Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 02, 2020

The new EU-UK trading relationship could deliver more UK economic pain

- Many UK companies fear the impact of any post Brexit trade deal on their supply chains, the increased red tape, and their sales to the EU.

- UK services could be worst hit sector when the UK leaves the EU Single Market, implying deep economic costs.

- Failed EU-UK trade talks will spark a new UK recession during 2021.

We advocate a cautious assessment for prospects for UK growth in 2021-22. The UK faces a new spike in COVID-19 infections; the return of tough containment measures, alongside incurring inevitable economic costs from when it leaves the EU Customs Union and Single Market on 31 December 2020.

A free trade agreement (FTA) for goods between the European Union (EU) and UK should be concluded by end-2020 despite talks floundering on the issue of regulatory alignment and how to achieve it. EU insists that it will only allow the UK "zero tariff, zero quota" access to the EU Single Market if the UK commits legally to a set of "level playing field" principles that minimize the risk that it will undercut the EU on environmental regulation, workers' rights and state aid to business.

A slimmed down Brexit trade deal is a likely outcome, which broadly excludes most services. However, there could be some access to the Single Market for some UK services based on equivalence. This is not a stable outcome, with equivalence at risk of being withdrawn at short notice as a result of regulatory divergence.

Many UK firms not ready for the new EU trading relationship

UK exporters will face additional checks for safety and security documentation, customs papers and, in some cases, regulatory compliance from the start of 2021. This is likely to apply whether there is a trade deal or not.

Business surveys suggest that many UK firms are not fully ready. The Institute of Directors' survey conducted last September reveals that only 60% of business that expected to be affected by the end of the transition period thought they would be fully prepared by end-2020. Many UK firms admit COVID-19 has halted preparations.

The Confederation of British Industry warns that many UK companies have "already had their resilience stripped away" by COVID-19, and are concerned about "their supply chain, the bureaucracy, the red tape they're going to have to deal with, the markets they lose".

UK manufacturers could encounter new non-tariff barriers in the face of any regulatory divergence between the UK and the EU, implying new checks and delays to verify compliance with EU rules.

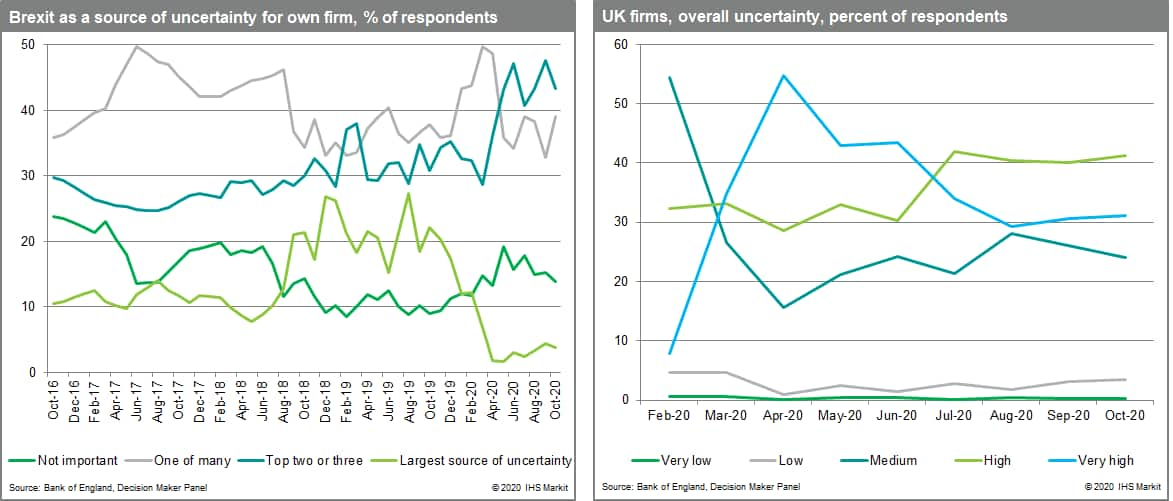

The Bank of England's Decision Maker Panel confirms that many UK businesses remain uncertain about the EU-UK future trading relationship.

Fears of UK port disruptions

A new system called the Customs Declaration Service (CDS) is to be introduced but the UK Association for International Trade warns that the new 'untested, incomplete' IT system is likely to cause widespread chaos at UK ports. The new system has been designed to handle the transit of more than 17,000 goods every day but the new network is said to take 45 minutes longer than currently for a single customs declaration.

Th National Audit Office said that although the government had made progress updating customs systems and other infrastructure it still expected 'widespread disruption' after the transition period ends.

The lack of focus on UK services in trade talks

The EU-UK trade talks deal has focused on UK manufacturing, given its large export base, while the services sector has received less attention. Indeed, Catherine McGuinness, head of the City of London Corporation's policy and resources committee warns that UK's services industry is emerging as the "neglected child" of the EU-UK talks on a future relationship and could be worst hit sector.

UK services are vital to its economy, accounting for 46% of its total exports, with the EU by far being its largest market, particularly for its financial services.

The EU is removing the regulatory barriers to trade in services by mutual recognition of member states' rules alongside setting supranational rules to regulate some sectors. The European Court of Justice (ECJ) settles any dispute between cross-border service providers and public policy requirements of a member state.

A comprehensive trade deal including services will be difficult to achieve if the UK insists on full sovereignty of its parliament and precedence over the sovereignty of all other parliaments and no jurisdiction of the ECJ in English law. This suggest any EU-UK trade deal will struggle to address regulatory compliance and non-tariff barriers to the trade in services, implying UK services providers will face obstacles when trading with the EU member states.

Failed EU-UK trade talks will extend UK economic pain

The failure of the UK to reach a trade agreement with EU will damage the UK economy. The Bank of England warns that that the long-term effects "would be larger than the long-term effects of COVID." Meanwhile, our no-trade deal assessment is similarly gloomy, with the UK likely to face a new recession during 2021 after tougher COVID-19 containment measures set to spark new GDP losses in the final quarter of 2020. Our no-trade scenario assumes that UK GDP would contract both in 2021 and 2022 before growth returns in 2023.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-new-euuk-trading-relationship-could-deliver-more-uk-econom.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-new-euuk-trading-relationship-could-deliver-more-uk-econom.html&text=The+new+EU-UK+trading+relationship+could+deliver+more+UK+economic+pain+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-new-euuk-trading-relationship-could-deliver-more-uk-econom.html","enabled":true},{"name":"email","url":"?subject=The new EU-UK trading relationship could deliver more UK economic pain | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-new-euuk-trading-relationship-could-deliver-more-uk-econom.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+new+EU-UK+trading+relationship+could+deliver+more+UK+economic+pain+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-new-euuk-trading-relationship-could-deliver-more-uk-econom.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}