Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 23, 2020

State-level employment impact of COVID-19

Our expectation is for a slow recovery with conditions starting to approach "normal" after a vaccine is widely available, which we estimate to be in the latter part of 2021. Until then, COVID-19 will be an ever-present weight on economic activity until caseloads can be reliably managed. The surge in COVID-19 cases raises the risk that certain states, or even the US overall, could see a "W" shaped.

The Northeast will take the longest to return to pre-pandemic employment levels, as the region is taking a measured reopening approach and its regional economy is more mature and historically slow growing. The Northeast is also the most densely populated region, which poses another challenge in this environment. While employment growth rates from the third quarter of 2020 and spanning into 2022 will look stronger in the Northeast, this stems from the fact that it is climbing back from a deeper fall.

The South has seen the softest decline in employment and is on the fastest track to recoup those job losses, especially since it is typically among the top performing regions. However, this is assuming that caseloads do not continue to spiral out of control, with the South facing the most acute downside risks given the recent COVID-19 trends.

Going forward, the fact that California, Florida, and Texas have had to pause or roll back reopening plans will tap the brakes on their near-term employment recovery.

Near-term employment outlook

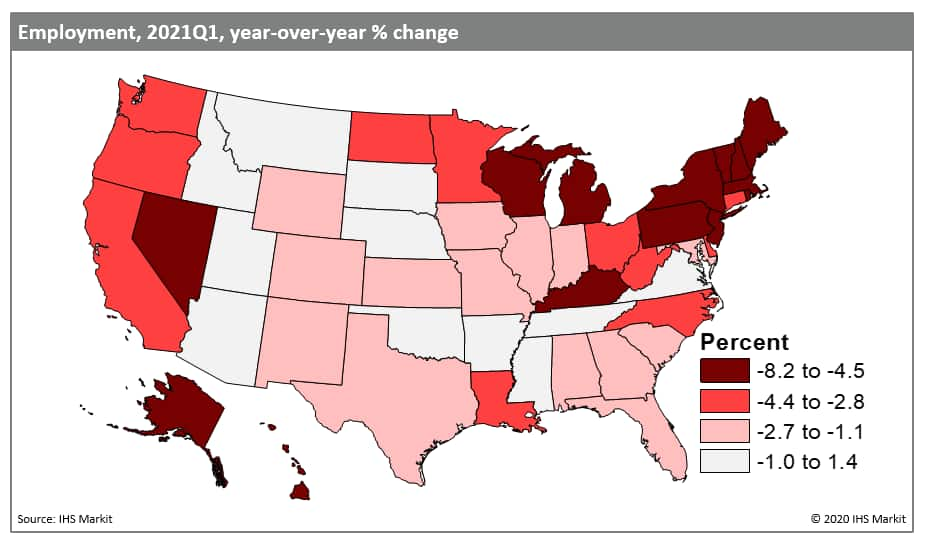

Year-over-year (y/y) employment growth through the first quarter of 2021 reflects the dramatic decline in employment during the second quarter of 2020 followed by the early recovery over the latter part of 2020 and into 2021. The results are heavily influenced by the extent of the epic second-quarter 2020 decline, which is why the Northeastern states perform poorest and the South and Plains states rank best.

Yet if we were to push the period ahead one quarter and looked at y/y growth in the second quarter of 2021, then the Northeast and Midwest would rank at the top.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstatelevel-employment-impact-of-covid19-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstatelevel-employment-impact-of-covid19-.html&text=State-level+employment+impact+of+COVID-19++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstatelevel-employment-impact-of-covid19-.html","enabled":true},{"name":"email","url":"?subject=State-level employment impact of COVID-19 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstatelevel-employment-impact-of-covid19-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=State-level+employment+impact+of+COVID-19++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstatelevel-employment-impact-of-covid19-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}