Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 18, 2023

Top 10 PMIs to watch in 2023

S&P Global's PMI surveys cover over 40 countries, derived from monthly survey data provided by over 30,000 companies. Choosing the most important indicators to monitor over the coming year from a database of over 6000 indices has therefore been a challenging task, and there are naturally a wide range of other indicators that we could have included as crucial gauges to watch. However, in our selection we give some insight into the key economic themes we expect to need to monitor especially closely in 2023, and which indicators we considered to be best placed to assess how these issues are developing.

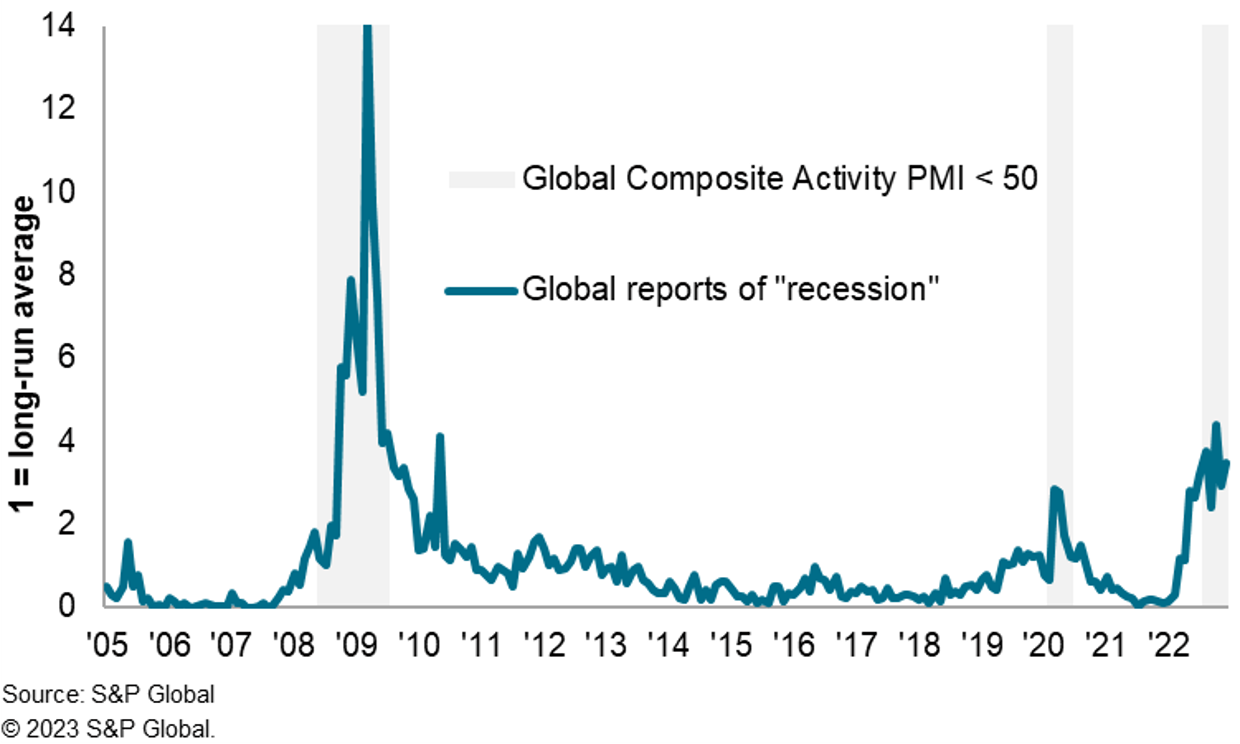

1. Global PMI Comment Tracker: Recession

Our real-time gauge of recession expectations among businesses remains at levels not seen since 2008/09.

The indicator, derived from analysis of anecdotal evidence provided by PMI contributors when answering the monthly surveys, has fallen from its recent peak but remains elevated by historical standards and indicative of recession. It therefore remains an important indicator to monitor in assessing 2023 global recession risks.

