Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 04, 2020

The impact of COVID-19 on the UK fishing industry

Using vessel port callings data to gain early insight into how global trade is affected by COVID-19.

Collectively, the EU is the largest exporter of fish products worldwide and the importance of the fishing industry to these countries is vital*. In fact, despite the fact the UK fishing industry only contributes to 0.1% of the country's economy**, it played a massive role in the Brexit debates with disagreement about quotas and exclusive fishing zones being high on the agenda. Within the EU the top importing countries include France, Italy and Spain whereas the top exporters include the Netherlands, Sweden and Denmark. The UK is the sixth largest exporter in the EU, exporting two thirds of the fish it catches.

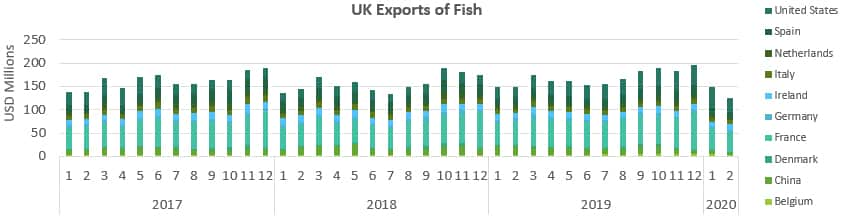

As COVID-19 continues to have an impact and lockdown continues throughout the world, the UK fishing industry appears to be struggling. The Marine Management Organisation announced on the 20th April that they will launch a £10 million Fisheries Response Fund to help the fishing businesses struggling due to the impact of COVID-19***. Using our Global Trade Atlas a decrease in UK exports of fish in both January and February was identified. UK exports of HS03 - Fish and Crustaceans, Molluscs and Other Aquatic Invertebrates were down 22% in January vs December 2019 and a further 16% in February 2020 vs January 2020 (Figure 1). Comparing February 2020 to February 2019 showed a year-on-year decrease of 8.35% with a huge 74% decrease in exports to China.

Figure 1: UK Exports of HS03 (Fish and Crustaceans, Molluscs and Other Invertebrates) Source: IHS Markit Global Trade Atlas

Although the trade data shows clear decreases in export activity through to February 2020, unfortunately there can often be a time lag in receiving trade data from customs authorities meaning it is hard to determine in advance when a recovery in trade may occur. Given the possible relationship between the number of fishing vessels returning to port and the amount of fish available for export, it is possible to supplement the trade data and derive early insights into the state of the fishing industry using port callings data.

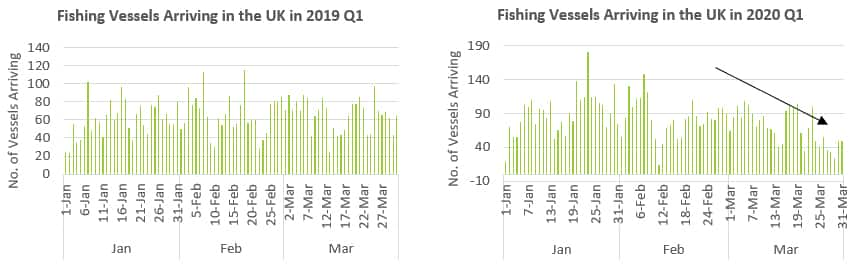

IHS Markit Maritime & Trade monitors the real-time movements of high-seas fishing vessels with an IMO number. Analysis of the number of fishing vessels arriving into the UK shows that in 2019 the levels remained largely consistent throughout January to March (Figure 2). Meanwhile a comparison to January-March 2020, when the impact of COVID-19 on the UK was increasing, shows a decrease throughout February to March (Figure 2). This suggests the lockdown may be influencing the ability of vessels to operate normally, hence leading to lower volumes of fish catches and the observed decreases in trade (Figure 1).

