Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

Oct 16, 2018

Trade Policy Insights: US and Canada in USMCA – Dollars, Tonnes, and National Security Tariffs

Author: Daniela Stratulativ, Head of Global Trade Analysis, IHS Markit Maritime & Trade

Key points:

- US - Mexico - Canada trade agreement – USMCA reached on Sep 30. The agreement has to be ratified by US, Mexican and Canadian legislatures. It is expected it will enter into force in the second half of 2019.

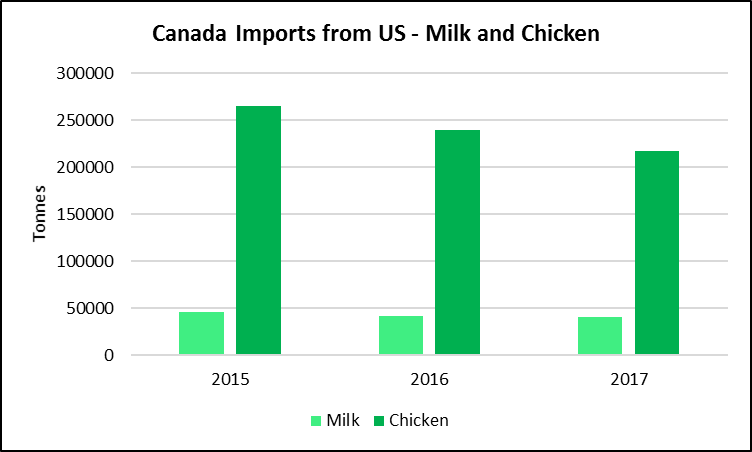

- Canada opens market to US dairy, poultry, eggs by setting quantities allowed to enter Canada duty-free. Highest increases in volumes traded are expected for milk and chicken, reaching close to 500,000 tonnes in the next 6 years.

- In the USMCA, the dispute resolution process from 1994 NAFTA is preserved: Canada can challenge US duties on Canadian exports on a panel with representatives from both countries.

- If US plans to impose new tariffs under national security Section 232, there will be a period of 60 days before tariffs will be applied to Canadian goods and services. During this period, US and Canada will negotiate an appropriate outcome.

- Automotive exemptions from future tariffs have been set to allow Canada to increase exports. Products include passenger vehicles, light trucks and auto parts.

- Agreement clause on signatories negotiating trade agreements with a 'non-market country' states that if one party enters into such agreement, the other two can withdraw from the USMCA.

Canada US – Disputes and US tariffs imposed on the basis of national security

The dispute resolution process of the 1994 NAFTA will be preserved. Canada can challenge duties placed by US on Canadian exports on an expert panel with representatives from both countries. Without this dispute resolution process, the cases would be resolved in court in US, the country imposing the duties.

In the future, US could decide to impose tariffs on imports that threaten to impair the national security, according to Section 232 of The Trade Act of 1962. The agreement specifies that US shall not adopt or maintain a measure imposing tariffs or import restrictions on goods or services of Canada under Section 232, for at least 60 days after imposition of a measure. During that 60-day period, US and Canada will seek to negotiate an appropriate outcome based on industry dynamics and historical trading patterns. Canada may take a measure of equivalent commercial effect in response. In addition, Canada retains its WTO rights to challenge a Section 232 measure.

US, Mexico, Canada bilateral negotiations with a 'non-market country' – China

Chapter 32 of the agreement states that if one of the signatories plans to enter into trade negotiations with a non-market country, the other two parties have to be notified three months in advance. If such agreement is drafted, it has to be submitted for review of the other two USMCA parties 30 days before being signed. If agreement is signed, the other two parties can withdraw from the USMCA.

If Canada and Mexico decide to enter into trade negotiations with China, the USMCA clause has to be considered, and negotiations to be conducted accordingly, given the close trading relations with US. Canada exports to US in 2017 represented over 75% of total Canadian exports and reached 320 bn USD. China was the 2nd largest export market for Canada, with a share of 4%. In 2017, US was Mexico's largest export market, with 80% share, followed by Canada at 3%, Germany 2% and China 1.6%.

Automotive – exemption for Canada imports from US future tariffs leads to opportunities

In regards to automotive, Canada negotiated an exemption from future tariffs that US might impose with respect to passenger vehicles, light trucks, or auto parts. US shall exclude:

- 2,600,000 passenger vehicles imported from Canada on an annual basis

- light trucks imported from Canada; and

- such quantity of auto parts amounting to 32.4 billion USD in declared customs value in any calendar year.