2. Global Manufacturing Order-to-Inventory Ratio

The order-to-inventory ratio is a leading indicator of global production. The index was in territory consistent with contracting output at the end of 2022, with high stock levels and falling demand from customers combining to exert downward pressure on production.

After inventories have adjusted to the economic environment and inflation cools, we may see a pick-up in the ratio, which would bode well for a manufacturing sector recovery later in the year.

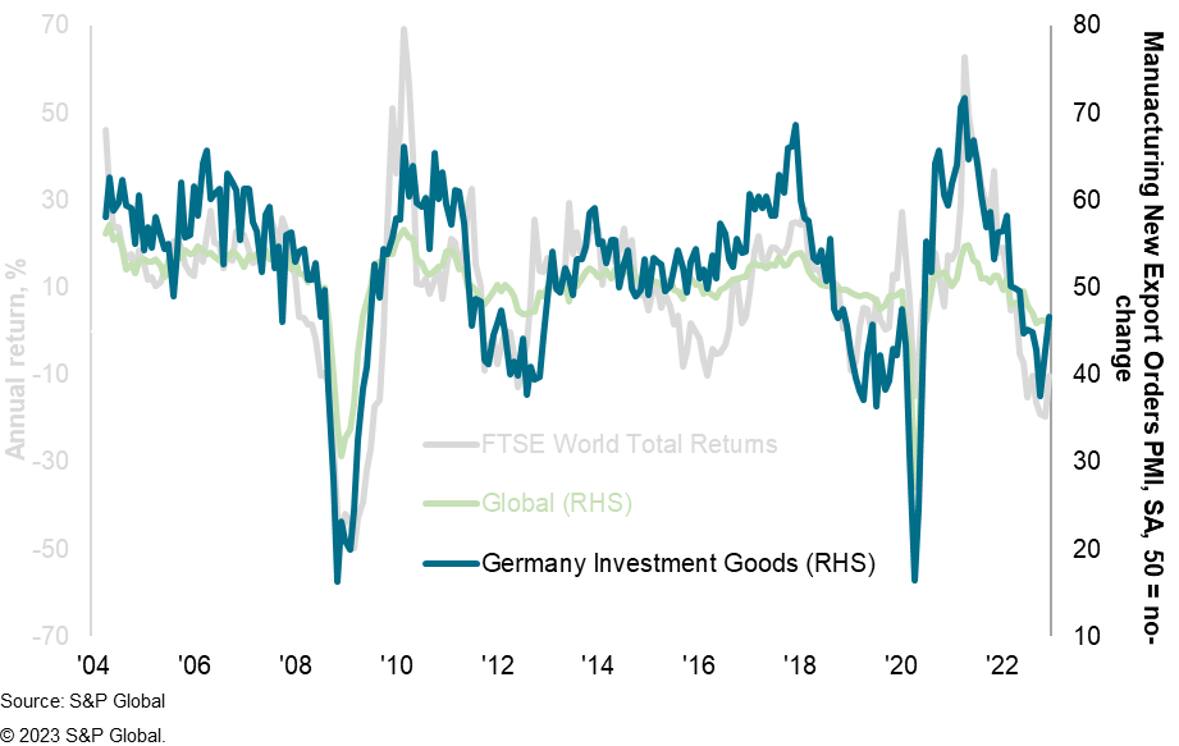

3. Germany Investment Goods Manufacturing New Export Orders

While the Global New Export Orders Index is our best indicator of global trade flows, we see a greater degree of cyclicality in the corresponding index for German Investment Goods. This indicator - which also acts as a proxy for global vehicle demand - showed tentative signs of the manufacturing downturn bottoming out at the end of last year. This index also shares a strong correlation with global equity market returns, and will therefore be crucial to monitor from both an economic and financial market perspective in 2023.

