Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 10, 2018

Survey data in spotlight as Bank of England holds interest rates

- Bank of England's MPC voted 7-2 to leave interest rates on hold

- Weak start to the year assumed to be temporary, meaning rate hike delayed not discarded

- Survey data will provide clues as to growth momentum and timing of rate hikes

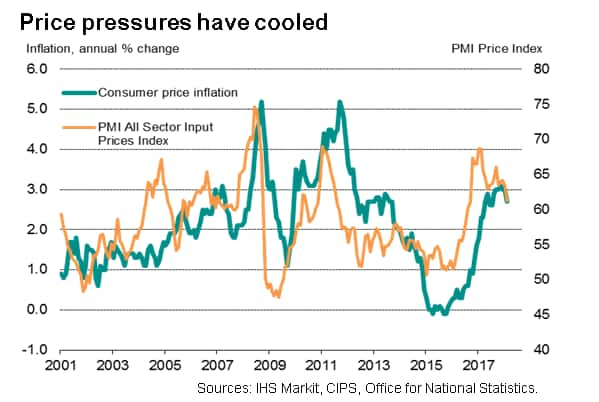

The Bank of England left interest rates unchanged at the Monetary Policy Committee's May meeting, in line with expectations that policymakers would back away from hiking borrowing costs after a flurry of disappointing economic data and a steeper than expected cooling of inflation.

However, two of the MPC's nine members voted to raise rates, and the Bank's analysis of the economic situation leaves the door open for a rate hike in coming months, dependent on the soft patch at the start of the year proving to have been temporary.

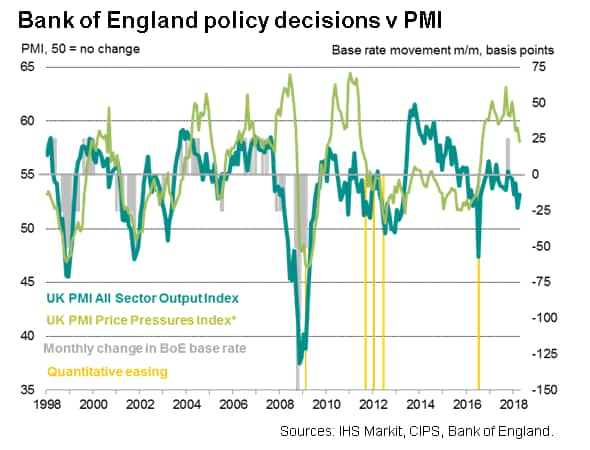

The discussion at the press conference following the latest policy decision indicates that the focus now clearly lies on coming months' survey data to help ascertain whether the Bank is correct in assuming that growth will revive again, or whether the economy is experiencing a more fundamental slowing.

Rate hike delayed

The lack of policy action represents a volte-face compared to April, when rhetoric from the Bank of England led financial markets to price-in a near certain May rate hike following the first rate rise for a decade last November.

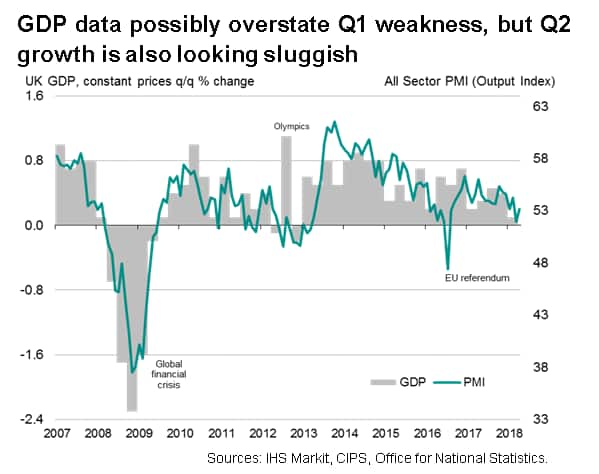

However, since the last meeting, GDP growth is estimated to have almost stalled at 0.1% in the first quarter, and business surveys suggest the rate of expansion remained disappointingly meagre at around 0.2% at the start of the second quarter.

The Bank of England has consequently downgraded its economic growth forecasts for 2018, from 1.8% to 1.4%, reflecting the slower than anticipated start to the year, but kept 2019 and 2020 projections largely unchanged at 1.7%, down from 1.8%.

The largely unchanged medium term outlook leaves expectations alive for rates to rise later in the year, likely August, highlighting how policymakers believe the weak start to 2018 to have been a temporary soft patch, linked mainly to heavy snowfall. Note also that the Bank expects first quarter GDP growth to eventually be revised up to 0.3%, which would match the signal from the PMI surveys for the first three months of the year.

In terms of inflation, "CPI inflation is projected to fall back slightly more quickly than [forecast] in February, reaching the [2%] target in two years. These projections are conditioned on a gently rising path for Bank Rate over the next three years."

Or rate hike postponed?

However, while the Bank's central projection for the economy is largely unchanged, writing the first quarter weakness off as temporary, the Bank is also conscious of the risk that the underlying pace of economic growth may have in fact waned so far this year. Survey data suggest that some of this slowdown can be linked to weaker economic growth in continental Europe, but companies are also reporting that domestic demand among households and businesses has been dampened by uncertainty about the economic outlook and higher prices.

Furthermore, while annual wage growth has picked up, favourable base effects (with weak pay growth last year) have flattered the picture.

Data dependent

The data in the next few months will therefore be watched closely for clues as to the next policy move, and could also be crucial for the MPC's credibility. Unless both wages and the pace of economic growth pick up in coming months, the chances are that an August rate hike can also be ruled out. What's more, the November rate hike will also start to look increasingly like a policy error. The next major clues come with the May PMI surveys, which will give an important steer on second quarter GDP growth.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-in-spotlight-as-bank-of-england-holds-interest-rates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-in-spotlight-as-bank-of-england-holds-interest-rates.html&text=Survey+data+in+spotlight+as+Bank+of+England+holds+interest+rates+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-in-spotlight-as-bank-of-england-holds-interest-rates.html","enabled":true},{"name":"email","url":"?subject=Survey data in spotlight as Bank of England holds interest rates | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-in-spotlight-as-bank-of-england-holds-interest-rates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Survey+data+in+spotlight+as+Bank+of+England+holds+interest+rates+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-in-spotlight-as-bank-of-england-holds-interest-rates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}