Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 07, 2023

Top US regional economic predictions for 2023

A mild recession is coming in the US. Unemployment and migration trends are shifting. How will these factors play out across different states and regions?

Here are our top regional economic predictions for 2023:

1. US states will fall into recession.

The US will enter a mild recession over the first half of 2023, and

most states will follow. This downturn will have less of a regional

theme than past ones given its mild nature and the main drivers

precipitating it, which are more broadly based.

The housing correction will have a high degree of regional

variance, with the previously booming West incurring the deepest

home price declines and thus most related economic damage,

especially Arizona, California, Colorado, Nevada, and Utah.

Industry structure will also help shape the regional narrative. The

energy industry, for example, will outperform this year, giving the

major energy-producing states — Alaska, New Mexico, North

Dakota, Oklahoma, Texas, and Wyoming — relatively better

economic outlooks.

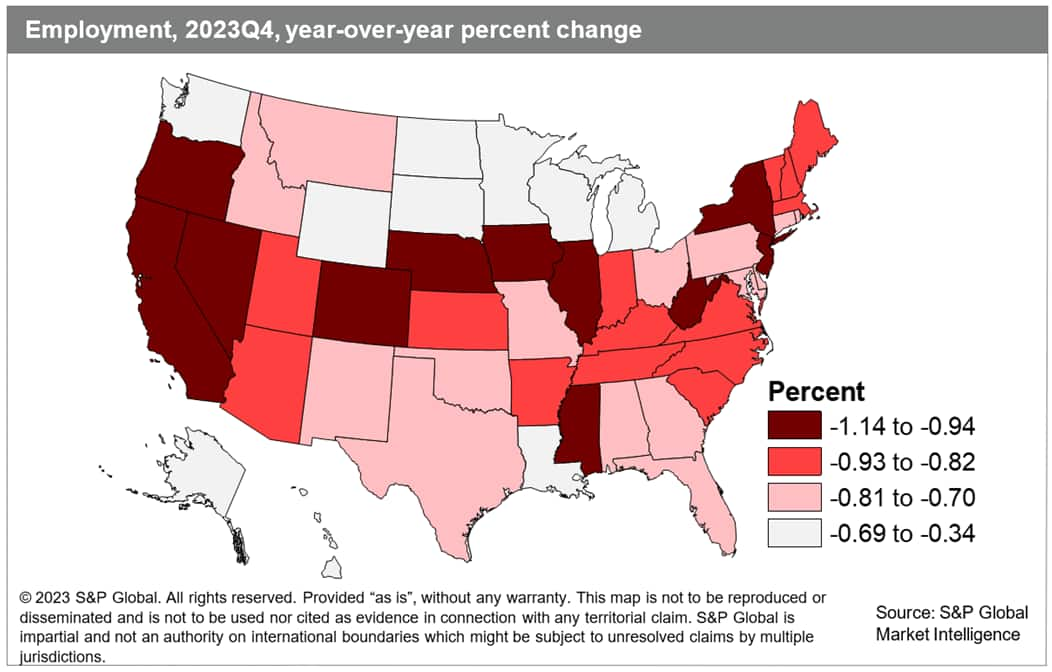

2. It will be a long road back to pre-pandemic

employment levels for 20 states.

As of December 2022, employment in 26 states exceeded their

February 2020 levels. The remaining states have a difficult road

ahead.

Four states — Oklahoma, Iowa, Massachusetts, and New Mexico

— have current deficits at or below 0.5% that could recover

over the next month or two if trends continue apace. Another group

of states — Delaware, Kansas, Minnesota, Pennsylvania, and

Wisconsin — can see light at the end of the tunnel, although

their recoveries will halt as the recession takes hold.

A dozen other states had little or no shot of fully recovering in

2023 even under good economic conditions given how deep their

current deficits are, including Alaska, Hawaii, Louisiana, New

York, North Dakota, and Vermont.

All told, 20 states will not have fully recovered by the time the

next recession hits, many of them concentrated in the Northeast and

Midwest.

3. The unemployment rate will rise in every

state.

In 2022, 28 states registered a record low unemployment rate, as

demographic trends and pandemic-related disruptions continued to

suppress the labor force. This labor tightness will ease somewhat

in 2023, as layoffs pick up and more firms implement hiring

freezes.

