Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 18, 2020

Update: The current situation in the port of Beirut, Lebanon

Introduction

Following the catastrophic warehouse explosion on Tuesday 4th August, much has evolved not only politically within Lebanon, but also within the port of Beirut. The investigation into the Rhosus, the ship which allegedly originally carried the 2,750-tonne cargo of Ammonium nitrate to Beirut is still underway.

In this post, we'll discuss the dependencies that the port of Beirut had, and the role it played as the largest port in Lebanon. We'll explore some of the damages which have been established since the event, as well as look at ramifications on trade.

Port Arrivals

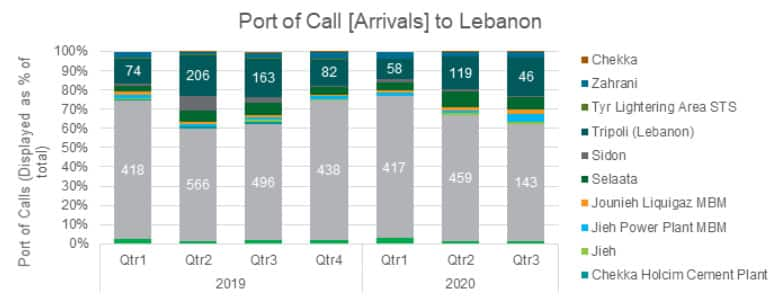

With more than 60% of arrivals occuring within the port of Beirut, this proves to be a vital infrastructure supporting the economic activity (not only import, but export). The port of Tripoli, which is the second most developed port in Lebanon proved to receive very little traffic in contrast to its bigger brother further south whom is home to 28 different berths and terminals, ranging from dry cargo to tanker facilities, and operated by a number of companies such as LPT, Petrolgas, Universal Gaz, Cogico, Minstry of Oil, Medco and Uniterminals.

Figure 1: Port of calls [Arrivals] in Lebanon for vessels more than 100GT.

Source: IHS Markit Maritime Intelligence Risk Suite (MIRS)

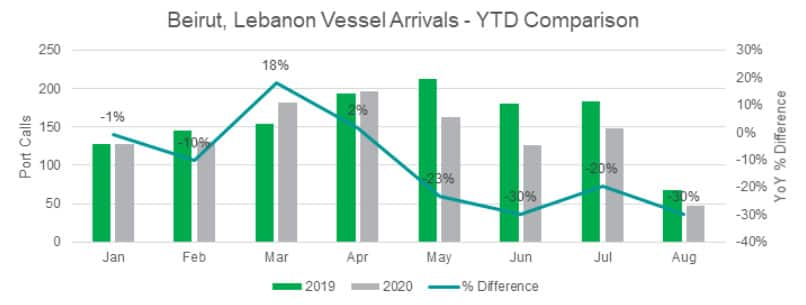

Despite the devasting damages which were incurred to the vessels identified in port [9 confirmed by IHS Markit's Casualty & Events service - read more below], this number could have potentially been higher if it weren't for the lower port callings likely resulting from COVID-19 and slowdown in economic activity. Looking at August year-to-date (up until the 13th), we can see how last year had 30% more vessels arriving in port during that time, even on the 4th August 2019, we saw seven new vessels arriving into port, whereas in 2020 only two called on the day.

Figure 2: Beirut Port Arrivals - year-to-date comparison.