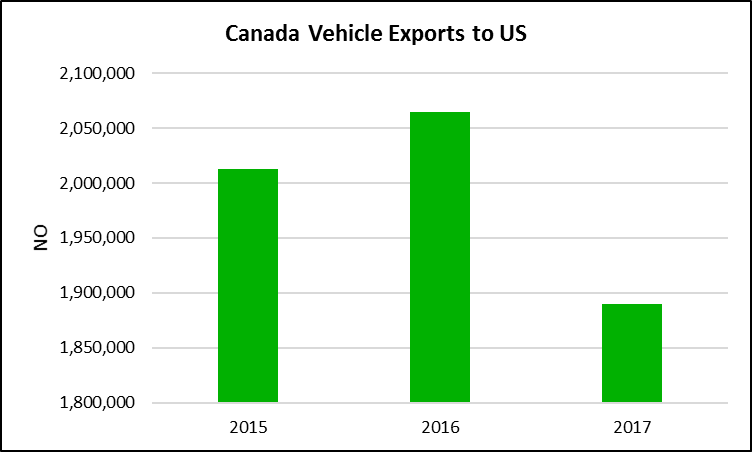

In 2017, Canada exports to US reached close to 1.9 million vehicles, decreasing by 8.5% over previous year.

Source: IHS Markit © 2018 IHS Markit

The number of vehicles Canada exported is within the limits of duty-free US imports set in the agreement.

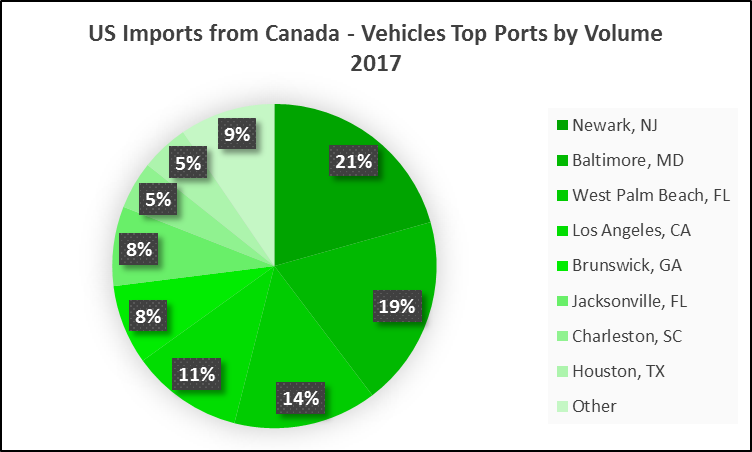

The top US ports receiving largest vehicle imports from Canada are Newark, with a share of 21%, and Baltimore 19%.