Every state will see its unemployment rate rise, and by the end of

2023, the unemployment rate will be close to or above 5.0% in every

region, with the highest rates in the West and Northeast.

4. Pandemic-fueled disruptions to state population

growth will settle down as the upcoming recession

approaches.

The high rate of inter-state moves in 2021 and 2022 reflected the

combination of large differences in costs of living across states,

increased job mobility afforded by remote work, and low mortgage

interest rates. The broader economic slowdown in 2023 will be an

obstacle for potential movers, making it more difficult to land a

position in a new locale as firms curtail hiring.

The state of the housing market is another challenge. Current homeowners face a tougher decision swapping into a new home at a much higher mortgage rate at a time when home prices remain elevated and affordability low.

The record inflows to the South and outflows from the Northeast will soften over 2023, even if they remain above pre-pandemic norms. Out West, California will see outmigration continue to soften from elevated levels, and in-migration to the Mountain region will be well below what was seen over the 2020-21 highs.

5. Home prices will contract across all four Census

regions.

Weakness in the housing market began to emerge over the latter half

of 2022 as rapid increases in mortgage rates combined with a

significant lack of affordability. Prices have already started to

fall and will continue to tumble through 2023. An impending

recession, elevated mortgage rates, and an increase in housing

inventory from resolving construction delays will all weigh on home

price growth.

While all regions will see home prices fall, the West will experience the deepest peak-to-trough decline with prices plunging by over 10% (seasonally adjusted). Prices in the other three Census regions will fall in the range of 6-8% from their 2022 peak.

6. The recent deceleration in headline CPI inflation

will continue in 2023.

Inflation will fall most rapidly in the Midwest, while the slowdown

in price growth will be more gradual in the Northeast and

West.

The Midwest will see the lowest year-over-year inflation rate of

the four Census regions by the fourth quarter of 2023. Midwestern

states are more car-dependent given their relatively low population

densities, so the topline price levels of their respective Consumer

Price Index (CPI) baskets are more sensitive to changes in gas

prices and automobiles. Recent data show declines in energy and

agricultural commodity prices pushing headline CPI inflation down

more than two percentage points below its peak through December

2022.

Services price growth is expected to moderate only slightly in

2023, largely due to persistently elevated levels of rent

inflation. This will keep overall CPI inflation more elevated in

the Northeast and West regions, which have the highest levels of

renters among the four Census regions.

7. Regions will see modest real income growth, with the

West lagging.

Real personal income growth has been especially volatile

since the pandemic began. Fiscal stimulus led to periods of

incredible growth over 2020 and 2021, and the levels fell back when

the stimulus measures ended, with 2022 representing a down year.

Growth will accelerate in 2023 but remain modest overall.

A tepid outlook for employment will hold down wage disbursements,

with elevated inflation pushing down real growth rates as well. By

the fourth quarter of 2023, real personal income will be up in

year-over-year terms in all regions, yet still below 2% — a

lackluster increase.

The West will lag the three other regions due in part to a deeper

downturn this year, in addition to stimulus checks that began

circulation in California during the fourth quarter of 2022, which

will exaggerate the slowdown in late 2023.

8. Manufacturing activity will lose

steam.

The manufacturing sector is likely already in recession, and

conditions will get worse before they get better. The dollar's

strength and weak global growth will hurt goods exports. Weaker

homebuilding will spill into supplier industries and upstream

energy spending will not be as robust as last year.

Manufacturing employment will decline in 2023, and the impact will

be felt most across states that rely most heavily on the

manufacturing sector, including Alabama, Indiana, Iowa, Kentucky,

Michigan, Ohio, and Wisconsin.

On the bright side, a recovery from the semiconductor shortage will

help boost auto production and provide some offset from broader

weakness in the industrial sector.

-With contributions from Alex Minelli

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-us-regional-economic-predictions-for-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-us-regional-economic-predictions-for-2023.html&text=Top+US+regional+economic+predictions+for+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-us-regional-economic-predictions-for-2023.html","enabled":true},{"name":"email","url":"?subject=Top US regional economic predictions for 2023 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-us-regional-economic-predictions-for-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Top+US+regional+economic+predictions+for+2023+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-us-regional-economic-predictions-for-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}