Source: IHS Markit MIRS

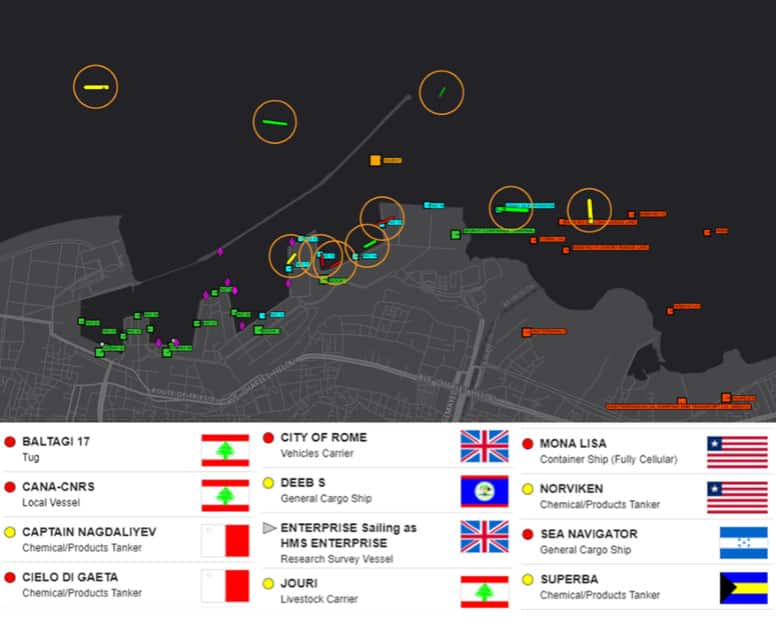

Since the events that transpired on the 4th, and the considerable damage caused to the infrastructure in ports, several vessels are seen to have passed through the established geofence surrounding the port of Beirut (three container ships, three cargo ships, two tankers, one vehicle carrier as well as one research vessel), bringing the number of vessels transmitting AIS in port during the last 48 hours to 12, most of which are visible within the area surrounding Dock 4, as well as to the east of the container terminal. Figure 3 below highlights these vessel positions (larger vessels have been highlighted).

Figure 3: Vessels seen in port in last 48 Hours.

Source: IHS Markit MIRS

Vessels are still transmitting their destination as 'Beirut', of which seven are due to be arriving within the month. These include a mix of two bulk carriers coming from Latin America (Brazil & Uruguay), three container ships (coming from Malta & Turkey), one RoRo carrier coming from France, as well as a general cargo ship which had previously been in the port of Beirut.

The Bulk shipments from Latin America likely represent substantial shipments in grains and cereals.

Damages to Ships

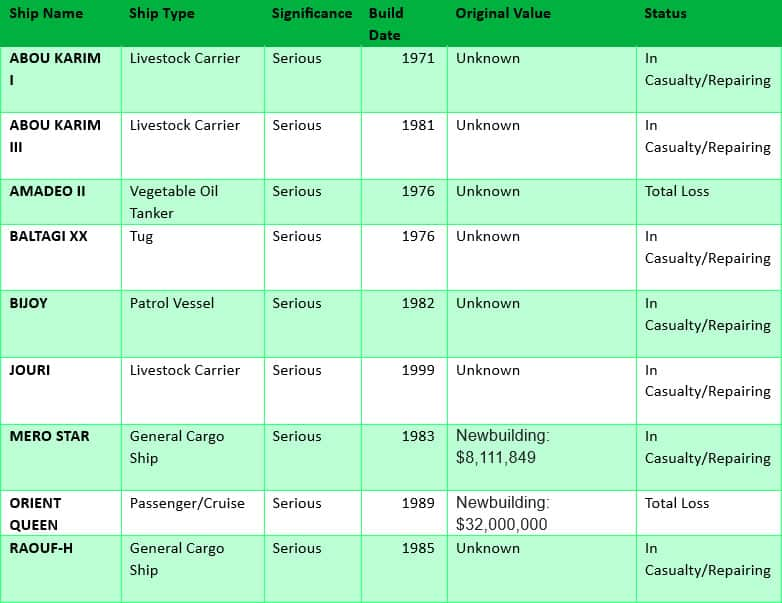

Considerable damages were caused to the vessels in close proximity to Dock 3 where nine different casualty records were created in the IHS Markit Casualty & Events database. These included: three livestock carriers, one vegetable oil tanker, two general cargo ships, one passenger/cruise vessel, one tug and one patrol vessel. Figured 4 and 5 below highlight these vessels as well as some further information regarding original sales value and reported status.

Figure 4: Known vessels involved in casualty events with current status and newbuild price.

Source: IHS Markit MIRS

Although we believe to have captured all of the major vessel casualties, we suspect that some of the tugs have remained to be catalogued. IHS Markit is currently in the process of trying to establish the damages of these vessels presently.

Figure 5: Events recorded through IHS Markit Casualty & Events database.

Source: IHS Markit MIRS

Orient Queen [IMO: 8701193]

Passenger Cruise Ship ORIENT QUEEN IMO No. 8701193 was involved in a hull/machinery incident at Beirut, Lebanon on 04 Aug 2020. Sustained damage caused by a chemical explosion at a nearby warehouse ashore whilst berthed at Berth No. 11, Beirut, Lebanon in Lat. 33 54' 14"N, Long. 035 31' 24"E at 1800 hours LT (UTC+3) on 04/08/20 in good weather. Sustained severe damage, took water, developed list to starboard side, capsized and partially submerged alongside quay. At least two crew reported dead with another 11 injured. One crew member reported missing. The vessel is registered under Med Cruises Inc, and was the only vessel registered under the Libyan company.

Bijoy [IMO: 7920015]

Patrol Vessel BIJOY IMO No. 7920015 was involved in a hull/machinery incident at Beirut, Lebanon on 04 Aug 2020. Sustained damage caused by a chemical explosion at an adjacent warehouse ashore whilst berthed Berth No. 6, Beirut, Lebanon in Lat. 33 54' 01"N, Long. 035 30' 48"E at 1800 hours LT (UTC+3) on 04/08/20 in good weather. Sustained damage to bridge and the deck. Inspection effected. At least 21 navy crew sustained injury. One of whom in critical condition and taken to American University of Beirut Medical Center. Rest taken by ambulance and airlifted to Hamoud Hospital for medical attention The vessel is registered under the Bangladesh Government Navy, and is one of 14 vessels otherwise registered to the Bangladesh registered company.

