Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 18, 2019

The impact of protectionism tariffs

In March 2018, President Donald Trump invoked Section 232 of the Trade Expansion Act of 1962 to impose 25% tariffs on steel and 10% tariffs on aluminum imports from almost every country in the world (Argentina, Brazil, and South Korea voluntarily accepted quotas rather than tariffs). In April 2018, the Trump administration announced additional tariffs on various imported goods from China under Section 301 of the Trade Act of 1974.

The first set of tariffs, known as "steel protectionism", hit approximately USD35 billion in imports of iron, steel, and other raw metals. The second set covers an even larger volume of imported goods from China—primarily computers, electronics, electrical equipment, and machinery— bringing the combined total of newly tariffed imports to roughly USD265 billion.

We investigated the impact of these tariffs on the US macroeconomy and its important sectors—recognizing both direct and spillover effects to the global economy. For industry detail, we quantified how increases in the prices of key raw materials and intermediate inputs will affect purchases of construction equipment and construction activity. In addition, we analyzed the effects of potential retaliatory tariffs on US farm exports and agricultural equipment purchasing.

Impact to the macroeconomy

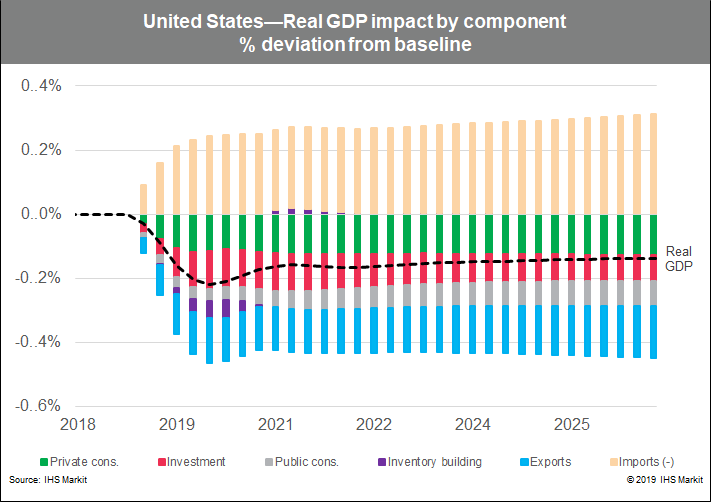

- While the tariffs will improve the US trade balance, they will constrain total real domestic spending and the corresponding production in many industries. The negative impacts are largely from higher prices, which will be felt by both producers and consumers

- The average loss in GDP is USD29 billion per year for 10 years, with consumers reducing their real spending by more than USD23 billion per year.

- Job losses in the US that can be attributed to the full effects of the tariffs will average 26,000 per year over the next 10 years.

Impact to industry

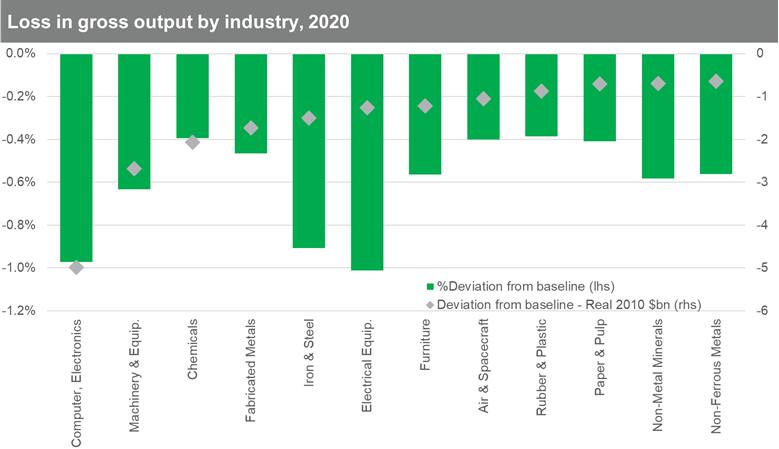

- Both steel protectionism and the additional tariffs on China will raise costs in many downstream industries, significantly reducing production in the machinery and equipment, computer and electronics, and electrical equipment sectors.

- Sales of construction equipment will be directly hurt, lowering the industry's domestic output by an average of almost USD500 million per year over the next 10 years. The tariffs will inflate the production cost of construction equipment, primarily through the transmission of steel price increases, thereby raising prices for purchasers and lowering demand. As the higher-cost steel feeds through the supply chain, it will increase construction costs and dampen construction activity.

- The 10% tariff on imports of aluminum ingot and related mill products, castings, and forgings will permanently raise the prices of primary and intermediary aluminum products. Only primary aluminum producers will benefit.

- The indirect damage on global demand will hurt US companies that rely on a growing export market. In addition, retaliatory tariffs are depressing US crop prices, especially soybeans, which constrains farm income and agricultural equipment purchasing.

The newly enacted tariffs are unmistakably impairing the US

economy through direct, indirect, and induced effects. Many

important domestics industries will need to adjust considerably to

these tariffs and the corresponding effects on global trade.

Our findings were calculated utilizing our Global Link Macro-Industry

Model in conjunction with IHS Markit industry experts.

This post was authored by Michael Boldin, a consultant at IHS Markit

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-protectionism-tariffs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-protectionism-tariffs.html&text=The+impact+of+protectionism+tariffs+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-protectionism-tariffs.html","enabled":true},{"name":"email","url":"?subject=The impact of protectionism tariffs | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-protectionism-tariffs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+impact+of+protectionism+tariffs+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-impact-of-protectionism-tariffs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}