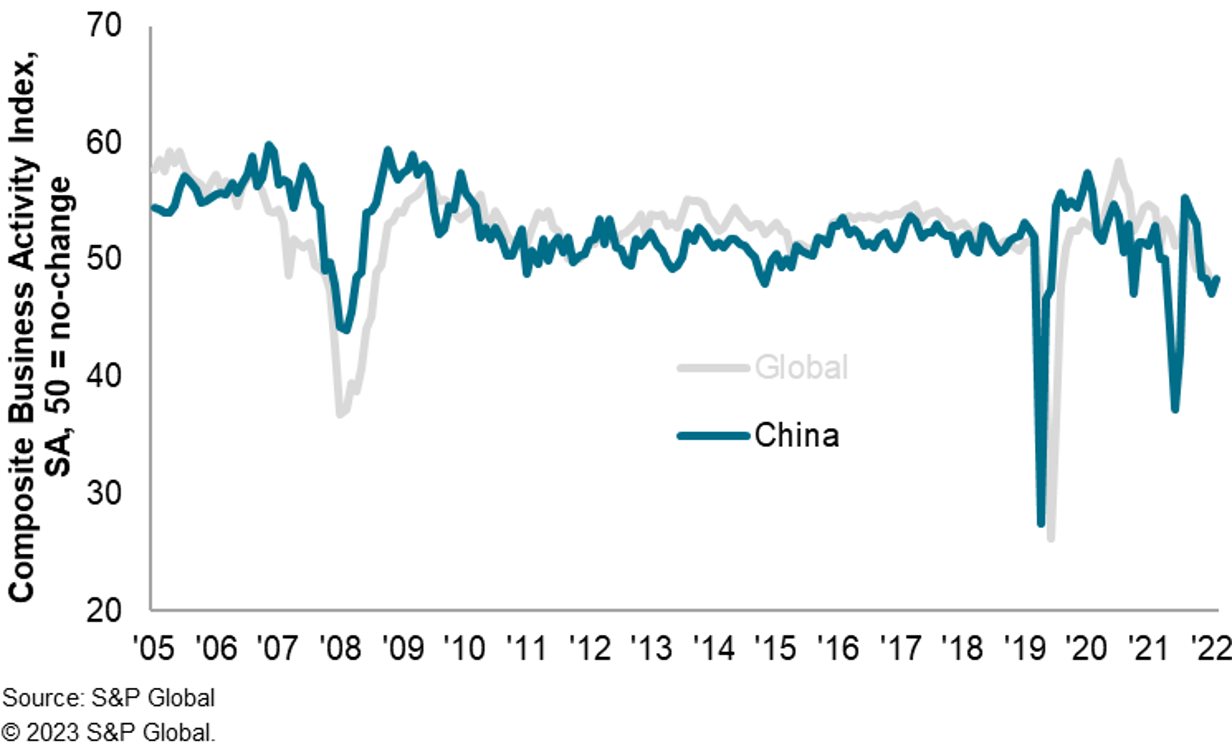

4. Caixin China PMI Composite Business Activity Index

China's transition away from its zero-COVID strategy could be an important boost for global growth in 2023. On the other hand, there may be near-term economic pain from the resulting health issues.

Tracking Chinese economic conditions in real-time will be therefore vital for understanding the broader economic outlook this year, and the PMI output index covering both manufacturing and services will provide the first insights into how the mainland China economy is faring amid the reopening.

