Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 24, 2021

Sub-Saharan African tourism industry unlikely to recover in near term

- The SSA tourism industry is likely to start its recovery in early 2022-2023. Reaching pre-COVID-19 tourism levels could take much longer, to around 2025-26.

- Seychelles' is expected to lead the tourism sector recovery in SSA following the fast rollout of the COVID-19 vaccine program. This recovery remains vulnerable to upsurges in COVID-19 cases, increasing the risk of the reinstatement of local and global government restrictions.

- Other countries to follow later include Mauritius, South Africa, and Cape Verde.

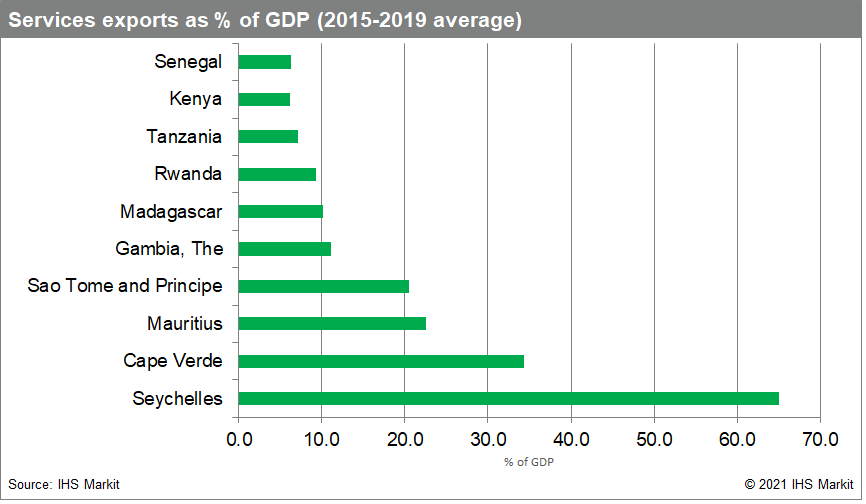

- The sluggish recovery in the glob tourism industry continues to pose a risk to tourist-dependent economies' GDP growth, foreign exchange inflows, government revenue and debt sustainability.

Growth prospects of North America's and Western Europe's tourism sectors are brightening rapidly, benefiting from the boom in services spending anticipated during the second half of 2021. Achieving herd immunity from coronavirus disease 2019 (COVID-19) with fewer localised government restrictions and the unwinding of household savings underline the expectation. Nonetheless, a return to 2019 levels in terms of tourism activity could take from to two to four years, IHS Markit estimates show. For other regions in the world, the recovery in the tourism industry could be slower. In Japan, South Africa, Australia, and Latin America, COVID-19 herd immunity and fewer government restrictions are only likely by early 2022, followed by China and the rest of Asia during the second half of 2022. COVID-19 herd immunity in the SSA region will lag significantly and is only likely by 2023-24, except for some key markets in the region.

The recovery of the SSA tourism industry will probably be constrained by recurrent COVID-19 outbreaks and the slow rollout of COVID-19 vaccine programmes anticipated over the medium term. Most SSA citizens will remain on the "red list" for foreign travel to other regions, as the COVID-19 pandemic remains broadly unrestrained. Non-SSA citizens travelling back home from SSA would require proof of a COVID-19 vaccination or a negative COVID-19 test ahead of arrival, while an isolation period remains likely. For example, current legislation requires that all travelling German and French citizens returning to their home country must produce a negative COVID-19 polymerase chain reaction (PCR) test taken within 72 hours prior to arrival or an antigen test within 24 hours prior to arrival, with self-isolation for 7-14 days when returning from certain countries in SSA. SSA countries, on the other hand, have less-severe legislation in place and only require a negative COVID-19 test upon arrival.

Although SSA makes up only a small fraction of the global tourism market, the industry remains an important growth driver and source of export earnings and government revenue for countries such as Cape Verde, Gambia, Kenya, Mauritius, Seychelles, South Africa, and Tanzania. In many instances, such countries are highly reliant on European tourism. Europeans account for more than 66% of total tourist arrivals in Seychelles, while tourists from Germany and the United Kingdom dominate Cape Verde's tourism industry. Tourists from France, Germany, Réunion, and South Africa make up the largest share of Mauritius's arrivals. In Kenya, European visitors and inter-regional travellers show up most in airport statistics. Of all these countries, only Seychelles has reached a COVID-19 inoculation rate of 139 doses per 100 people (roughly 60% of the total population), followed by Mauritius at 35.8 doses per 100 people. Cape Verde's COVID-19 inoculation rate stands at 6.2 doses per 100 people and South Africa at 2.3 doses per 100 people. Kenya's COVID-19 inoculation rate currently stands at 1.87 doses per 100 people.

