Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 17, 2023

Singapore economic expansion moderates as global economy slows

The Singapore economy grew at a pace of 3.8% year-on-year (y/y) in 2022, helped by significant easing of pandemic-related restrictions. However, Singapore's manufacturing sector faced increasing headwinds during the second half of 2022 due to the slowdown in the US, EU and mainland China.

This has been mitigated by improving conditions in the service sector, notably the rebound in international tourism, business conventions and air travel as border restrictions are easing across much of the Asia-Pacific region. The reopening of international borders in mainland China is expected to further boost the rebound in international tourism inflows.

Singapore economy shows some moderation

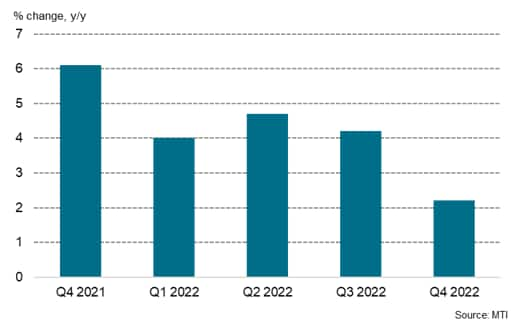

Singapore's advance estimate for Fourth Quarter GDP for 2022 showed a moderation in the pace of growth to 2.2% y/y, compared with 4.2% y/y in the Third Quarter. On a quarter-on-quarter basis, GDP growth slowed to 0.2% q/q in Q4 2022, compared with 1.1% q/q in Q3 2022.

Singapore real GDP growth

The service sector recorded a small contraction of 0.4% q/q in Q4 2022, although showing positive growth of 4.1% y/y. The gradual removal of many COVID-19 related restrictions since April 2022 supported buoyant growth in the accommodation and food services, real estate, administration and support services segment, which grew by 8.2% y/y.

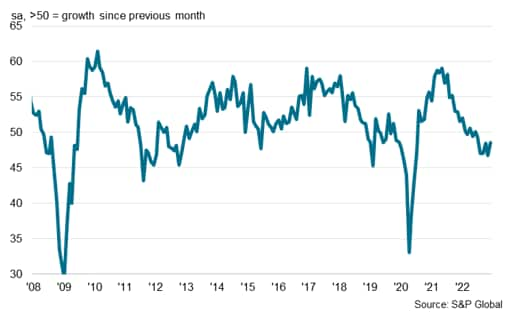

The headline seasonally adjusted S&P Global Singapore Purchasing Manager's Index (PMI) eased from 56.2 in November to 49.1 in December. Posting below the 50.0 neutral threshold, the PMI signalled a deterioration in private sector conditions following a two-year growth period, albeit at a mild rate.

S&P Global Singapore PMI

Manufacturing sector slowdown

Latest statistics from Singapore's Economic Development Board showed that manufacturing output continued to weaken in November, declining by 3.2% year-on-year (y/y). This reflected contraction in output of electronics and also chemicals, with together account for 53.3% of the total weight of the manufacturing sector.

The slowdown in global electronics demand has impacted on electronics output, which fell by 12.4% y/y in November, with output in the key semiconductors segment declining by 14.0% y/y. Chemicals output fell by 11.3% y/y in November, with petrochemicals output declining by 17.5% y/y due to the impact of both weak demand as well as plant maintenance shutdowns.

Singapore manufacturing output

Overall, total manufacturing output growth during the first eleven months of 2022 was up 3.3% y/y. However, the electronics sector will face continuing headwinds in the near term due to weak growth momentum expected for the US and EU in 2023.

Inflation pressures

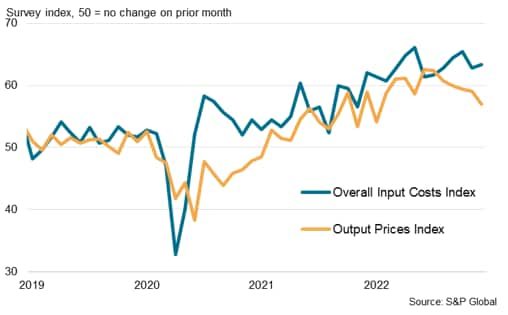

According to the December S&P Global Singapore PMI survey, input cost inflation rose at the end of 2022, attributed to higher purchase costs and wages. Cost pressures heightened with higher prices reported across a range of categories such as raw materials, transportation and energy, and was further aggravated by rising interest rates and currency conversion costs. Despite the rise in input costs, output price inflation fell according to latest survey indications. Firms continued to share their cost burdens with clients but at a slower rate in December so as to avoid further dampening demand.

Singapore PMI input and output prices

Singapore's CPI inflation rate remained at 6.7% % year-on-year (y/y) in November, the same pace as in October and remaining lower than the 7.5 y/y recorded in September. The Monetary Authority of Singapore (MAS) Core Inflation measure remained at 5.1% y/y in November, the same pace as in October and remaining below the 5.3% y/y recorded in September.

The MAS and Ministry of Trade and Industry (MTI) estimate that for calendar 2022, CPI All Items inflation is expected to average around 6.0%, and MAS Core Inflation around 4.0%.

