Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 10, 2023

Singapore's economic growth improves in third quarter of 2023

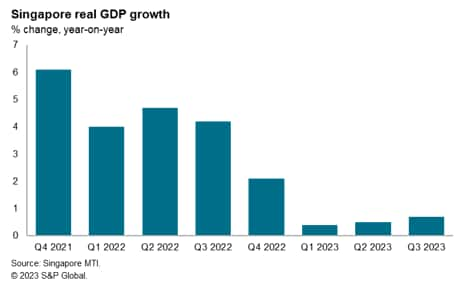

Singapore's economic growth momentum in 2023 year-to-date has slowed significantly compared with annual GDP growth of 3.6% in 2022. A key factor driving the weakness of economic growth has been contracting manufacturing output and exports. However, GDP growth momentum improved to a pace of 0.7% growth year-over-year (y/y) in the third quarter of 2023, compared with 0.5% y/y in the second quarter of 2023.

The near-term outlook is expected to remain constrained by weak demand in several important export markets for Singapore's manufactures, notably the mainland China and European Union (EU). The service sector economy is expected to be more resilient, boosted by the continued recovery of international tourism travel in the APAC region. Notably, Singapore's international tourism arrivals have rebounded strongly during 2023.

Singapore economy improves in third quarter of 2023

According to the advance GDP statistics for Q3 2023 GDP released by Singapore's Ministry of Trade and Industry (MTI), Singapore's GDP growth rate was 0.7% year-over-year (y/y) in the third quarter of 2023, improving on the 0.5% y/y in the second quarter of 2023. but much weaker than the 3.6% annual GDP growth rate achieved in 2022.

Measured on a quarter-on-quarter basis (q/q), GDP growth was up 1.0% q/q in the third quarter of 2023, much stronger than the 0.1% q/q growth rate in the second quarter of 2023.

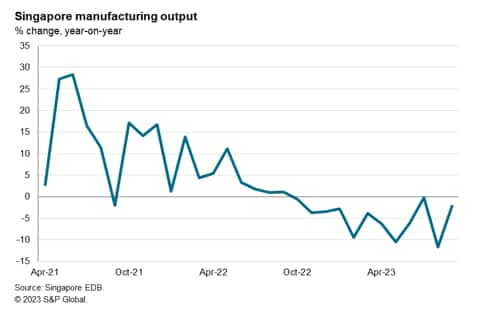

Manufacturing output rose by 0.2% q/q in Q3 2023 compared with a contraction of 1.5% q/q in Q2 2023 and a decline of 4.5% q/q in Q1 2023. However, on a year-over-year basis, manufacturing output continued to show a significant contraction of 5.5% y/y in the third quarter of 2023, after declining by 7.7% y/y in the second quarter.

The construction sector remained a bright spot amongst the goods-producing industries, with output up by 6.0% y/y in Q3 2023, after a rise of 7.7% y/y in Q2 2023 and 7.9% y/y in Q1 2023.

The service sector also showed positive growth of 1.9% y/y in Q3 2023, compared with 2.8% y/y in Q2 2023, Services output was up 0.7% q/q in Q3 2023. The removal of many COVID-19 restrictions since April 2022 and improving tourism flows supported buoyant growth in the accommodation segment, which grew by 4.7% y/y in Q3 2023, after 6.1% y/y in Q2 2023 after growing by 6.8% y/y in Q1 2023.

International tourism has rebounded during 2023, with total international visitor arrivals having reached 10.1 million for the first nine months of 2023 an increase of 171% compared to the same period of the previous year. The tourism rebound has been helped by strong tourism inflows from other APAC nations, notably Indonesia, Malaysia, India and Australia. There has also been a significant upturn in visitors from mainland China in recent months. The number of visitor arrivals is broadly on track to meet the Singapore Tourism Board's target of 12 million tourist visitors in 2023, about double the total tourism arrivals in 2022, which was estimated at 6.3 million.

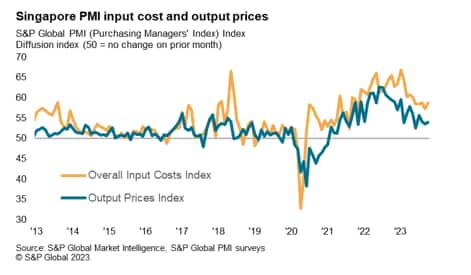

Singapore's private sector expansion was sustained at a strong pace in October, according to the latest PMI data. Solid new business growth drove higher total activity.

The headline seasonally adjusted S&P Global Singapore Purchasing Manager's Index (PMI) posted 53.7 in October. Although slightly lower than the 54.2 reading in September, the latest reading continued to signal a solid expansion in private sector conditions. Moreover, this marked the eighth consecutive month in which Singapore's private sector economy expanded.

