Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 16, 2018

Sweden moves closer to first interest rate rise in a decade

- Following an as expected meeting of the executive board of the Swedish central bank (Riksbank) last week (3 July), inflation has measured near/above target for a fourth consecutive month. In our opinion the tone of the Riksbank discussion in conjunction with this inflation release, increases the probability that Sweden will move ahead of the ECB and begin to normalize interest rate at the December 2018 meeting.

- This indicates a marked tonal shift from April's meeting when changes to the forward guidance and dovish language from the Riksbank led to many market observers commenting that a rate rise this year was unlikely.

- As is now typical for inflation releases Thursday's announcement was met with a flurry of activity in FX markets, as the krona strengthened against both the euro and dollar. The krona ended the day on Wednesday (11 July) at EUR1:SEK10.29, but reached a high of EUR1:SEK10.37 on Thursday, the strongest level observed for the currency in the last week. The dollar followed a similar path against the krona.

- In our opinion an increase in FX market volatility since the beginning of the year also weighs on the rate rise side of the Riksbank balance sheet.

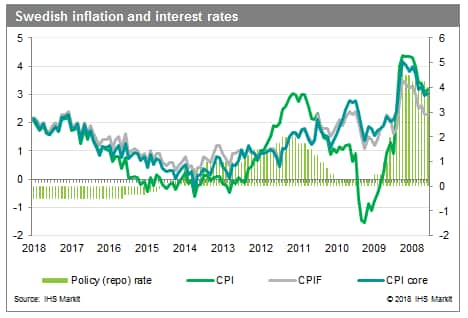

As expected the Swedish Riksbank executive board voted to maintain interest rates, at the beginning of July. However, the tone of the Riksbank discussion had clearly evolved compared to April's meeting. Board members highlighted stronger than anticipated inflation, extremely high volatility in FX markets, and the emergent housing bubble; as reasons to revise monetary policy. The board voted to extend the banks mandate for foreign exchange interventions; highlighting that they anticipate needing to intervene in the marketplace. The board also approved a new set of forecasts which shows a significant upward revision of their inflation forecast. It would appear that the Riksbank now expects that inflation will outperform the 2% target in 2018-19. Two board members advocated for raising rates before the December meeting. Henry Ohlsson recommend raising the repo rate to -0.25% immediately, whilst Martin Flodén advocated moving to -0.25% at either September or October's meeting. Showing that the balance of the board is shifting.

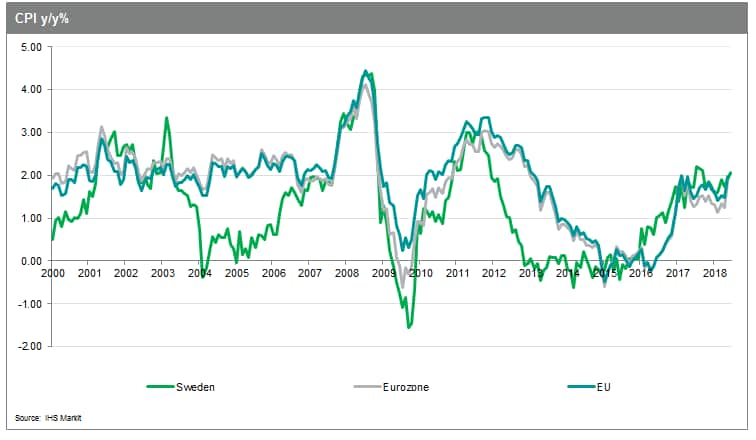

Last week Statistics Sweden released estimates for inflation in June, indicating that the consumer price index (national definition) expanded by 2.1% y/y. Simultaneously, the consumer price index at fixed interest rates (CPIF), also known as underlying inflation, expanded by 2.2% y/y, slightly up on May's 2.1% y/y. As the CPIF rate is preferred inflation measure of the Riksbank, we can now say that inflation has been above target for the last two consecutive months; and close to or above target for the last four consecutive months. This set of results, and the subsequent market reaction plays into our view that the first Swedish interest rate rise will happen in December 2018, in line with the forward guidance, and that the Riksbank will move ahead of the ECB. In previous rounds we had speculated that in spite of the forward guidance, the Riksbank would not raise rates until after the ECB. We now think that given the ECB indication that they will not amend interest rates until approximately September 2019, the Riksbank will take the end of the Asset Purchasing Programme as its international trigger for normalising monetary policy.

On the domestic side we also think the pressure to begin normalizing is becoming overwhelming. The last time that the CPIF was consistently in excess of 2% was during the middle of 2017, at that time the Riksbank was clear that they were still concerned about domestic inflationary pressures, and they were forecasting a future slowdown in inflation. There was a clear hesitance emanating from concerns that if interest rates were raised to early, it would dampen domestic inflationary pressure and hamstring the Swedish economic recovery. We believe that the narrowing spread between the CPIF and core inflation should mitigate some of these concerns. We also believe that monetary policy issues excluding inflation have now become so significant that the Riksbank cannot afford to wait much longer. The most obvious of which is pressure being put on FX markets. The decision to push back the forward guidance at April's board meeting was a contributing factor to the krona falling to its lowest value in a century, outside of an economic crisis. However, we also anticipate that the extremely cautious Riksbank is very unlikely to surprise markets with an early move at the September meeting.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsweden-moves-closer-to-first-interest-rate-rise-in-a-decade.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsweden-moves-closer-to-first-interest-rate-rise-in-a-decade.html&text=Sweden+moves+closer+to+first+interest+rate+rise+in+a+decade+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsweden-moves-closer-to-first-interest-rate-rise-in-a-decade.html","enabled":true},{"name":"email","url":"?subject=Sweden moves closer to first interest rate rise in a decade | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsweden-moves-closer-to-first-interest-rate-rise-in-a-decade.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sweden+moves+closer+to+first+interest+rate+rise+in+a+decade+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsweden-moves-closer-to-first-interest-rate-rise-in-a-decade.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}