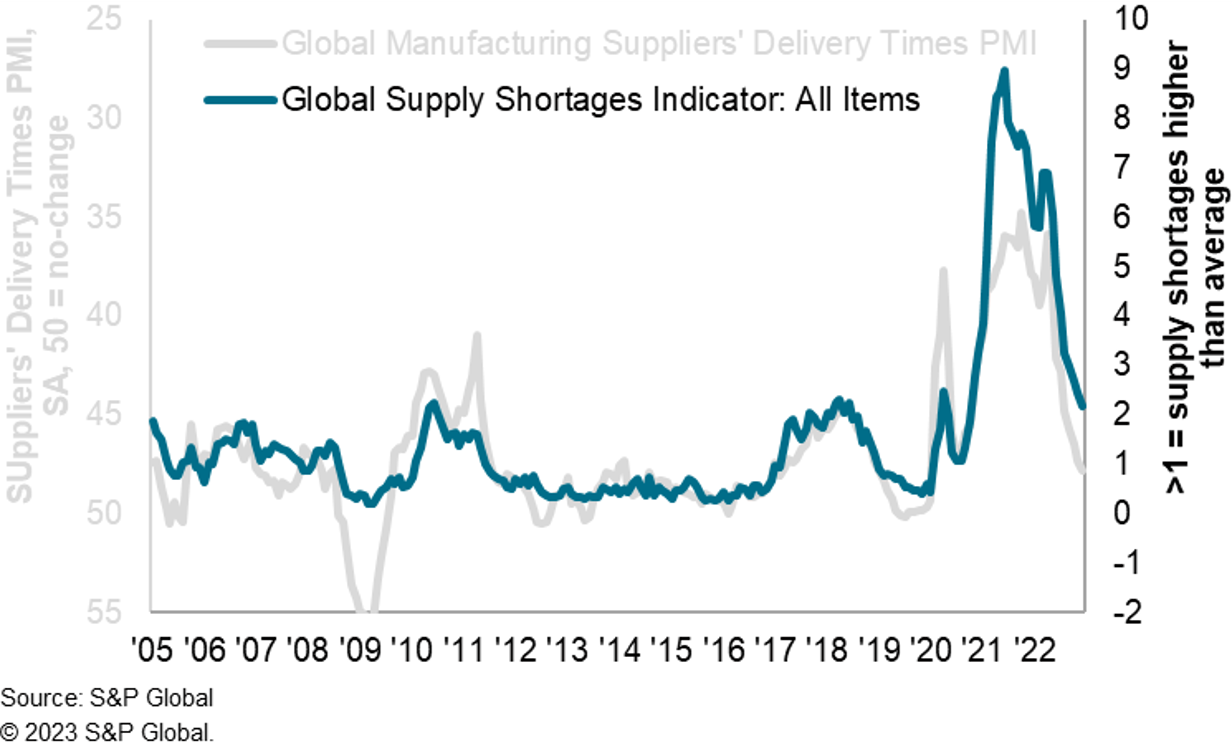

5. Global Supply Shortages Indicator: All Items

Supply chain pressures receded drastically in the second half of 2022 as input demand fell and supplier capacity improved. We subsequently saw less delays, according to our Suppliers' Delivery Times Index. Our Global Supply Shortages Indicator, which tracks the reported scarcity of 27 critical commodities and components, has likewise fallen sharply. It will be crucial to monitor this over the course of 2023 to understand the drivers of inflation and monitor global supply conditions.

6. Global PMI Comment Tracker: Salary Costs

Our global PMI Comment Tracker index of salary costs appears to be the stickiest of our inflation trackers with staff shortages still acute and businesses continuing to hire. Central banks have made it clear that second-round inflation effects via wages are going to be a key determinant of the policy path in 2023, making this gauge something to monitor especially closely in the coming months. If salary costs stay high, or rise further, second-round inflation effects may solidify the case for tighter rates for longer.

