Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 24, 2023

Sri Lanka secures IMF funding; austerity measures likely to worsen civil unrest risks

The Executive Board of the International Monetary Fund (IMF) approved a four-year, USD2.9-billion extended fund facility arrangement for Sri Lanka. Mainland China joined other major bilateral creditors in giving financing assurances supporting Sri Lanka's debt restructuring earlier in March.

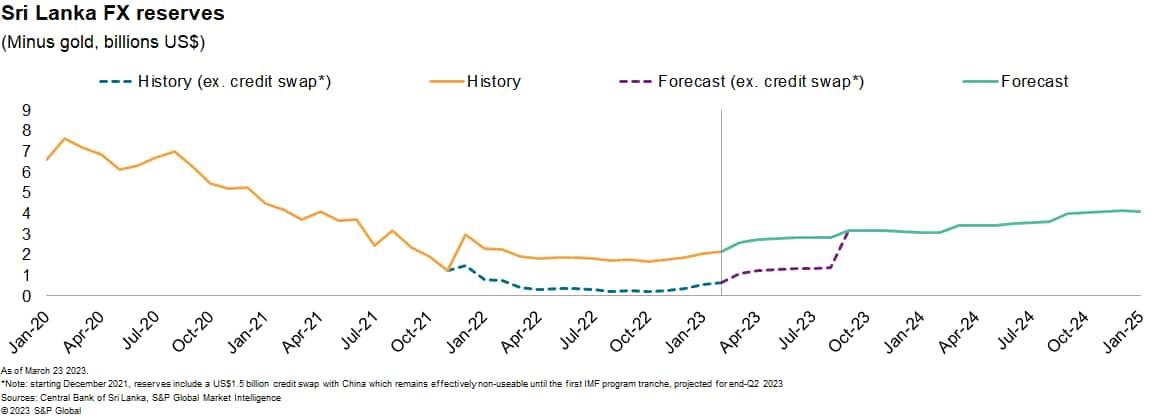

The Board's approval permits an initial disbursement of about USD333 million, to be followed by eight conditional disbursements during the program. The initial IMF disbursement will provide temporary relief, restoring foreign-exchange reserve levels and stabilizing the banking sector.

The deal should also unlock funding from other multilateral lenders, including the World Bank and the Asian Development Bank, and from bilateral partners whose financing had been awaiting completion of an IMF program.

This new funding - combined with the IMF-driven fiscal measures to reduce state expenditures and increase fiscal revenue collection - should provide Sri Lanka with a much-more stable and sustainable economic base for the coming years. The IMF package also reduces banks' risk profile from holding domestic sovereign debt.

As part of IMF conditionality, Sri Lanka's regulatory authorities are undergoing a review of the banking sector's bad loan problems, with the assessment scheduled to be completed by August 2023. Benefiting from IMF support and new funding, the central bank and the government will be better placed to grant capital injections if required to stronger banks. Under IMF guidelines, weaker banks are likely to be absorbed into the stronger banks: Privatization of struggling state-owned banks is unlikely, given a lack of buying interest.

Austerity measures and wider debt restructuring negotiations coming

Disbursement of further IMF tranches will require advancing wider debt restructuring negotiations and implementing further revenue-raising domestic policy measures, and delays are likely. Given the complexity of Sri Lanka's debt, an agreement among all bilateral creditors and commercial bondholders on a debt restructuring plan will probably take over a year to reach.

However, the IMF is likely to view a preliminary agreement between the government and major bilateral lenders - including mainland China - as sufficient to permit disbursement of the second program tranche due in late September 2023. Even this will be challenging, as mainland China has been consistently resistant towards formal capital write-downs, instead favoring coupon relief and debt extensions.

In addition to progressing its debt restructuring strategy, the Sri Lankan government will need to implement further austerity measures to receive subsequent IMF disbursements. President Ranil Wickremesinghe announced on March 22 new measures aimed at reducing the primary deficit and increasing state revenue.

Initial public reaction to securing IMF support should be positive, as the new funds are likely to stem currency depreciation, which has been driving inflation, while offering relief from ongoing shortages of essential commodities.

However, the subsequent implementation of unpopular austerity measures - including further tax and energy tariff increases, reducing public spending (including cutting subsidy programs), and efforts to privatize SOEs - will sustain government instability risks and exacerbate civil unrest. This dynamic is likely to be indicated by the results of local government elections scheduled for April 25 and subsequent presidential and parliamentary elections due in 2024.

Protests and strikes involving hundreds of people are already taking place regularly in Colombo. Extensive security deployments are likely to prevent gatherings outside Colombo's main business district and Galle Face, where government buildings and residences are located. Altercations between protesters and police are likely during protests.

Indicators of changing risk environment

A reduction in inflation, which reached 46.4% in 2022 driven by elevated global prices and domestic supply shortages, should reduce the short-term severity of anti-government protests.

The anti-government protest movement is likely to grow should opposition party leaders publicly encourage rallies and strike action.

A change in government would increase the risk of policy reversal and disruption to the implementation of IMF conditions and future disbursements.

Failure to maintain the planned fiscal consolidation program would worsen Sri Lanka's long-term economic outlook, discouraging investment and encouraging renewed currency pressures.

Better-than-expected earnings from key industries such as tourism, textiles, and agriculture would ease pressure on the financial position of the public and private sectors and reduce the need for unpopular fiscal measures.

-With contributions from Andrew Vogel.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsri-lanka-secures-imf-funding-austerity-measures-likely-to-wor.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsri-lanka-secures-imf-funding-austerity-measures-likely-to-wor.html&text=Sri+Lanka+secures+IMF+funding%3b+austerity+measures+likely+to+worsen+civil+unrest+risks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsri-lanka-secures-imf-funding-austerity-measures-likely-to-wor.html","enabled":true},{"name":"email","url":"?subject=Sri Lanka secures IMF funding; austerity measures likely to worsen civil unrest risks | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsri-lanka-secures-imf-funding-austerity-measures-likely-to-wor.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sri+Lanka+secures+IMF+funding%3b+austerity+measures+likely+to+worsen+civil+unrest+risks+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsri-lanka-secures-imf-funding-austerity-measures-likely-to-wor.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}