Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 09, 2021

US equity investor sentiment surges higher as earnings outlook brightens

- Risk appetite up for second month running, with expectations of near-term returns at survey high

- Sentiment buoyed by fundamentals, earnings and improving policy and macro outlooks

- Financials see strongest favor, but tech sees biggest outlook upgrade

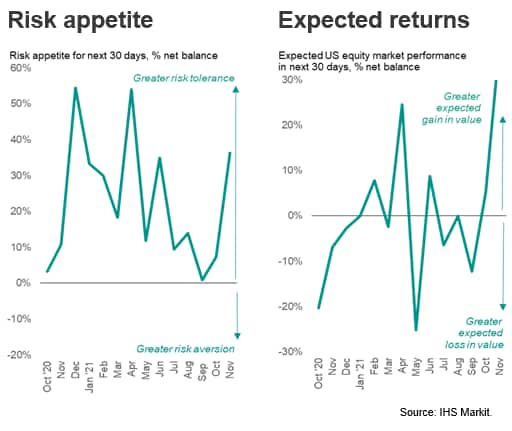

US equity investor risk appetite improved for a second month running in November, rising to the highest since April. Expectations of near-term returns meanwhile hit a new high, fueled by improved prospects for earnings, equity fundamentals and shareholder returns, as well as brighter outlooks for macro and policy factors.

The Risk Appetite Index from IHS Markit's Investment Manager Index™ (IMI™) monthly survey, which is based on data from around 100 institutional investors each month, rose from +7% in October to +36% in November, its highest since the survey peak of +54% seen back in April 2021. As such, the survey indicates a substantial improvement from the near-evaporation of risk appetite recorded back in September.

The swelling of risk appetite was accompanied by a marked uplift in investors' expectations of market returns over the coming month to a survey high, surpassing the prior (April) peak by a wide margin and building further on the improvement seen in October.

By comparison, the survey's Expected Returns Index had fallen to -12% in September, which preceded the brief market fall, before rising again to signal to a marked turnaround in sentiment which has gathered momentum over the past two months. The index has now risen to +38%.

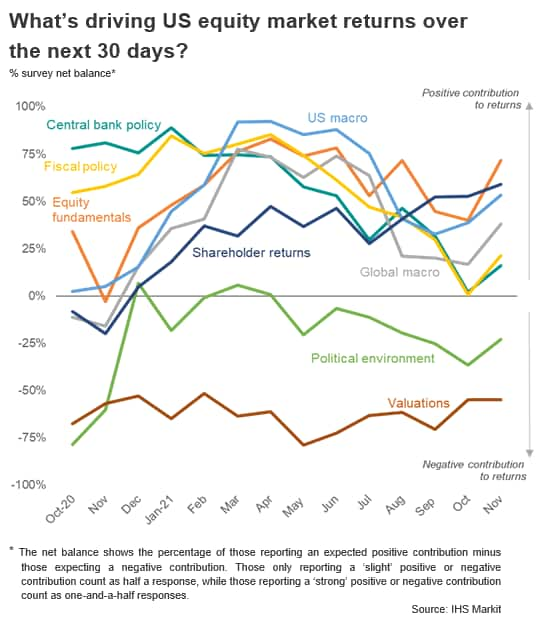

The biggest drivers of the market in the near-term are considered to be equity fundamentals and shareholder returns, the former viewed as the most supportive since August and the latter seen as more supportive than at any time over the 14-month survey history.

However, November also saw investors' expectations of market support from both central bank and fiscal policy lift higher, having sunk in both cases to survey lows in October. Similarly, the macro environment is also seen as more positive for equities than viewed in October, with both the US and global economies set to provide the biggest contributions to returns since July, coinciding in particular with signs of the COVID-19 Delta wave easing.

With the S&P 500 reaching new highs, valuations against historical levels meanwhile remain by far the largest perceived anchor on the market, and is the only factor not to see an improving trend in November.

The political environment is again perceived as a net drag on returns, albeit slightly less so than in October, reflecting concerns over domestic budget spending as well as broader geopolitical issues and China's tech regulation.

