Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 29, 2022

The world economy faces an extended cooling off period

Persistent inflation and expectations of further monetary tightening have pushed up interest rates on government bonds, corporate debt, mortgage loans, and consumer credit. The result is a broad slowdown in household and business spending.

The months ahead will likely bring recessions in Europe and North America - economies that produce half of global output. Contractions in these regions will dampen growth in other parts of the world through trade and capital flows.

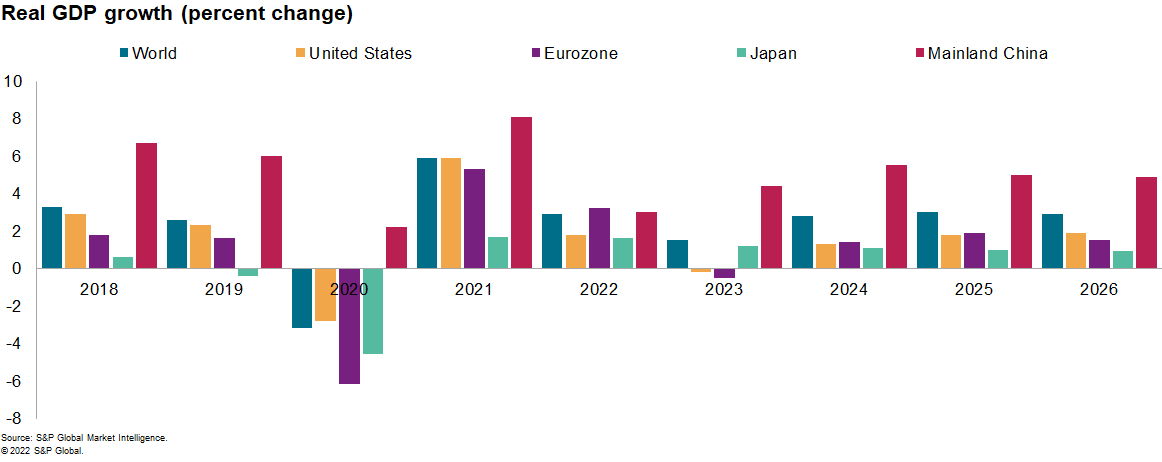

With moderate growth in Asia Pacific, the Middle East, and Africa, the world economy can avoid a downturn, although growth will fall short of potential in 2023. We project global real GDP growth to slow from 5.9% in 2021 to 2.9% in 2022 and 1.5% in 2023.

Monetary tightening will eventually succeed in cooling inflation, allowing interest rates to retreat and global economic growth to pick up to a 3% pace in the mid-2020s.

Global economic outlook

The S&P Global Market Intelligence forecast does not envision a global economic recession.

With the world's population forecast to increase 0.9% in 2023, our forecast of 1.5% real GDP growth represents a modest 0.6% increase in real GDP per capita.

Sustained growth in the emerging markets of Asia Pacific, the Middle East, and Africa will keep the global economy moving forward. While we project overall growth in the advanced countries to stall in 2023, the emerging markets will achieve 3.2% growth in real GDP.

With inflation moderating and monetary policies easing, we expect global real GDP to pick up to 2.8% in 2024 and 3.0% in 2025, rates that are close to potential output growth.

US Economic Outlook

After upbeat reports on retail sales and revenues in key services industries, we expect an upward revision to third-quarter real GDP growth (from 2.6% annualized) and modest consumer-led growth in the fourth quarter of 2022.

Yet, the path to 2% inflation will inevitably be painful. We continue to forecast a recession in the first half of 2023, led by declines in residential investment, commercial construction, and consumer spending on goods.

The US unemployment rate will likely rise from 3.7% in October 2022 to a high of 5.7% at the end of 2023. After a 0.2% drop in 2023, we predict real GDP to increase 1.3% in 2024 as inflation subsides and interest rates retreat.

Inflation Outlook

After much delay, major central banks are making a determined effort to subdue inflation through interest rate hikes and net asset sales. As a result, financial conditions are tightening amid increasing volatility.

By March 2023, we expect policy rates to reach highs of 4.75-5.00% in the US, 4.25% in Canada, 4.00% in the United Kingdom, and 2.75% in the eurozone. These monetary policy shifts will affect economic activity with "long and variable" lags.

Inflation has peaked and we expect it will slow markedly in 2023 and 2024. Worldwide, consumer prices increased an estimated 8.3% year on year (y/y) in October, up sharply from a cyclical low of 1.3% in November 2020 and the highest pace since 1995. October's price acceleration was punctuated by y/y inflation rates of 11.6% in Germany, 11.1% in the United Kingdom, and a record 10.6% in the eurozone.

We expect that global inflation will soon begin to moderate in response to tightening financial conditions, softening demand, and easing supply conditions.

Downward price pressures are already in the pipeline, as widely reported in S&P Global's surveys of purchasing managers. With limited spare capacity in energy and metals markets, the commodity price correction is nearing its end.

Yet, with demand cooling, the deceleration in prices of intermediate and finished goods will bring some relief to consumers. We project global consumer price inflation to slow from 7.7% in 2022 to 5.1% in 2023 and 3.0% in 2024.

Labor shortages pose upside risks to the inflation outlook. This is most visible in countries where labor force participation has not fully recovered from the COVID-19 pandemic or where inflows of immigrants and guest workers have diminished.

Rising unemployment will dampen wage pressures in Europe and North America, but it could take two or more years to bring inflation rates down to central bank targets.

Eurozone winter

The eurozone faces a winter recession as exceptionally high energy prices undermine household purchasing power.

Assuming normal winter weather and thus adequate energy supplies, eurozone real GDP is projected to swing from a 3.2% expansion in 2022 to a 0.5% contraction in 2023 before recovering 1.4% in 2024.

A key downside risk is that a much colder winter draws down gas in storage and leads to energy rationing, centered on the industrial sector. Germany, Austria, Poland, Czechia, and Slovakia are most at risk, reflecting their past reliance on Russian energy and their manufacturing supply chain integration. The upward shift in relative energy costs is a long-run threat to Europe's manufacturing competitiveness.

Mainland China

Mainland China's economic growth remains subpar. Real GDP growth rebounded to 3.9% y/y in the third quarter from just 0.4% in the second quarter, led by gains in the industrial sector.

Weak October data on retail sales, service output, and exports depict a shaky economic recovery, and a widespread increase in COVID-19 infections in November could bring another setback.

Government policy is shifting toward supporting economic growth, and while financial relief for property developers could provide an economic lift, a robust rebound in the property sector is unlikely.

Real GDP growth will likely slow from 8.1% in 2021 to 3.0% this year before picking up to 4.4% in 2023.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-world-economy-faces-an-extended-cooling-off-period.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-world-economy-faces-an-extended-cooling-off-period.html&text=The+world+economy+faces+an+extended+cooling+off+period+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-world-economy-faces-an-extended-cooling-off-period.html","enabled":true},{"name":"email","url":"?subject=The world economy faces an extended cooling off period | S&P Global&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-world-economy-faces-an-extended-cooling-off-period.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+world+economy+faces+an+extended+cooling+off+period+%7c+S%26P+Global http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-world-economy-faces-an-extended-cooling-off-period.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}