Source: IHS Markit © 2018 IHS Markit

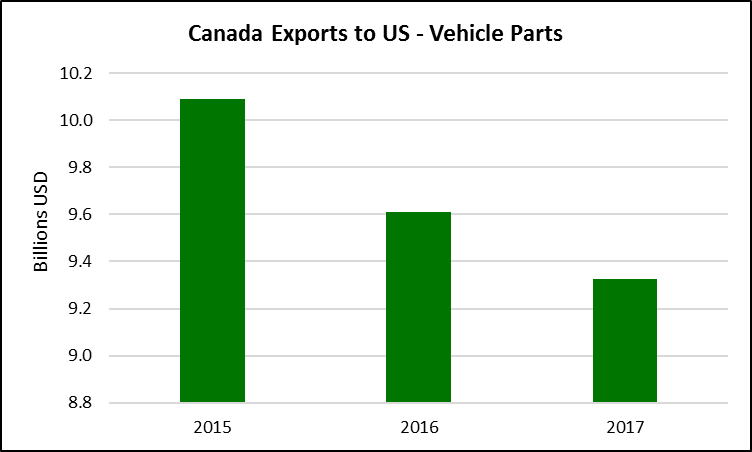

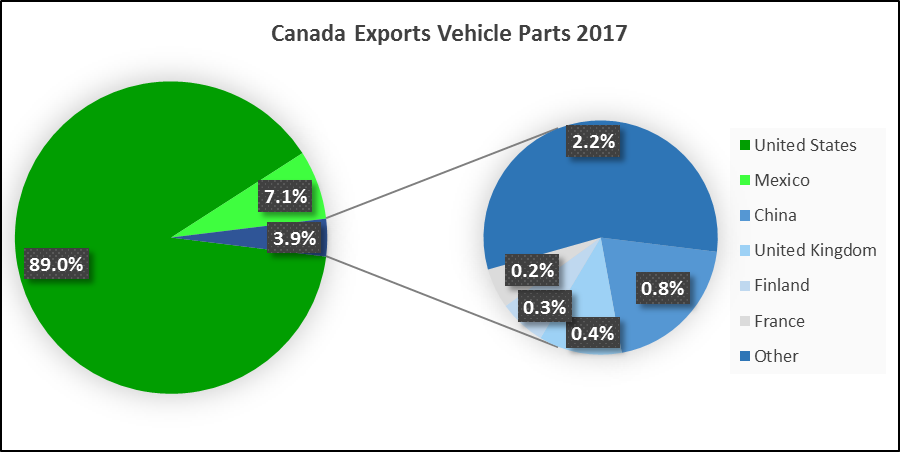

In regards to US auto parts imports from Canada, the agreement sets a duty-free limit of 32.4 billion USD in declared customs value. In 2017 Canadian auto parts exports to US reached 9.3 billion USD, decreasing by 3% compared to previous year. With the exemption set in the agreement, Canada will be able to increase duty-free exports of auto parts more than 3 times the current exports. Total value of Canadian vehicle parts exports reached 10.5 bn in 2017.

Source: IHS Markit © 2018 IHS Markit

Canada exports of vehicle parts to US might increase due to USMCA terms, if the US demand increases. This will likely lead to a decrease of Canadian exports of vehicle parts to Mexico, China, UK, Finland, France, amongst others.

Source: IHS Markit © 2018 IHS Markit

Following the announcement of the trade deal, shares of Canadian auto parts suppliers went up significantly. According to the Canadian Automotive Parts Manufacturers' Association, the agreement will result in more investment and more volume purchases from existing investment.

US agricultural products increased access to Canadian market – change in trade volumes

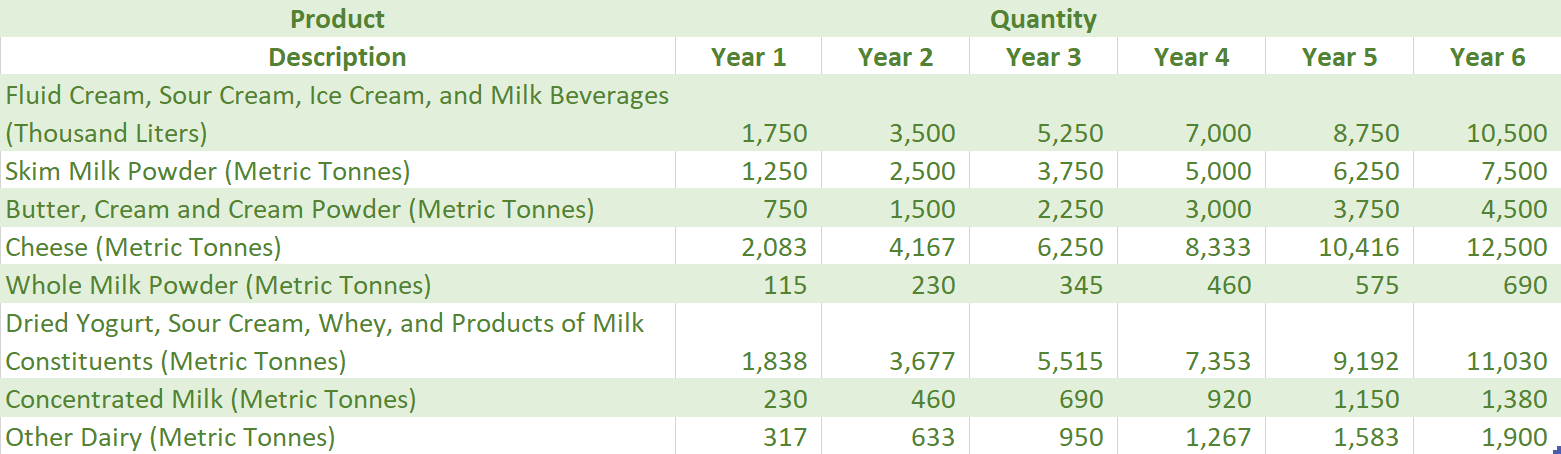

Under the new agreement, Canada has increased market access to US dairy, poultry and eggs, by setting tariff rate quotas (TRQs). Volumes imported in excess of set quantities will continue to receive WTO MFN tariff treatment. The TRQs are applied on a calendar year basis or dairy year basis (August to July).