RAOUF-H [IMO: 8325535]

General Cargo Ship RAOUF-H IMO No. 8325535 was involved in a hull/machinery incidedent at Beirut, Lebanon on 04 Aug 2020. Sustained damage caused by a chemical explosion at an adjacent warehouse ashore whilst moored at No. 8 Berth, Beirut, Lebanon in Lat. 33 54' 12"N, Long. 035 31' 02"E at 1800 hours LT (UTC+3) on 04/08/20 in good weather. Several crew sustained injuries (Two casualties) with a least of one of them taken taken off the vessel for medical attention. The vessel is registered under Raouf Marine Co SA (Part of GMC Marine Co SA), and was the only registered vessel under this subsidiary.

ABOU KARIM I [IMO: 7120768]

Livestock Carrier ABOU KARIM I IMO No. 7120768 was involved in a hull/machinery incident at Beirut, Lebanon on 04 Aug 2020. Sustained damage caused by a chemical explosion at an adjacent warehouse whilst moored alongside MV 'ABOU KARIM III' off No. 9 berth at Beirut, Lebanon at 1800 hours LT (UTC+3) on 04/08/20 in good weather and visibility. The vessel had been laid up since June 2016. Subsequently took water and developed list to starboard. This vessel is registered under Khalifeh Shipping Line Co and is the only vessel registered vessel under the Lebanon registered company.

ABOU KARIM III [IMO: 8003060]

Livestock Carrier ABOU KARIM III IMO No. 8003060 was involved in a hull/machinery incident at Beirut, Lebanon on 04 Aug 2020. Sustained damage caused by a chemical explosion at an adjacent warehouse whilst moored at No. 9 berth at Beirut, Lebanon at 1800 hours LT (UTC+3) on 04/08/20 in good weather and visibility. The vessel had been laid up since 2017. This vessel is registered under Khalifen MM, a subsidiary of Khalifeh Shipping Line Co, and is the only vessel registered under this Lebanon registered company.

JOURI [IMO: 9174775]

Livestock Carrier JOURI IMO No. 9174775 was involved in a hull/machinery incident at Beirut, Lebanon on 04 Aug 2020. Sustained damage caused by a chemical explosion at a nearby warehouse ashore whilst berthed at Berth No. 12, Beirut, Lebanon in Lat. 33 54' 24"N, Long. 035 31' 25"E at 1800 hours LT (UTC+3) on 04/08/20 in good weather. Extent of damage unknown. This vessel is registered under Etab Shipping SA, a subsidiary of Nabolsi Group, and is one of two vessels registered under the Panama registered company.

MERO STAR [IMO: 8321682]

General Cargo Ship MERO STAR IMO No. 8321682 was involved in a hull/machinery incident at Beirut, Lebanon on 04 Aug 2020. Sustained damage caused by a chemical explosion at an adjacent warehouse ashored whilst moored at No. 8 Berth, Beirut, Lebanon in Lat. 33 54 15N, Long. 035 31 08E at 1800 hours LT (UTC+3) on 04/08/20 in good weather. Sustained damage to hull and took water. At least two crew members sustained serious injuries. This vessel is registered under Friends Shipmanagement Inc, and is the only vessel registered under the US registered company.

BALTAGI XX [IMO: 7342316]

Tug BALTAGI XX IMO No. 7342316 was involved in a hull/machinery incident in Beirut, Lebanon on 04 Aug 2020. Sustained damage caused by a chemical explosion at a nearby warehouse ashore whilst berthed at Berth No. 6, Beirut, Lebanon in Lat. 33 54' 01"N, Long. 035 30' 54"E at 1800 hours LT (UTC+3) on 04/08/20 in good weather. Extent of damage unknown. This vessel is registered under Baltagi H, and is the only vessel registered under the Lebanon registered company.