Moderating global electronics demand adds to headwinds

The electronics manufacturing industry is a key segment of Singapore's manufacturing sector, accounting for 40% of the total weight of manufacturing output, dominated by semiconductors-related production. The latest S&P Global survey data indicates that the global electronics manufacturing industry is facing headwinds from the weakening pace of global economic growth.

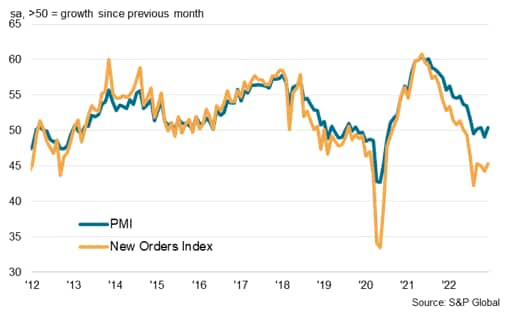

According to the headline S&P Global Electronics PMI survey, the global electronics composite index was at 50.4 in December 2022, improving slightly compared to 49.1 in November, but still showing a significant slowdown compared with late 2021 and early 2022. The latest survey results indicate that the global electronics industry is now experiencing neutral conditions, although output and new orders remain weak.

S&P Global Electronics Output PMI

The two principal sub-components of the Global Electronics PMI - new orders and output - both remained in contraction territory during December. December survey data indicated a significant reduction in backlogs of work at global electronics manufacturers. Lower new order inflows allowed firms to work through outstanding business in a timely manner, according to panellists.

Weakening economic growth momentum in the US and EU has impacted on consumer demand for electronics, with the economic slowdown in mainland China during 2022 also contributing to the downturn in new orders.

S&P Global Electronics PMI and new orders

Singapore's economic outlook

The Singapore economy recorded a second year of economic recovery from the pandemic in 2022, growing by 3.8% y/y, after growth of 7.6% y/y in 2021. Singapore's GDP growth in 2022 was buoyed by strong growth in domestic consumption and an upturn in international tourism expenditure, as COVID-19 restrictions were progressively eased in Singapore as well as a growing number of other Asia-Pacific economies.

However, with increasing headwinds to global growth momentum in 2023 due to expected weak growth in the US and EU at the outset of 2023, the outlook for Singapore's manufacturing sector and some trade-related services is for weaker growth in 2023. With domestic demand in mainland China expected to gradually improve during 2023, this should help to mitigate the impact of slowing export orders for Singapore's manufacturing sector from the US and EU.

The increase in Singapore's Goods and Services Tax by 1% from 7% to 8% implemented on 1st January 2023 will also act as a slight drag on economic growth, raising fiscal revenue by an estimated 0.7% of GDP per year.

In 2023, taking into account the 1% increase in GST from 1st January 2023, headline and core CPI inflation are projected to average 5.5%-6.5% and 3.5%-4.5% respectively. MAS Core Inflation is projected by the MAS and MTI to remain elevated over the next few quarters, with risks still tilted to the upside, due to factors such as potential renewed shocks to world commodity prices and persistent global inflation pressures. Although prices of energy and food commodities have eased from their peaks, businesses will face higher utility prices and rising unit labour costs in the near-term. The MAS and MTI expect that MAS Core Inflation will moderate in the second half of 2023, as tightness in the domestic labour market eases and global inflation pressures moderate.

The medium-term outlook for Singapore's manufacturing sector is supported by a number of positive factors.

The medium-term global demand outlook for Singapore's electronics industry remains favourable. The outlook for electronics demand is underpinned by major technological developments, including 5G rollout over the next five years, which will drive demand for 5G mobile phones. Demand for industrial electronics is also expected to grow rapidly over the medium term, helped by Industry 4.0, as industrial automation and the Internet of Things boosts rapidly growth in demand for industrial electronics.

In the biomedical manufacturing sector, significant new manufacturing facilities are being built by pharmaceuticals multinationals. This includes a new vaccine manufacturing facility being built by Sanofi Pasteur and a new mRNA vaccine manufacturing plant being built by BioNTech.

The aerospace engineering sector is currently experiencing rapid growth as the reopening of international borders in APAC is boosting commercial air travel across the region. Singapore's role as a leading international aviation hub is likely to continue to strengthen over the medium-term, helped by strong growth in APAC air travel and its role as a key Maintenance, Repair and Overhaul (MRO) hub in APAC.

In the service sector, Singapore is expected to continue to be a leading global international financial centre for investment banking, wealth management and asset management. Singapore will also continue to be a key APAC hub for shipping, aviation and logistics, as well as an important APAC hub for regional headquartering.

However an important long-term challenge for the Singapore economy will be from ageing demographics, which will result in rising social welfare costs and could gradually reduce Singapore's long-term potential GDP growth rate.

Read the accompanying press release here.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-expansion-moderates-as-global-economy-slows-Jan23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-expansion-moderates-as-global-economy-slows-Jan23.html&text=Singapore+economic+expansion+moderates+as+global+economy+slows+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-expansion-moderates-as-global-economy-slows-Jan23.html","enabled":true},{"name":"email","url":"?subject=Singapore economic expansion moderates as global economy slows | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-expansion-moderates-as-global-economy-slows-Jan23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Singapore+economic+expansion+moderates+as+global+economy+slows+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapore-economic-expansion-moderates-as-global-economy-slows-Jan23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}