Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 08, 2021

Three key economic takeaways from September's Asia Sector PMI

Asia Sector PMI data showed an economic improvement in the region with eight of the 18 sectors reporting output growth in September, up from five in August. Consumer services, which had performed poorly in August, rebounded in September. On the other hand, the automobiles & auto parts sector experienced a sharp drop in output. Here are three key observations from September's IHS Markit Asia Sector PMI.

Many Asia sectors return to growth in September, consumer services rebounded

The latest IHS Markit Asia Sector PMI™ revealed an improving growth picture across the region with more sectors reporting expansion in September. This included many service sectors, reflecting the easing strain on business activity from the COVID-19 Delta wave.

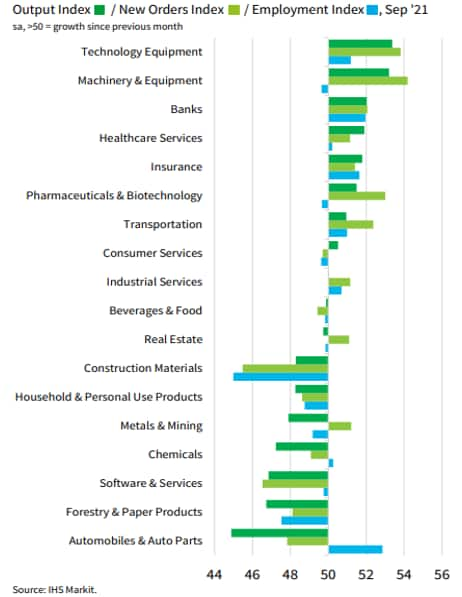

IHS Markit Asia Sector PMI

Specifically, eight of the 18 sectors recorded output growth, up from a mere five sectors in August. This included various services sector, such as the healthcare and consumer service sectors, that previously saw output in contraction. The easing of the strain from the spread of the more infectious COVID-19 Delta variant, as cases receded, had helped to enable these sectors to see month-on-month improvements in activity. In contrast, the other key issue of supply constraints continued to hold many manufacturing-related sectors back in September.

Automobile & auto parts output plunges while technology equipment sector sees strongest growth

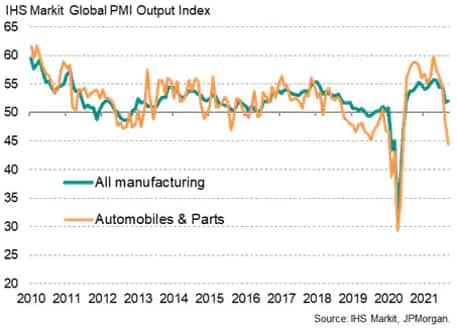

Performance in the automobile and auto parts sector fell through the ranks amongst Asia sectors; a phenomenon also present in the consolidated global PMI data. Auto makers worldwide suffered a record underperformance amid supply chain delays.

Global manufacturing output

Global sector PMI data signalled that the automobile & parts producers saw the steepest decline in production in the 12-year history of the data. Although softer demand contributed to the lower output, backlogs were shown to have accumulated as delivery times worsened, reflecting the supply issues. One of the most widely reported issues had been the availability of semiconductors, although it is interesting to note that technology equipment output saw the strongest output growth amongst Asia sectors in September. As it is, auto and auto parts makers globally were shown to have expressed better optimism with regards to production in the year ahead, but we will await evidence such better readings from PMI new orders and suppliers' delivery times sub-indices to prove that these hopes are not unfounded.

Financials lead output among broad sectors despite Evergrande crisis concerns

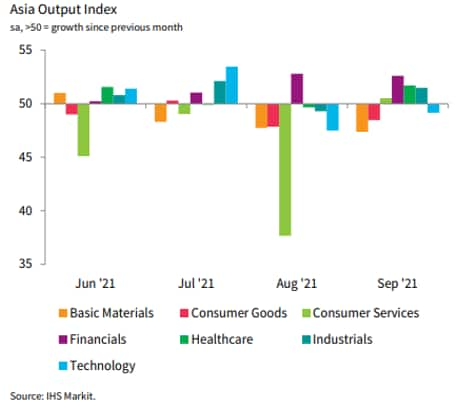

Despite the market's concerns that erupted with the worries surrounding China's Evergrande Group's debt issues, the financial sector continued to lead output growth amongst the broad sectors tracked by IHS Markit in September.

September Asia sector output

Arguably, the base case scenario had largely leaned towards one of a handling of the situation by the Chinese authorities to prevent any systematic fall-out. That said Asia markets, particularly financial stocks, took a tumble into September as a result of the jitters stemming from this headline story. As it is, private sector financial firms continued to perform well in Asia as shown by the latest PMI data, but will have to weather the volatility stemming from developments around the Evergrande liquidity issues. The upcoming US earnings season in mid-October may prove to be another item worth watching in the week ahead. US Sector PMI had so far suggested that we continue to see financials chalking up strong, but slower, growth in Q3.

Jingyi Pan, Economics Associate Director, IHS Markit

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthree-key-economic-takeaways-from-septembers-asia-sector-pmi-oct21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthree-key-economic-takeaways-from-septembers-asia-sector-pmi-oct21.html&text=Three+key+economic+takeaways+from+September%27s+Asia+Sector+PMI+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthree-key-economic-takeaways-from-septembers-asia-sector-pmi-oct21.html","enabled":true},{"name":"email","url":"?subject=Three key economic takeaways from September's Asia Sector PMI | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthree-key-economic-takeaways-from-septembers-asia-sector-pmi-oct21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Three+key+economic+takeaways+from+September%27s+Asia+Sector+PMI+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthree-key-economic-takeaways-from-septembers-asia-sector-pmi-oct21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}