Manufacturing sector slowdown continues in third quarter of 2023

Latest statistics from Singapore's Economic Development Board showed that manufacturing output continued to contract in September 2023 compared to the same month a year ago, declining by 2.1% y/y. However, when measured on a month-on-month (m/m) basis, manufacturing output rose by 10.7% m/m.

There was a mixed picture across different industry segments. Electronics output rose by 10.2% y/y in September while chemicals output fell by 12.9% y/y. Transport engineering output rose by 13.2% y/y. However, precision engineering output fell by 10.4% y/y while biomedical manufacturing slumped by 18.9% y/y, due to a 41.4% y/y decline in pharmaceuticals output.

Reflecting the weakness of manufacturing sector new orders since mid-2022, Singapore's non-oil domestic exports (NODX) fell by 13.2% y/y in September after declining by 22.5% y/y in August, according to latest data released by Enterprise Singapore.

Exports of electronics products fell by 11.6% y/y in September after a decline of 21.1% y/y in August. Exports of non-electronic products also showed a steep decline of 13.6% y/y in September 2023. Key export sectors recording large declines were exports of pharmaceuticals, which fell by 31.2% y/y. Exports of non-electronic products to mainland China rebounded by 34.5% y/y, after falling by 19.5% y/y in August. This helped to mitigate the impact of declining electronic exports, resulting in total non-oil domestic exports to mainland China rising by 26.2% y/y in September.

Non-oil domestic exports to South Korea remained weak, declining of 29.2% y/y in September. Exports of electronics products fell by 20.2% y/y, while exports of non-oil domestic products fell by 32.9% y/y.

Meanwhile exports to the US rose by 9.7% y/y in September 2023, reversing the strong contraction of 32.4% y/y in August.

Inflation pressures persist

According to the latest S&P Global Singapore PMI survey, average input prices rose in October, reflecting higher input costs and wages. Furthermore, the rate at which average input prices increased accelerated to the joint-highest since May. Purchase prices rose as supply constraints worsened, which simultaneously led to a lengthening of lead times in October. Due to higher input prices, Singaporean private sector firms continued to raise their own output prices.

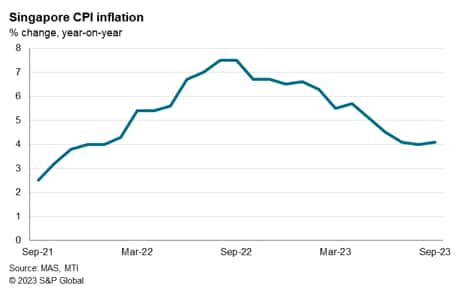

Singapore's headline CPI inflation rate edged up to 4.1% y/y in September compared with 4.0% y/y in August. The Monetary Authority of Singapore (MAS) Core Inflation measure fell to 3.0% y/y in September compared with 3.4% y/y in August.

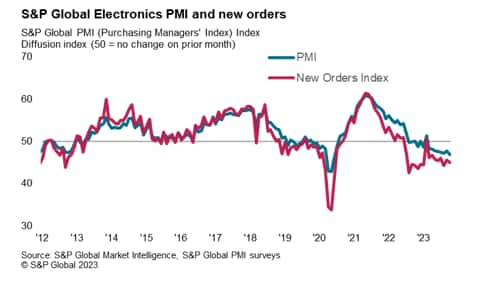

Headwinds from moderating global electronics demand

The electronics manufacturing industry is a key segment of Singapore's manufacturing sector, accounting for 40% of the total weight of manufacturing output, dominated by semiconductors-related production. S&P Global survey data since mid-2022 indicates that the global electronics manufacturing industry is continuing to face headwinds from the weak pace of global economic growth.

The headline seasonally adjusted S&P Global Electronics PMI fell to 46.9 in October compared with 47.7 in September, continuing to signal contractionary conditions in the global electronics sector. New orders remained weak, with a reading of 45.0, still signalling contraction in global demand for electronics.

According to data from Singapore's Economic Development Board, Singapore's electronics output rose by 10.2% in September, although electronics output was down by 6.8% y/y in the first nine months of 2023. Semiconductors output, which accounts for the largest share of total electronics production in Singapore, rose by 13.5% y/y in September, although posting a decline of 6.6% y/y for the first nine months of 2023.

Singapore's non-oil domestic exports of electronics continued to show sharp declines in September 2023, falling by 11.6% year-on-year according to exports data released by Enterprise Singapore. Exports of integrated circuits fell by 16.2% y/y, while exports of PCs fell by 33.2% y/y.