Figure 2: Number of fishing vessels arriving into the UK from January to April in 2019 and January to April 2020. Source: IHS Markit Maritime Data

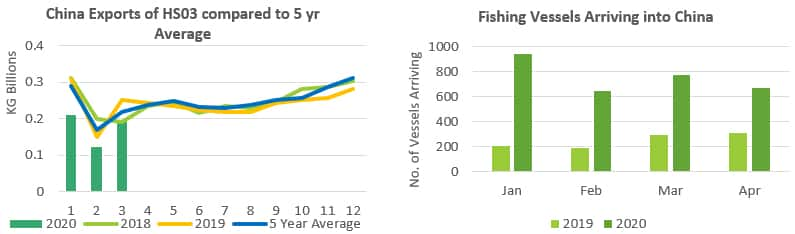

Given that China was the country first affected by COVID-19, their recovery began sooner relative to other countries. China is the largest exporter of fish globally exporting over 2.9 million tonnes in 2019. As a country who is effectively a few months ahead of the UK in their response to COVID-19, looking at their trade data along with the movement patterns of fishing vessels could provide an indication of how the fishing industry may behave in the UK in the coming months. China trade data saw large decreases in January and February, to levels lower than the five-year average, followed by a slight improvement in March as the situation improved (Figure 3). This mirrors the trend in the number of port calls. From this we can infer that if the number of port calls increase, then the exports may also see an increase in coming months. Interestingly the number of port calls in 2020 was much higher than in 2019 but the export trade is not a substantial volume higher.

Figure 3: China's exports of HS03 (Fish and Crustaceans) Source: IHS Markit Global Trade Atlas. NB January and February 2020 data supplied as aggregate and then normalised.

Figure 4: Fishing vessels arriving into China during Q1 2020 up to April. Source: IHS Markit Maritime Data<span/>

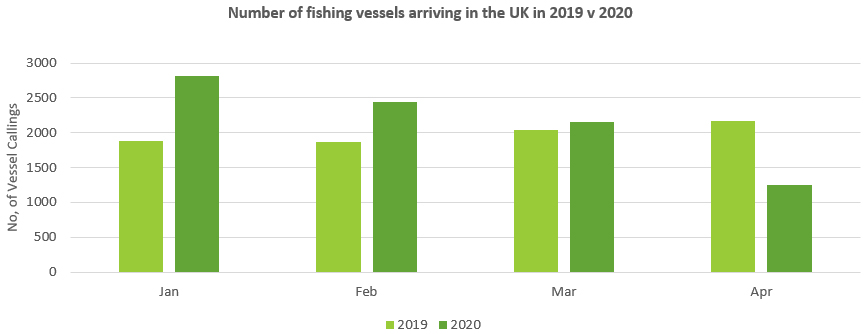

Hence, insight can be drawn from the number of vessels calling into the UK. The number of fishing vessels arriving into the UK is higher in January 2020 than January 2019, suggesting we would be expecting year-on-year growth in the number of vessel callings. However, the number of vessels arriving in the UK has decreased month-on-month with March showing similar numbers of callings in 2019 to 2020. In April the number of callings in 2020 fell significantly to only 1,245 below that of the same period in 2019.

Figure 5: Number of fishing vessels arriving into the UK in 2019. Source: IHS Markit Maritime Data

This rapid decrease in the number of callings indicates the UK fishing industry could be in for more bad news with possibly even lower exports for April. Monitoring the number of vessels arriving into the UK on an ongoing basis could be a valuable tool for assessing when the tides may be turning for the UK fishing industry.

It is possible that this type of analysis using port callings data could be useful in assessing trade in other sectors too. IHS Markit Commodities at Sea uses real-time tracking of dry bulk vessels and tankers to gain valuable insight into how the trade of commodities such as crude oil, iron ore and coal are responding to COVID-19. Similar methodology may have the potential to be applied to other vessel types or industries.

* https://www.statista.com/statistics/268269/top-10-exporting-countries-of-fish-and-fishery-products/

*** https://www.gov.uk/government/news/update-on-fisheries-response-fund-monday-20-april-2020

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-covid19-on-the-uk-fishing-industry.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-covid19-on-the-uk-fishing-industry.html&text=The+impact+of+COVID-19+on+the+UK+fishing+industry+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-covid19-on-the-uk-fishing-industry.html","enabled":true},{"name":"email","url":"?subject=The impact of COVID-19 on the UK fishing industry | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-covid19-on-the-uk-fishing-industry.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+impact+of+COVID-19+on+the+UK+fishing+industry+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-covid19-on-the-uk-fishing-industry.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}