Trade

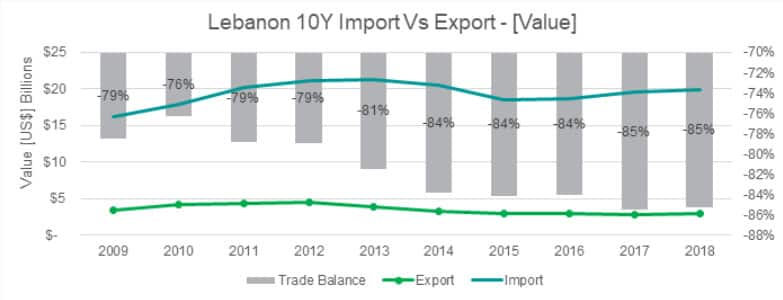

Over the last ten years, trade in Lebanon has shown an increase in activity, with total trade rising by 16% between 2019 and 2018 (TotalTrade=ExportTrade+ImportTrade), with a steady 2% year-on-year average increase. This new vigor in the Lebonese economy to develop its trade ties with the rest of the world has however resulted in an increase in dependencies in trade. Global Trade Atlas data reveals that as of 2018, this trade deficit increased from US $-12.7 Billion to US $17.0 Billion, increasing by a staggering US $4 Billion/up 34% (Trade Deficit=Export Trade-Import Trade). Trade deficits in the world today aren't uncommon as alternative sourcing becomes preferential due to lower price points and availability, allowing for commodities to be imported from the rest of the world for domestic purposes. These increase in dependencies however increase the potential risks should anything disturb these supply chains.

Figure 6: Lebanon total trade by value

Source: IHS Markit Global Trade Atlas

Lebanon's primary export activity (looking at value) is surrounding precious gems and metals (such as gold & diamonds) which accounted for 19.52% of their total export value market share in 2018, as well as metal wastes and scraps (scrap ingots of iron/steel and copper), which represented 6.99%.

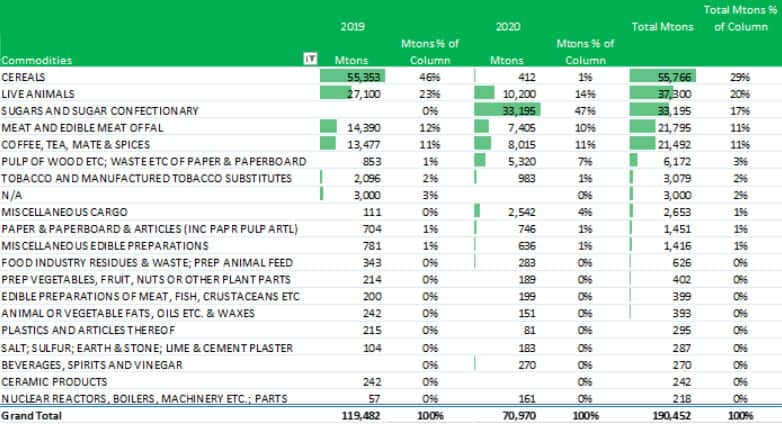

This is considerably overshadowed by their primary dependencies in trade in terms of imports, which constitutes of petroleum oils, motor cars, pharmaceutical goods. There is also a considerable import base for live animals/animal products as well as cereals, which are sourced predominantly from Latin America (more specifically Brazil, which represents a 13.37% import market share for these products).

In 2019 and 2020 we continue to see a high dependency from Brazil, with agricultural goods such as cereals (Maize) and sugars (Cane) coming through in high quantities. These would have predominantly gone to Beirut for discharge, but with the now destroyed infrastructure, the question is; how will Lebanon maintain these vital trade lanes?

Figure 7: Brazil exports to Lebanon year-to-date (January to June).

Source: IHS Markit PIERS Enterprise

In cross checking inbound vessels to Beirut with our Commodities At Sea - Dry Bulk solution, we've identified that the Cielo Di San Francisco [IMO: 9585663] is currently being used to ship 32,636 tons of maize by Oleaginosa Morena, due to arrive on the 7th of September. The Italian flagged bulk carrier has a grain cargo capacity of 46,230 tons. With much of the grain terminal infrastructure destroyed in Beirut, this vessel is equipped with four cranes of 36 tonnes to help with offloading.

Trade Forecast

Our latest GTA Forecast predicted that trade import volumes would be down by 23% in 2020 following the COVID-19 impact, with a recovery in 2021, which would see an increase in 36%, However the added infrastructure damage caused the explosion will undoubtedly impede this recovery until the years to come. It is unsure at this point what the future truly holds for Lebanon.

Figure 8: Lebanon waterborne trade imports.

Source: IHS Markit GTA Forecasting

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupdate-the-current-situation-in-the-port-of-beirut-lebanon.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupdate-the-current-situation-in-the-port-of-beirut-lebanon.html&text=Update%3a+The+current+situation+in+the+port+of+Beirut%2c+Lebanon++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupdate-the-current-situation-in-the-port-of-beirut-lebanon.html","enabled":true},{"name":"email","url":"?subject=Update: The current situation in the port of Beirut, Lebanon | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupdate-the-current-situation-in-the-port-of-beirut-lebanon.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Update%3a+The+current+situation+in+the+port+of+Beirut%2c+Lebanon++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupdate-the-current-situation-in-the-port-of-beirut-lebanon.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}