Exports of electronics products to mainland China remained very weak in September, declining by 13.0% year over year. Singapore's electronics exports to South Korea fell sharply, by 20.2% year-over-year. Electronics exports to the US contracted marginally, falling by 2.9% year-over-year in September. However, electronics exports to Japan rebounded, rising by 17.8% y/y. Electronics exports to the EU showed a strong upturn, with positive growth of 30.8% year over year.

Singapore's economic outlook

After a second year of rapid economic recovery from the pandemic in 2022, economic growth momentum has moderated significantly during 2023. GDP growth is forecast by S&P Global Market Intelligence to slow to 1.2% in 2023, a significant moderation in growth momentum compared with GDP growth of 3.6% in 2022 and 8.9% y/y in 2021.

According to the September 2023 Survey of Professional Forecasters produced by the MAS, the median GDP forecast for 2023 is for growth of 1.0%, significantly lower than the forecast from the June 2023 Survey, which was for GDP growth of 1.4% in 2023.

With continuing headwinds to global growth momentum in 2023 due to very weak growth in the US and EU and sluggish economic recovery in mainland China, the outlook for Singapore's manufacturing sector remains challenging. However, stronger exports of services, notably due to rising international tourist arrivals, will help to mitigate the impact of weaker growth in manufacturing exports.

The increase in Singapore's Goods and Services Tax by 1% from 7% to 8% implemented on 1st January 2023 has also acted as a slight drag on economic growth in 2023, raising fiscal revenue by an estimated 0.7% of GDP per year.

In 2023, taking into account the 1% increase in GST from 1st January 2023, headline and core CPI inflation are projected to average 4.5%-5.5% and 3.5%-4.5% respectively. MAS Core Inflation is projected by the MAS and MTI to moderate in the second half of 2023, as import costs remain low and tightness in the labour market eases. However the MAS and MTI note upside risks to the inflation outlook from potential shocks to global food commodity prices as well as if persistent tightness in the labour market keeps upward pressures on wage rises.

The medium-term outlook for Singapore's manufacturing sector is supported by a number of positive factors.

Despite near-term headwinds, medium-term prospects for Singapore's electronics industry remains favourable. The outlook for electronics demand is underpinned by major technological developments, including 5G rollout over the next five years, which will drive demand for 5G mobile phones. Demand for industrial electronics is also expected to grow rapidly over the medium term, helped by Industry 4.0, as industrial automation and the Internet of Things boosts rapidly growth in demand for industrial electronics. Singapore also remains an attractive hub for supply chain diversification for some high value-added segments of the electronics industry, as electronics manufacturers continue to diversify their supply chains for production of critical electronics products, notably semiconductors. Reflecting these trends, in 2022, Singapore attracted significant new foreign direct investment inflows into electronics manufacturing.

In the biomedical manufacturing sector, a number of new manufacturing facilities are being built by pharmaceuticals multinationals. This includes a new vaccine manufacturing facility being built by Sanofi Pasteur and a new mRNA vaccine manufacturing plant being built by BioNTech.

The aerospace engineering sector is currently experiencing rapid growth as the reopening of international borders in APAC is boosting commercial air travel across the region. Singapore's role as a leading international aviation hub is likely to continue to strengthen over the medium-term, helped by strong growth in APAC air travel and its role as a key Maintenance, Repair and Overhaul (MRO) hub in APAC.

In the service sector, Singapore is expected to continue to be a leading global international financial centre for investment banking, wealth management and asset management. Singapore will also continue to be a key APAC hub for shipping, aviation and logistics, as well as an important APAC hub for regional headquartering.

However, an important long-term challenge for the Singapore economy will be from ageing demographics. In Budget 2023, the Finance Minister stated that a key issue for the Singapore economy over the medium to long term will be from demographic ageing, with Singapore having one of the world's fasted ageing populations. The proportion of Singapore's population that is currently aged over 65 years is one-sixth of the population, but this will rise to an estimated one-quarter by 2030. This will result in rising healthcare and social welfare costs and could gradually reduce Singapore's long-term potential GDP growth rate. The role of fiscal policy in addressing demographic ageing will continue to be a key focus for government policy over coming years as the economic impact of demographic ageing intensifies.

Access the Singapore PMI press release and the Global Electronics PMI press release.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapores-economic-growth-improves-in-third-quarter-of-2023-nov23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapores-economic-growth-improves-in-third-quarter-of-2023-nov23.html&text=Singapore%27s+economic+growth+improves+in+third+quarter+of+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapores-economic-growth-improves-in-third-quarter-of-2023-nov23.html","enabled":true},{"name":"email","url":"?subject=Singapore's economic growth improves in third quarter of 2023 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapores-economic-growth-improves-in-third-quarter-of-2023-nov23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Singapore%27s+economic+growth+improves+in+third+quarter+of+2023+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsingapores-economic-growth-improves-in-third-quarter-of-2023-nov23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}