Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 20, 2018

UK inflation fall brings relief to households

- UK consumer price inflation drops to a seven-month low of 2.7%

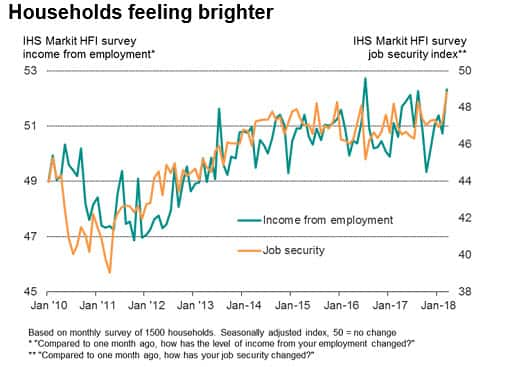

- Survey data highlight that households are feeling brighter as real pay squeeze eases

- Bank of England likely to focus on pay data, meaning May rate hike still in play

A faster than expected cooling of UK inflation means the squeeze on incomes is coming to an end, with survey data highlighting how the mood among households has started to improve in March.

UK inflation fell to 2.7% in February, according to the Office for National Statistics, down from 3.0% in January and below expectations of a drop to 2.8%. This should be the start of a descent to below 2% over the next two years or so, as the impact of the pound’s post EU-referendum weakness fades.

Core inflation also fell sharply, down from 2.7% to 2.4%, driven by falling services inflation, which hints at subdued domestic demand pressures on prices.

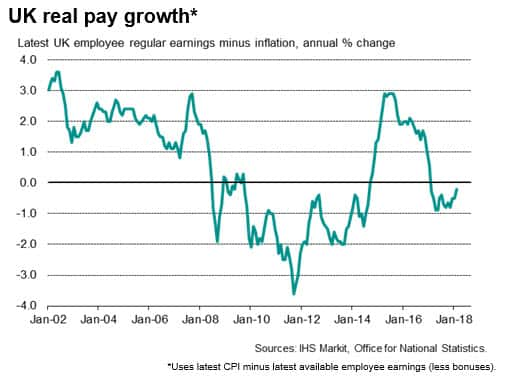

The latest headline inflation rate was the lowest since last July and brings inflation down closer to pay growth, which is currently running at 2.5%. The recent squeeze on household incomes from falling real pay may therefore soon be coming to an end, which is something that has already helped soothe household financial strains, according to fresh survey data for March published by IHS Markit.

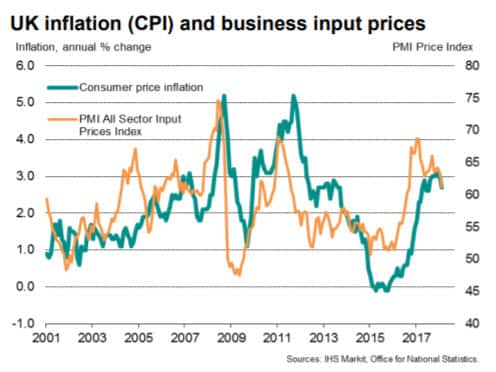

Other price indicators have also turned down, fueling the view that consumer price inflation will ease further in coming months. Average prices charged by companies for their goods and services showed the smallest monthly rise for six months in February, according to the PMI survey data, which typically feeds through to lower consumer prices. Official data on factory input and output prices have likewise shown pipeline inflationary pressures cooling. The recent strengthening of the pound should also help to alleviate some of the recent upward pressure on prices from costlier imports.

Bank of England decision to focus on pay

While price pressures look set to cool further, pay growth appears to be on the rise, which is a key area of interest as far as policymakers are concerned. Recruitment industry data show employers are having to ramp up pay to attract suitable staff due to growing labour shortages, which is a common precursor to faster pay growth in the economy as a whole. The household survey data also showed rising levels of income from employment and job security in March.

Given other trends in the economy, the larger than expected drop in headline inflation will do little to deter policymakers from raising interest rates. The economy appears to be enjoying further steady growth in the first quarter, expanding at a rate at or above that deemed to be its long-term sustainable pace according to the Bank of England. Wages are rising and households are already braced for higher borrowing costs, with the majority (57%) anticipating another hike within the next six months and one-in-three expecting rates to rise in the next three months.

Finally, the Brexit transition deal meanwhile means worries about a “hard Brexit” have subsided, paving the ground for Bank of England policymakers to hike interest rates again in May, should the data releases in coming weeks support such a move. Given policymakers’ appetite to normalize policy, it’s likely that it would require severe disappointments in terms of the coming economic growth and wage data to derail plans to implement a hike in May.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-inflation-fall-brings-relief-to-households.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-inflation-fall-brings-relief-to-households.html&text=UK+inflation+fall+brings+relief+to+households","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-inflation-fall-brings-relief-to-households.html","enabled":true},{"name":"email","url":"?subject=UK inflation fall brings relief to households&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-inflation-fall-brings-relief-to-households.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+inflation+fall+brings+relief+to+households http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-inflation-fall-brings-relief-to-households.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}