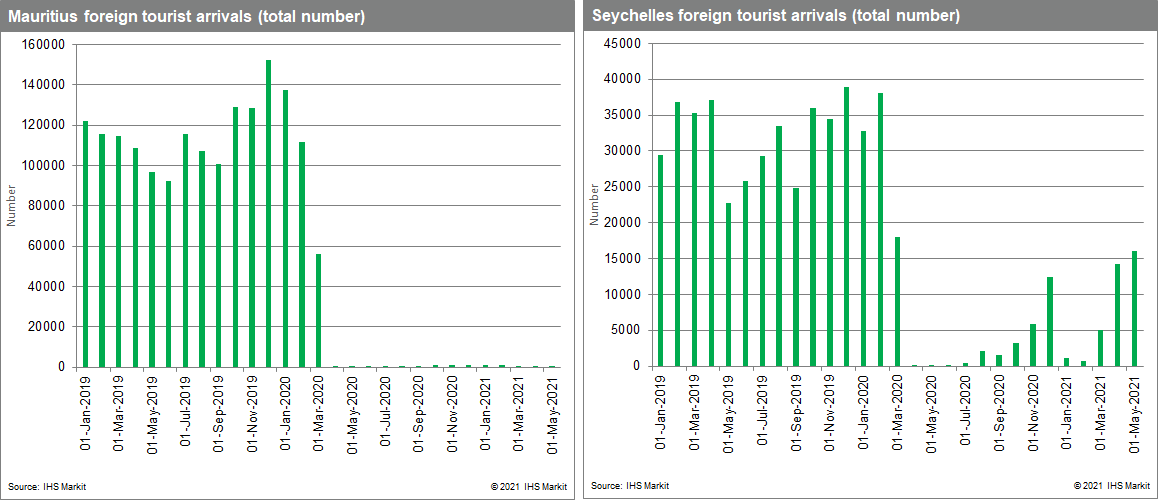

It is not surprising that a country such as Seychelles has stepped up its COVID-19 inoculation rate since March, allowing for the opening of its borders to foreign visitors. The return of visitors to Seychelles has been quicker compared to other countries such as Mauritius and South Africa. Zimbabwe took a unique approach and focused its COVID-19 inoculation rollout on staff assigned to tourism hotspots such as Victoria Falls.

Most travellers are allowed to enter Seychelles regardless of their vaccine status (with exceptions being travellers from countries such as Brazil and South Africa); however, visitors must provide a negative result from a COVID-19 PCR test taken within 72 hours prior to departure to Seychelles.

A second wave of COVID-19 cases in Seychelles during April-May 2021, much more severe than the first, triggered stricter COVID-19 pandemic-related government restrictions in early May. The flair-up of COVID-19 cases once again placed Seychelles on some European countries' high-incidence list, with strict return policies for tourists. IHS Markit assumes a slump in tourism arrivals to the archipelago in the coming months as a result.

The efficient rollout of the COVID-19 vaccine programme in Seychelles, however, will allow for a faster recovery of the tourism sector compared to other tourist destinations in the SSA region over the medium term. The recovery of the tourism sectors in Cape Verde, Mauritius, and South Africa is assumed to follow gradually. Delays in COVID-19 vaccine deliveries, global COVID-19 vaccine shortages, fiscal constraints, and the ongoing risk of new COVID-19 variants will continue to pose a risk to the SSA tourism sector's recovery. Overall IHS Markit assumes that the tourism industry in SSA could start to recover by early 2022-23. Reaching pre-COVID-19 levels of tourism could take much longer, to around 2025-26.

Want more on SSA economic recovery? Listen to our latest podcast on the recovery pathway

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubsaharan-african-tourism-industry-unlikely-recover.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubsaharan-african-tourism-industry-unlikely-recover.html&text=Sub-Saharan+African+tourism+industry+unlikely+to+recover+in+near+term+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubsaharan-african-tourism-industry-unlikely-recover.html","enabled":true},{"name":"email","url":"?subject=Sub-Saharan African tourism industry unlikely to recover in near term | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubsaharan-african-tourism-industry-unlikely-recover.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sub-Saharan+African+tourism+industry+unlikely+to+recover+in+near+term+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubsaharan-african-tourism-industry-unlikely-recover.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}