Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 02, 2024

Top five economic takeaways from September's PMI as global manufacturing deteriorates

At 48.8, down from 49.6 in August, the Global Manufacturing PMI, sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence, signalled a deterioration of operating conditions for a third successive month in September. The rate of decline accelerated to the steepest since last October, albeit remaining modest.

The deterioration points to the reversal of the manufacturing recovery seen in the first half of the year, which saw the sector's best performance for two years, with sub-indices from the PMI pointing to the downturn likely to gather further momentum in the fourth quarter.

To assess what's driving the change, we analyse the headline PMI's survey 'sub-indices'. Here are our top five takeaways from some of these sub-indices, which provides a deeper insight into the current manufacturing trends relating to output, demand, inventories, supply chains, employment and prices.

1. Global output declines amid broadening malaise

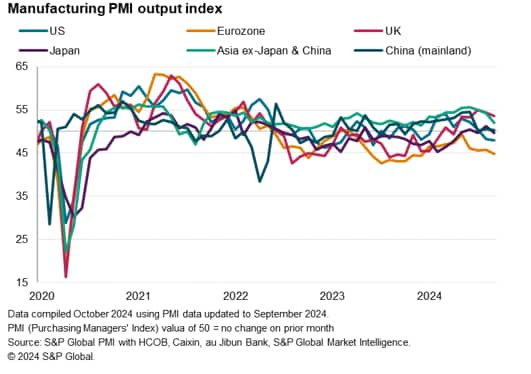

The PMI survey's sub-index of production, which tracks actual month-on-month changes in factory output, signaled lower production volumes in September, representing the first decline since last December after a flat August.

The survey data exhibit a correlation of 75% with the official annual rate of change in global production, with the survey data acting with a three-month lead. Using a simple regression-based model, the latest PMI data indicate that worldwide manufacturing output has stalled in the third quarter, having been growing worldwide at a relatively robust annual rate of approximately 2% during the second quarter, with downward momentum building ahead of the fourth quarter.

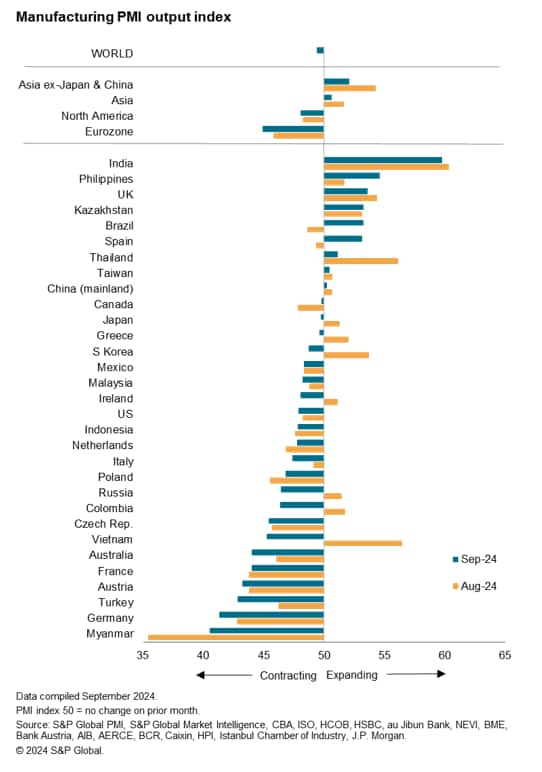

Among the major economies, the eurozone reported the steepest fall in production, led by Germany, though output also slipped deeper into contraction in the US and a marginal decline was recorded in Japan. Production meanwhile barely grew in mainland China, broadly stagnating for a third successive month, and a reduced rate of expansion was seen in the rest of Asia. The UK reported the fastest growth of the major economies, though even here the rate of growth cooled.

Of the other economies monitored by S&P Global's PMIs, only India and the Philippines reported faster manufacturing output growth than the UK. Meanwhile, only Myanmar reported a steeper rate of decline than Germany.

In total, output fell in 22 of the 31 economies for which PMI data are available.

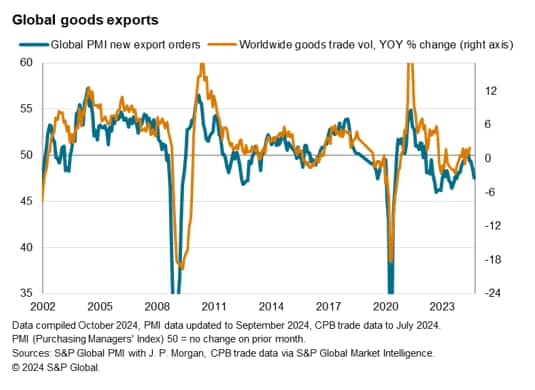

2. Global exports fall at accelerated rate

Global trade flows acted as a particular drag on production, with new export orders reportedly falling globally in September at the fastest rate for 11 months. The PMI data point to global trade volumes falling 3-4% in year-on-year terms.