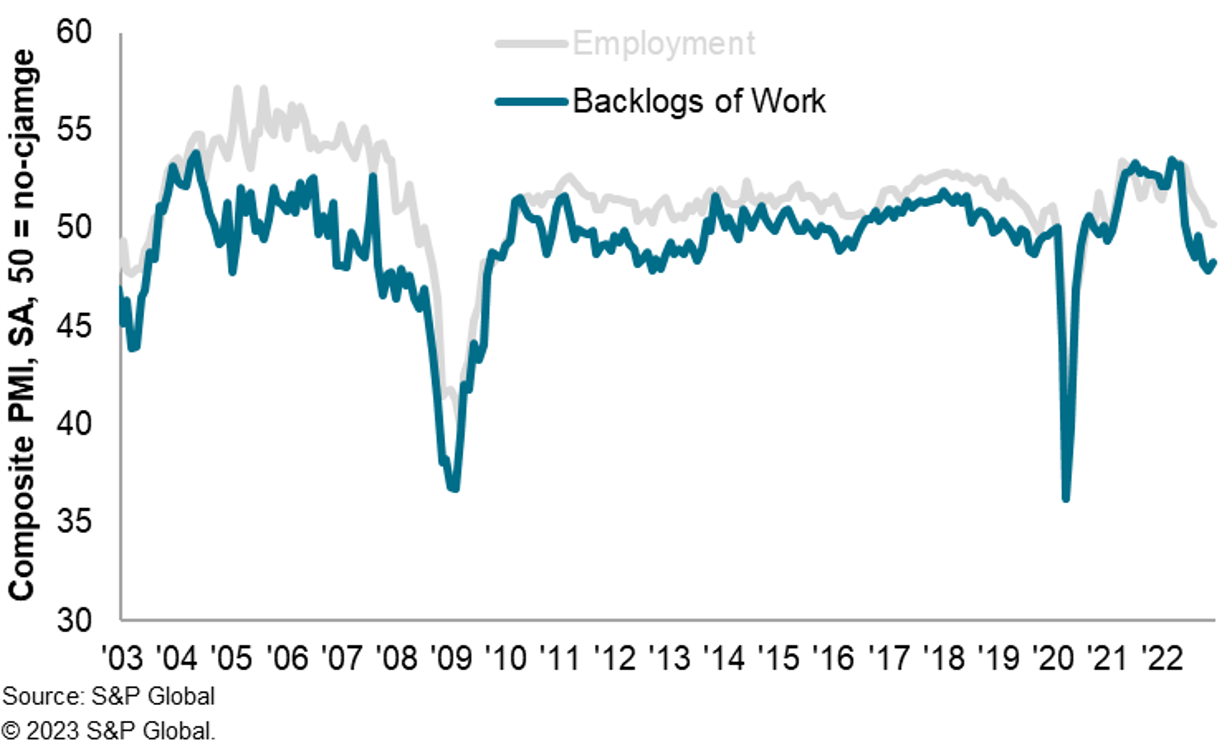

7. Global Composite PMI Backlogs of Work Index

We saw evidence of growing spare capacity across the global economy at the end of 2022 as falling levels of new orders allowed companies to clear their backlogs of work. Historically, falling backlogs are commensurate with lower employment levels, but this has yet to happen. As global central banks have forecast for unemployment rates to rise, any continued resilience across labour markets will raise the prospect of tighter interest rates for longer, but any further marked drop in backlogs of work could add to expectations of a policy pivot.

8. US Services PMI Input Prices Index

Producer price inflation has eased significantly and should continue to fall amid weak demand and improved supply conditions. As such, services costs may well be the key driver of consumer price inflation in 2023, especially if wage growth remains hot. Moreover, interest rates in the US have broad global implications on currency movements and interest rates elsewhere. The US Services PMI Input Price index will therefore prove crucial in determining the likely path of monetary policy at the Federal Reserve and beyond.

9. European Basic Materials PMI Output Index

European energy prices will likely remain a concern as long as the Ukraine war persists. While gas prices have fallen amid a warmer winter, next year could be very different if temperatures are much lower. Measuring the impact of higher energy costs is thus going to be important, and in Europe we will focus on Basic Materials. A highly-cyclical and energy-intensive sector, it will be one of the first to feel any negative effects of higher energy prices or an escalation of the war in Ukraine. Equally, it is likely to one of the first sectors to recover.