The quantities permitted to enter duty-free under the TRQs for each product are listed in the table below, for the first 6 years after USMCA enters into force. Starting in year 7, the quantity shall increase at a compounded annual growth rate of one per cent for the subsequent thirteen years.

Source: TRQs clauses of USMCA published agreement

For Turkey and Broiler Hatching Eggs & Chicks, the duty-free quantities are calculated on a percentage basis taking into account the Canadian domestic production.

For Eggs and Eggs Products: the agreement allows for duty-free quantity of 10 million dozen eggs in year 1; starting in year 2, the quantity shall increase at a compounded annual growth rate of one per cent for the subsequent ten years.

For the past 3 years, Canadian imports of US milk and chicken decreased, as shown:

Source: IHS Markit © 2018 IHS Markit

Canadian imports from US will have lower prices than domestic products in the following five categories: dairy, eggs, chicken, turkey and broiler hatching eggs and chicks. It is expected import volumes will increase, as specified by TRQs.

Canada agricultural exports to US – Tariff Rate Quotas

In exchange for the concessions made by Canada on US agricultural imports, US set tariff rate quotas (TRQs) for a number of Canadian agricultural exports. The agreement will increase US market access for Canadian sugar and sugar containing products, as well as dairy products. Volumes imported in excess of set quantities will continue to receive WTO MFN tariff treatment. The TRQs are applied on a calendar year basis.

The table below lists the quantities permitted to enter duty-free under the TRQs for each product, for the first 6 years after USMCA enters into force. Starting in year 7, the quantity shall increase at a compounded annual growth rate of one per cent for the subsequent thirteen years.

Source: TRQs clauses of USMCA published agreement

Starting in quota year seven, the quantity for each of the products in the table above, allowed to enter US duty free, shall increase at a compounded annual growth rate of one per cent for the subsequent thirteen years.

In addition, US set quotas for Sugar and Sugar Containing Products. For both categories, the quantity permitted to enter US duty-free is 9,600 tonnes per year. In order to enter US duty free, sugar has to be wholly obtained from sugar beets produced in Canada.

Additional terms are specified for Other Dairy, Sugar, and Sugar Containing Products, such as customs processes and rules of origin.

Products referenced:

Automotive:

Passenger vehicles: HS codes 8703.21 through 8703.90,

Light trucks 8704.21 and 8704.31

Vehicle parts: 8708

Canada – Agricultural products and corresponding tariff lines:

Milk: 0401.10.20, 0401.20.20

Cream: 0401.40.20, 0401.50.20

Skim Milk Powders: 0402.10.20

Butter, Cream Powder: 0402.21.22, 0402.29.22, 0405.10.20, 0405.20.20, 0405.90.20

Cheeses for Industrial Use: 0406.10.20, 0406.20.12, 0406.20.92, 0406.30.20, 0406.40.20, 0406.90.12, 0406.90.22, 0406.90.32, 0406.90.42, 0406.90.52, 0406.90.62, 0406.90.72, 0406.90.82, 0406.90.99, 0406.90.92, 0406.90.94, 0406.90.96

Cheeses of All Types: 0406.10.20, 0406.20.12, 0406.20.92, 0406.30.20, 0406.40.20, 0406.90.12, 0406.90.22, 0406.90.32, 0406.90.42, 0406.90.52, 0406.90.62, 0406.90.72, 0406.90.82, 0406.90.92, 0406.90.94, 0406.90.96, 0406.90.99

Yogurt and Buttermilk: 0403.10.20 and 0403.90.92

Whey Powder: 0404.10.22

Concentrated Milk: 0402.91.20, 0402.99.20

Milk Powders: 0402.21.12, 0402.29.12

Powdered Buttermilk: 0403.90.12

Products of Natural Milk Constituents: 0404.90.20

Ice Cream and Ice Cream Mixes: 1806.20.22, 1806.90.12, 1901.90.32, 1901.90.52, 2105.00.92, 2202.99.33

Other Dairy: 1517.90.22, 1901.20.12, 1901.20.22, 1901.90.34, 1901.90.54, 2106.90.32, 2106.90.34, 2106.90.94, 2309.90.32

