Given the recent softening in economic data and increased chatter of central government stimulus, distressed developers in the region are once again coming under pressure from short sellers.

The percentage of market capitalization on loan has been rising steadily since April this year, reaching a recent high of 0.75% at the beginning of July.

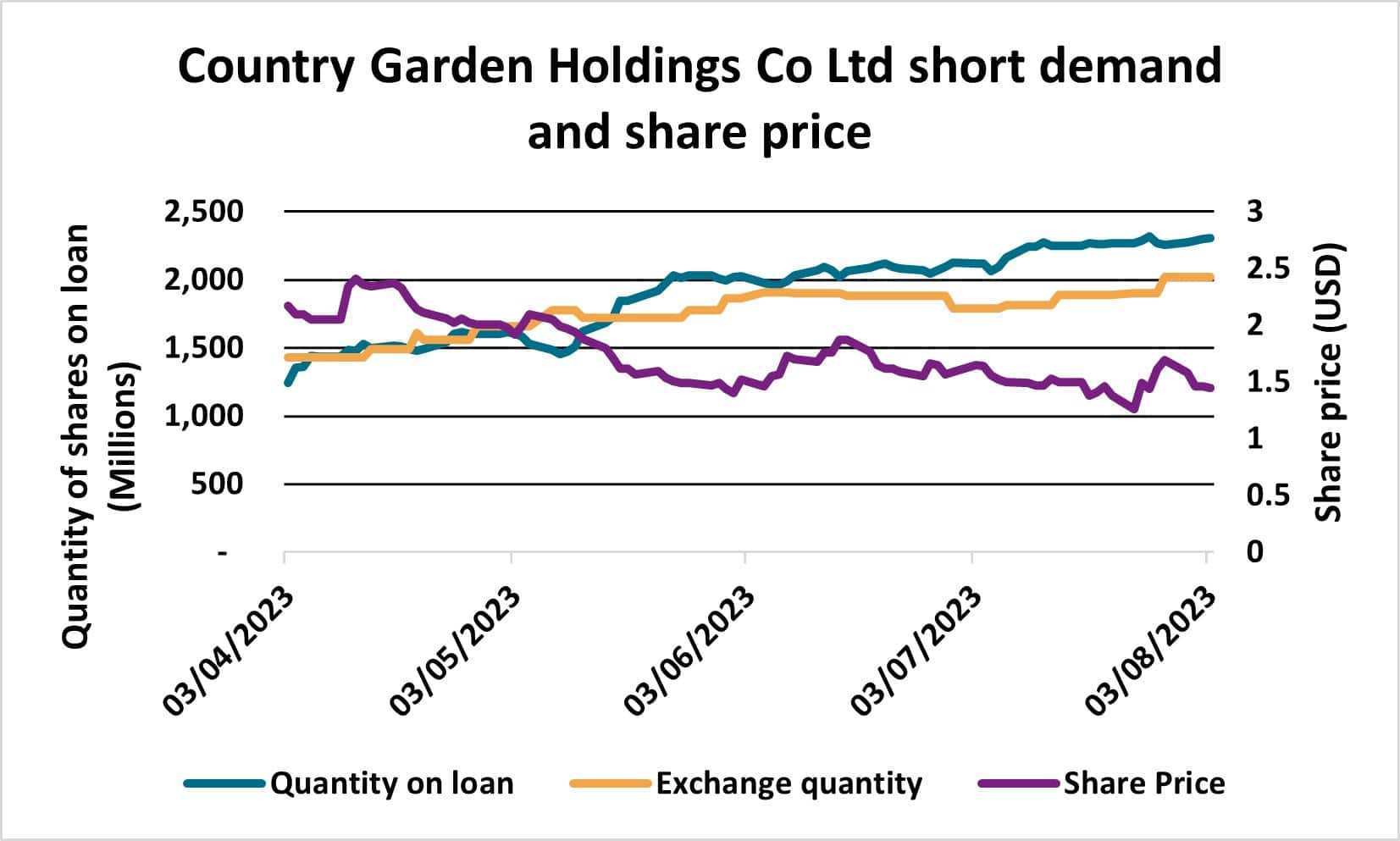

Country Garden Holdings Co Ltd (2007), the property firm that reportedly pulled their latest attempt to raise $300 million via a share offering in Hong Kong, has experienced strong borrowing demand in the securities lending markets.

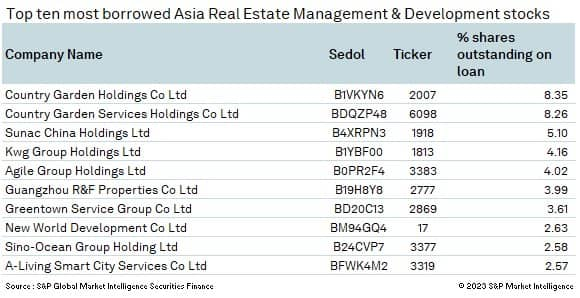

Country Garden Holdings Co Ltd (2007) continues to be the most heavily borrowed stock within the sector as it faces $2.9B of debt repayments for the rest of the year, weighing heavily on its ability to retain liquidity and meet payment deadlines. Average borrowing fees continue to move higher as active utilization surpasses 90% and the percentage of shares outstanding on loan in the company surpasses 8.5% of the free float.

Even though the People's Bank of China has agreed to extend outstanding loans across the sector, financial markets remain cautious of the sectors ability to manage its heavy debt burden whilst retaining the ability to generate value for investors.

Further changes in sentiment or economic data will remain key considerations for investors in the coming months as the sector remains on the watch list of regional governments, regulators, and financial markets.

For more information on how to access this data set, please contact the sales team at:

Global-EquitySalesSpecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshort-interest-climbs-higher-across-the-asia-real-estate-manag.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshort-interest-climbs-higher-across-the-asia-real-estate-manag.html&text=Short+interest+climbs+higher+across+the+Asia+real+estate+management+and+development+sector+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshort-interest-climbs-higher-across-the-asia-real-estate-manag.html","enabled":true},{"name":"email","url":"?subject=Short interest climbs higher across the Asia real estate management and development sector | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshort-interest-climbs-higher-across-the-asia-real-estate-manag.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+interest+climbs+higher+across+the+Asia+real+estate+management+and+development+sector+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fshort-interest-climbs-higher-across-the-asia-real-estate-manag.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}