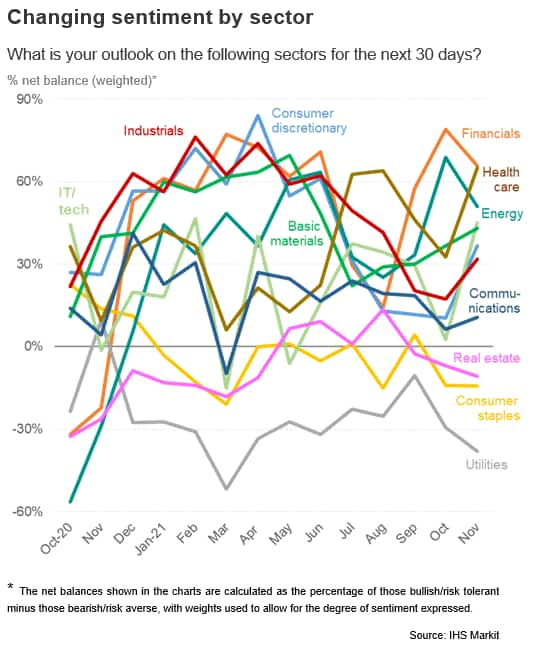

In terms of sector preferences, financials have retained the most-favored spot in November for a third successive month having seen the biggest positive shift in sentiment over the past year, followed by healthcare. However, it was tech stocks that enjoyed the largest upswing in favorability compared to October, with sentiment rising to the highest since February.

Economy hopes meanwhile lifted sentiment towards consumer discretionary, industrial and basic materials, though in some cases inflation and supply line worries continued to constrain appetite. Utilities, real estate and consumer staples are seeing ongoing bearish sentiment.

Upwardly revised earnings estimates

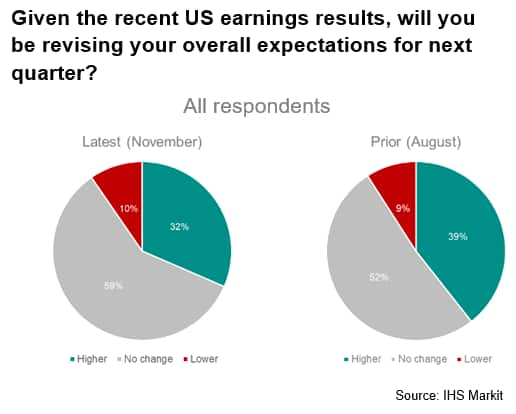

These improving factors coincide with a strong Q3 earnings season which has led investors to revise up their expectations of Q4 earnings on average.

The Q3 results so far have prompted 32% of investors to ramp up their expectations of Q4 earnings, according to the latest IMI poll, outnumbering the 10% that have revised down their expectations by three-to-one.

The net upward revision of +22% is lower than the reading of +30% seen back in August, but nevertheless is a strongly positive reading.

The overall net upward revision to Q4 earnings estimates tallies with the substantial jump in risk appetite recorded by the November IMI survey and coincides with equity fundamentals being the strongest expected driver for near-term market returns in the latest poll.

Commenting on the survey, Chris Williamson, Executive Director at IHS Markit and report author, said:

"A strong Q3 earnings season has coincided with brighter economic prospects and reduced concerns over COVID-19 as the Delta wave eases, propelling risk appetite higher in November. While central bank policy, fiscal policy and the macro environment are viewed as far less supportive of the market than earlier in the year, November has seen investors become less concerned, with expectations of near-term equity market returns spiking higher and Q4 earnings estimates revised higher."

Also commenting on how the survey results compare to trade settlement data, Kevin Roy, VP of IHS Markit's Global Issuer Solutions, said:

"We continue to see a significant correlation between the IMI survey results and the $21T in equity trading settlement data we track on a weekly basis. The positive sentiment upswing for tech has been led by hedge funds which reversed course and aggressively increased exposure after two consecutive weeks of selling. Meanwhile, healthcare stocks have benefited from both institutional and ETF inflows despite profit-taking by hedge funds."

Also commenting on the survey results, Thomas Matheson, head of dividend forecasting at IHS Markit, said:

"Shareholder returns are of increasing importance going into Q4 and investors expect to be rewarded with growing dividends and buybacks. As COVID-19 fears wane, rising inflation and labor costs are now the key risks to capital allocation priorities, however we expect dividends will prove to be just as persistent as any other cost and see S&P 500 dividends approaching double-digit growth in 2022."

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-investor-sentiment-surges-higher-as-earnings-outlook-brightens-nov21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-investor-sentiment-surges-higher-as-earnings-outlook-brightens-nov21.html&text=US+equity+investor+sentiment+surges+higher+as+earnings+outlook+brightens+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-investor-sentiment-surges-higher-as-earnings-outlook-brightens-nov21.html","enabled":true},{"name":"email","url":"?subject=US equity investor sentiment surges higher as earnings outlook brightens | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-investor-sentiment-surges-higher-as-earnings-outlook-brightens-nov21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+equity+investor+sentiment+surges+higher+as+earnings+outlook+brightens+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-investor-sentiment-surges-higher-as-earnings-outlook-brightens-nov21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}