Turkey: 0105.99.11, 0207.24.11, 0207.24.91, 0207.25.11, 0207.25.91, 0207.26.10, 0207.27.11, 0207.27.91, 0209.90.30, 0210.99.14, 1601.00.31, 1602.20.31, 1602.31.12, 1602.31.93

Eggs and Eggs Products: 0407.11.92, 0407.21.20, 0407.90.12, 0408.11.20, 0408.19.20, 0408.91.20, 0408.99.20, 2106.90.52, 3502.11.20, 3502.19.20

Broiler Hatching Eggs & Chicks: 0407.11.11, 0105.11.21

US – Agricultural products and corresponding tariff lines:

Fluid Cream, Sour Cream, Ice Cream, and Milk Beverages: 04014025, 04015025, 04039016, 21050020 and 22029928

Skim Milk Powder: 04021050 and 04022125

Butter, Cream and Cream Powder: 04015075, 04022190, 04039065, 04039078, 04051020, 04052030, 04052070, 04059020, 21069026 and 21069036

Cheese: 04061008, 04061018, 04061028, 04061038, 04061048, 04061058, 04061068, 04061078, 04061088, 04062028, 04062033, 04062039, 04062048, 04062053, 04062063, 04062067, 04062071, 04062075, 04062079, 04062083, 04062087, 04062091, 04063018, 04063028, 04063038, 04063048, 04063053, 04063063, 04063067, 04063071, 04063075, 04063079, 04063083, 04063087, 04063091, 04064070, 04069012, 04069018, 04069032, 04069037, 04069042, 04069048, 04069054, 04069068, 04069074, 04069078, 04069084, 04069088, 04069092, 04069094, 04069097 and 19019036

Whole Milk Powder: 04022150, 04022950, 23099028 and 23099048

Dried Yogurt, Sour Cream, Whey, and Products of Milk Constituents: 04031050, 04039045, 04039055, 04039095, 04041015, 04041090 and 04049050

Concentrated Milk: 04029170, 04029190, 04029945, 04029955 and 4029990

Other Dairy: 15179060, 17049058, 18062026, 18062028, 18062036, 18062038, 18062082, 18062083, 18062087, 18062089, 18063206, 18063208, 18063216, 18063218, 18063270, 18063280, 18069008, 18069010, 18069018, 18069020, 18069028, 18069030, , 19011016, 19011026, 19011036, 19011044, 19011056, 19011066, 19012015, 19012050, , 19019062, 19019065, 21050040, 21069009, 21069066 and 21069087

Sugar: 17011250, 17011350, 17011450, 17019130, 17019950, 17029020 and 2106946

Sugar Containing Products: 17019148, 17019158, 17022028, 17023028, 17024028, 17026028, 17029058, 17029068, 17049068, 17049078, 18061015, 18061028, 18061038, 18061055, 18061075, 18062073, 18062077, 18062094, 18062098, 18069039, 18069049, 18069059, 19011076, 19012025, 19012035, 19012060, 19012070, 19019068, 19019071, 21011238, 21011248, 21011258, 21012038, 21012048, 21012058, 21039078, 21069072, 21069076, 21069080, 21069091, 21069094, and 21069097.

This column is based on data from IHS Markit Global Trade Atlas (GTA).

Risks, opportunities, impact on supply chains and shipping industry can be identified for any products at 6-digit code level within GTA . Insights can be complemented with bill of lading data from PIERS and vessel movements via AIS.

We provide The New Intelligence for strategic decision-making to over 50,000 customers in 140 countries – Governments and private sector, including 80% of Global Fortune 500 companies.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-us-canada-in-usmca-tariffs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-us-canada-in-usmca-tariffs.html&text=Trade+Policy+Insights%3a+US+and+Canada+in+USMCA+%e2%80%93+Dollars%2c+Tonnes%2c+and+National+Security+Tariffs+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-us-canada-in-usmca-tariffs.html","enabled":true},{"name":"email","url":"?subject=Trade Policy Insights: US and Canada in USMCA – Dollars, Tonnes, and National Security Tariffs | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-us-canada-in-usmca-tariffs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Trade+Policy+Insights%3a+US+and+Canada+in+USMCA+%e2%80%93+Dollars%2c+Tonnes%2c+and+National+Security+Tariffs+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-policy-insights-us-canada-in-usmca-tariffs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}