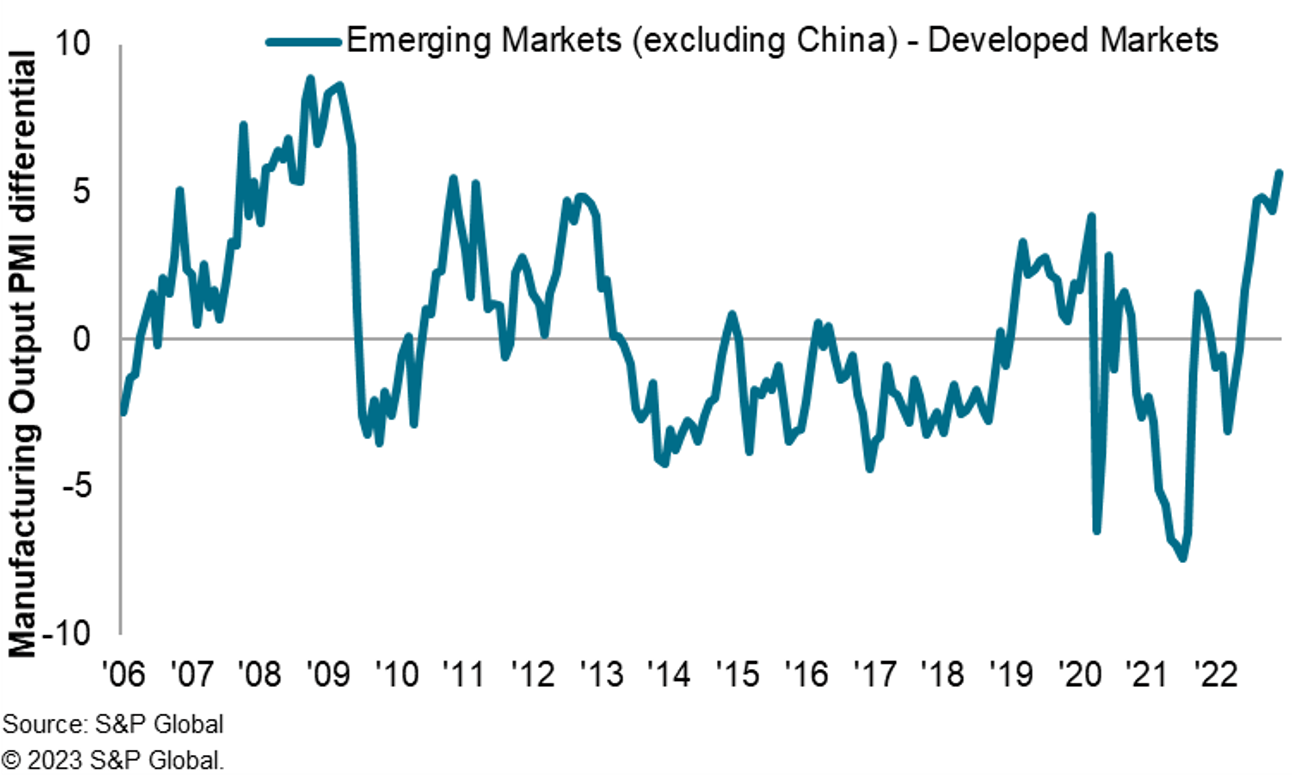

10. Manufacturing Output PMI spread for EM (ex. China) vs. DM

PMI data showed a strengthening outperformance of Emerging Markets (EMs) in December relative to their developed economy peers. This was despite EM central banks raising rates to keep up with the Fed, slumping demand in the US and Europe, and the US dollar appreciating sharply, factors which normally weigh on EM performance. We will be eager to see if emerging markets can continue to support the global economy in 2023 as the kind of outperformance we're seeing has historically been short-lived.

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-10-pmis-to-watch-in-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-10-pmis-to-watch-in-2023.html&text=Top+10+PMIs+to+watch+in+2023+%7c+IHS+Markit+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-10-pmis-to-watch-in-2023.html","enabled":true},{"name":"email","url":"?subject=Top 10 PMIs to watch in 2023 | IHS Markit &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-10-pmis-to-watch-in-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Top+10+PMIs+to+watch+in+2023+%7c+IHS+Markit+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-10-pmis-to-watch-in-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}