Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 13, 2018

The trade wars to come: How to determine risk exposure from potential Section 301 tariff actions

On March 22nd, President Trump signed a memorandum directing his administration to take retaliatory trade actions against China. This action came with the conclusion of the Section 301 investigation, conducted by US Trade Representative Robert Lighthizer, looking into unfair trade practices taken by China. Lighthizer's report concluded that China engages in systematic, state-sponsored practices that harm American intellectual property rights, innovation, and technology development. President Trump's response, outlined in the memorandum, focuses on three main points, with tariff actions on $50 billion worth of Chinese goods being central among them. On April 4th, the US Trade Representative released a proposed list of products on which a 25% tariff will be applied. The release of this list kicks off a comment period that concludes on May 11th - comments can be submitted here. It is unlikely that a final list will be released, or any tariffs be implemented, before late May/early June.

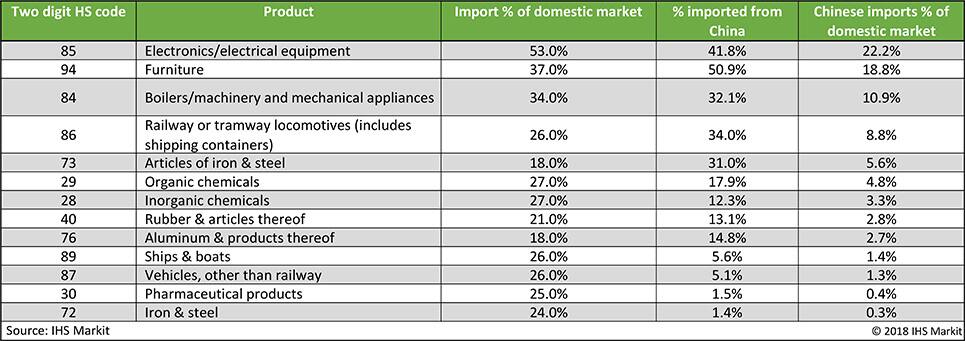

The analysis below looks at the risk exposure to markets included in the proposed list of products. The list contains over 1,300 products; this analysis looks at the markets most heavily targeted, breaking the list into 13 subgroups. We find that markets in which Chinese imports take up a disproportionate amount of the domestic supply face the highest upside price risk to potential Section 301 tariff actions.

Import exposure

Products on the list of tariff proposals face varying amounts of upside risk, depending on Chinese imports' share of the domestic market. If Chinese imports account for a large share of the domestic market, buyers will be left with fewer options to source from, giving them less room avoid the cost increases due to tariffs. Furthermore, if the domestic product for a market is heavily reliant on Chinese imports, domestic producers will obtain greater pricing power should these tariffs be implemented, as their competitors will be facing higher costs. For example, buyers of electrical equipment face the biggest risk should Section 301 tariffs be implemented, as Chinese imports account for more than 20% of the domestic market. Alternatively, buyers of pharmaceutical products face less of an upside risk in this market, as Chinese imports account for only 0.4% of the domestic market.

Details on HS codes can be found here.

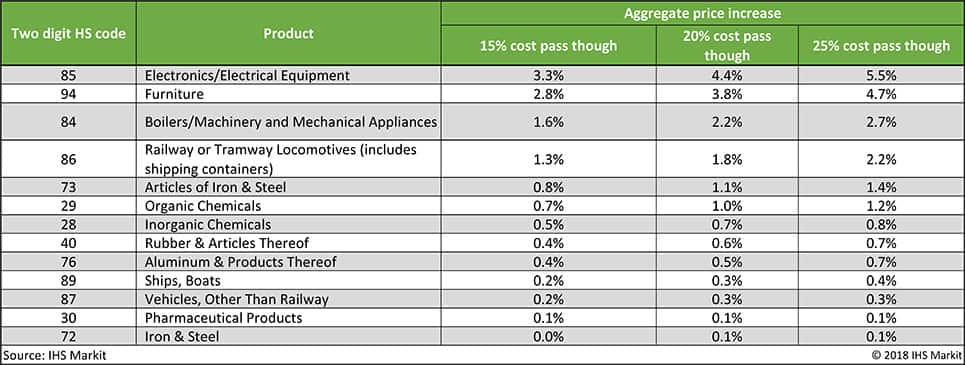

Price effects

For simplicity, this analysis is static; thus, it does not gauge dynamic effects that Section 301 tariffs would have on prices if implemented. To provide a picture of price risk to buyers, we have provided a table that looks at a range of price increases that will be borne from the implementation of a 25% tariff. Assuming the elasticity of demand is greater than zero, the ceiling for cost pass through would be just under 25%; this provides the maximum cost increase for our table. Price increases will also be somewhat mitigated as imports come in from other (albeit higher cost producing) countries to fill the void left by China.

A market's import exposure to Chinese products is what drives upside price risk. Consequently, buyers that source products heavily imported from China should begin devising contingency plans, while buyers in markets in which Chinese imports make up a small portion of domestic supply need not worry.

Conclusion

We will continue to monitor this situation as developments unfold, particularly as products are considered for removal during the public comment period. As shown in this analysis, we are able to determine which markets are most exposed to Section 301 tariff actions with the release the proposed list of products to be tariffed; however, we will not know the exact price effects until the final list of products is released. Once this occurs, we will have a more precise idea of how Section 301 tariffs will impact raw material prices. For now, we advise buyers to ascertain the exposure of their supply chains to Chinese imports on this list; this will allow them to determine whether contingency plans need to be made for sourcing.

Bottom line

A market's risk exposure to Section 301 tariff actions varies with the share of the domestic supply of which Chinese imports account. Markets that are more reliant on Chinese imports, such as electrical equipment and furniture, face large upside risk; meanwhile, others that rely less on Chinese imports, including pharmaceuticals and iron/steel, face little risk.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-wars-to-come-how-to-determine-risk-exposure.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-wars-to-come-how-to-determine-risk-exposure.html&text=The+trade+wars+to+come%3a+How+to+determine+risk+exposure+from+potential+Section+301+tariff+actions+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-wars-to-come-how-to-determine-risk-exposure.html","enabled":true},{"name":"email","url":"?subject=The trade wars to come: How to determine risk exposure from potential Section 301 tariff actions | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-wars-to-come-how-to-determine-risk-exposure.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+trade+wars+to+come%3a+How+to+determine+risk+exposure+from+potential+Section+301+tariff+actions+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-wars-to-come-how-to-determine-risk-exposure.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}