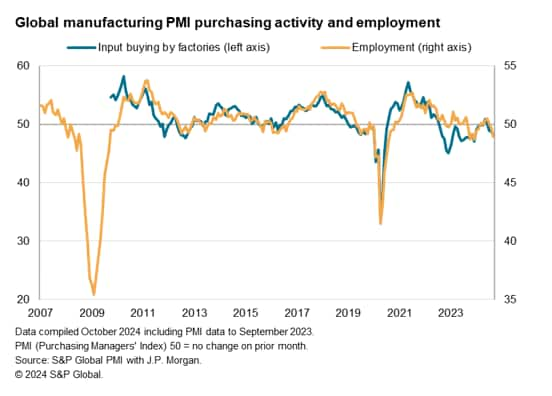

3. Companies reduce their payroll numbers and purchasing activity

The export order decline contributed to a third month of overall new order decline, with the rate of order book decline accelerating to the fastest since December 2022. This waning demand environment prompted firms to reduce their input buying and their payroll numbers at increased rates globally. Worldwide input buying and employment fell at the sharpest rates since last December. Both are indicators of factories scaling back their production needs to hint at the downturn in production gathering pace in coming months baring an improvement in the demand environment.

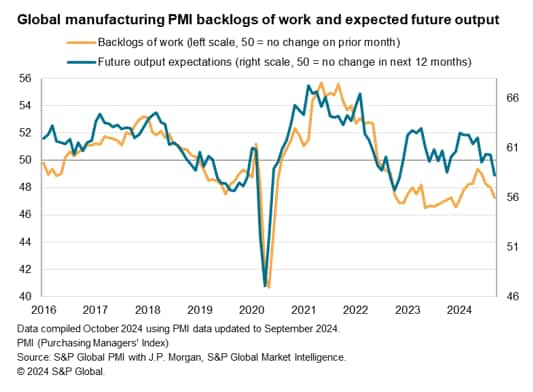

4. Optimism wanes as workloads fall and political uncertainty mounts

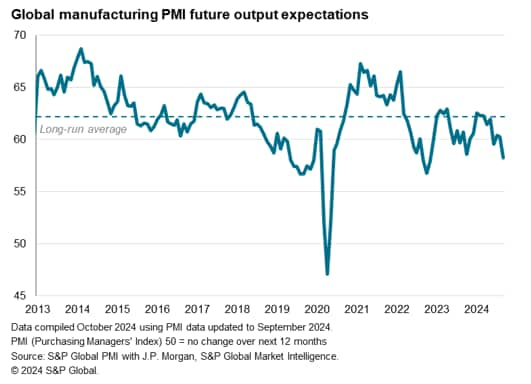

Optimism about the outlook over the next 12 months has meanwhile drifted sharply lower. Business expectations about factory output levels in the year ahead fell worldwide in September to their lowest since November 2022, dropping further below their long-run average.

While lower output expectations were often simply attributed to lower workloads - with backlogs of uncompleted orders falling in September at the sharpest rate since January, producers around the world also grew increasingly concerned about geopolitics, notably in relation to the US elections and political changes in Europe, as well as rising protectionism and tariffs.

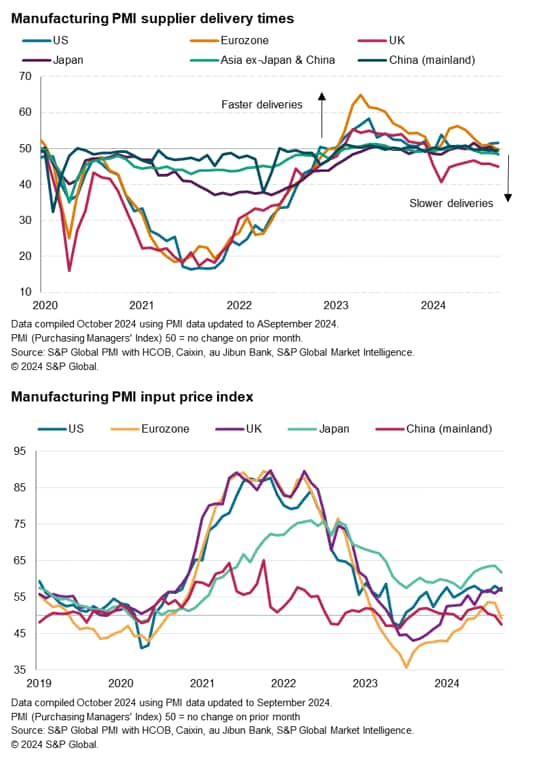

5. Manufacturing prices rise at muted rate amid subdued pricing power

Prices charged by manufacturers rose only very modestly in September as the weakened demand environment subdued pricing power and offset a further rise in raw material prices. The latter was often blamed on higher wages, as weak global trade and purchasing activity also inhibited pricing power at suppliers. Suppliers' delivery times, which tend to lengthen when suppliers are busier (and therefore more able to raise prices) were barely showing any signs of stress on supply chains in September according to the PMI survey respondents, adding to indications of subdued pricing power in the manufacturing economy at present.

However, supplier delivery performance varied globally, with the UK notable in again reporting a higher degree of supply delays amid shipping related issues. These higher shipping delays contributed to the UK's PMI gauge of factory input cost inflation ticking up to a 20-month high in September, contrasting with slower price growth in the other major economies.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-septembers-pmi-as-global-manufacturing-deteriorates-sep24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-septembers-pmi-as-global-manufacturing-deteriorates-sep24.html&text=Top+five+economic+takeaways+from+September%27s+PMI+as+global+manufacturing+deteriorates+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-septembers-pmi-as-global-manufacturing-deteriorates-sep24.html","enabled":true},{"name":"email","url":"?subject=Top five economic takeaways from September's PMI as global manufacturing deteriorates | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-septembers-pmi-as-global-manufacturing-deteriorates-sep24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Top+five+economic+takeaways+from+September%27s+PMI+as+global+manufacturing+deteriorates+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-septembers-pmi-as-global-manufacturing-deteriorates-sep24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}