Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 16, 2024

Third quarter economy signals sought from flash PMI data after Japan GDP shows rebound

After news of the Japanese economy staging an encouraging revival in the second quarter, August flash PMI survey data will be eagerly assessed for clues as to whether the economy can overcome gathering headwinds to growth.

A return to growth

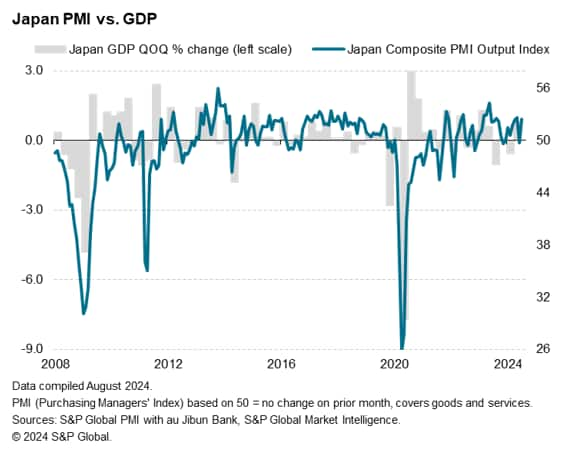

Japan's economy enjoyed a strong second quarter, according to official data, which corroborate recent robust survey data. Gross domestic product rose 0.8% in the three months to June, according to initial estimates from the Cabinet Office. The expansion comes as welcome news after the official data had shown GDP contracting 0.6% in the first quarter.

The second quarter improvement had been flagged in advance by the au Jibun bank PMI survey, compiled by S&P Global, which signalled rising output in the five months to May. Although the survey's headline index covering output of goods and services indicated no change in June, the second quarter average reading was a solid 51.5 against a survey long-run average of 49.2. Any index reading above 50 signals an expansion of output.

Encouragingly, the index rebounded from 49.7 in June to 52.5 in July, indicating a solid start to the third quarter for the Japanese economy.

Gathering headwinds

Whether this recent improvement in growth can be sustained in coming months is uncertain. While positive signs were provided by new orders growth reviving in the July PMI survey, with jobs growth and future business optimism also both ticking higher, Japan's economy certainly faces near-term challenges.

First, financial market volatility has spikes in Japan in recent weeks, fuelling uncertainty among investors, borrowers and savers alike.

Second, political uncertainty has arisen after the surprise announcement that Prime Minister Kushida will not be seeking re-election.

Third, a slowing in global tradehas hit Japan's openly oriented manufacturing economy, contributing to a 29th successive monthly fall in goods exports and leaving the economy reliant on the service sector to sustain growth.

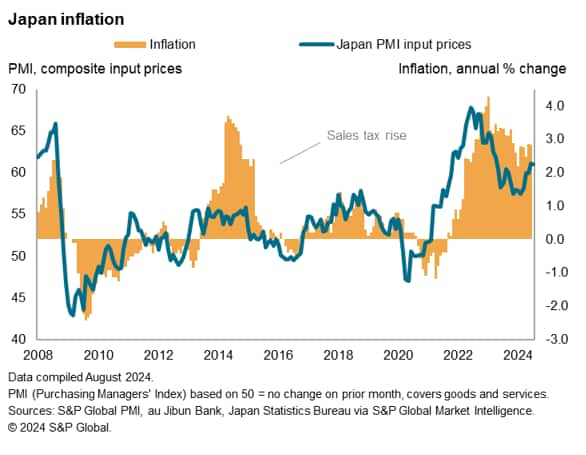

Fourth, the decline in goods exports comes despite a historical low value for the yen, which has driven up import costs. At 2.8%, inflation consequently remains elevated by historical standards for Japan.

These higher costs and currency woes have prompted a tightening of monetary policy by the Bank of Japan, which hiked interest rates in August to a post-financial crisis high of "around 0.25%". The hike came after policymakers ended Japan's negative interest rate regime back in March.

Higher interest rates are typically designed to support the currency and dampen domestic demand, which will act as additional brakes on exports and domestic spending respectively.

How Japan fares against these headwinds will be revealed by the flash PMI data, published 22nd August. The flash PMI will be eyed in particular for insights into manufacturing sector performance (notably including exports) as well as clues as to the resilience of consumer spending, and in particular that of foreign tourists, which has helped bolster the Japanese economy amid the weakness of the yen. Finally, price data will also be keenly assessed for future inflation trends.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthird-quarter-economy-signals-sought-from-flash-pmi-data-after-japan-gdp-Aug24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthird-quarter-economy-signals-sought-from-flash-pmi-data-after-japan-gdp-Aug24.html&text=Third+quarter+economy+signals+sought+from+flash+PMI+data+after+Japan+GDP+shows+rebound+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthird-quarter-economy-signals-sought-from-flash-pmi-data-after-japan-gdp-Aug24.html","enabled":true},{"name":"email","url":"?subject=Third quarter economy signals sought from flash PMI data after Japan GDP shows rebound | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthird-quarter-economy-signals-sought-from-flash-pmi-data-after-japan-gdp-Aug24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Third+quarter+economy+signals+sought+from+flash+PMI+data+after+Japan+GDP+shows+rebound+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthird-quarter-economy-signals-sought-from-flash-pmi-data-after-japan-gdp-Aug24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}