Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

WHITEPAPER

Aug 28, 2023

U.S. FinCEN & BIS High Priority Items List – Trade Patterns for Russian Battlefield Electronics

The U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) and the U.S. Department of Commerce's Bureau of Industry and Security (BIS) issued a joint alert regarding the proliferation of certain 'high priority goods' being exported and transshipped to Russia in order to support its war effort in Ukraine.

The alert, issued in May 2023, identifies 9 Harmonized System (HS) Codes which should be used by financial institutions and others for enhanced customer due diligence purposes. The 9 HS Codes are as follows;

- 8542.31 Electronic integrated circuits: Processors and controllers, such as microcontrollers

- 8542.32 Electronic integrated circuits: Memories, such as static random-access memory (SRAM)

- 8542.33 Electronic integrated circuits: Amplifiers, such as Operational Amplifiers

- 8542.39 Electronic integrated circuits: Other, such as Field Programmable Gate Arrays

- 8517.62 Machines for the reception, conversion and transmission or regeneration of voice, images, or other data, such as wireless transceiver modules

- 8526.91 Radio navigational aid apparatus, such as global navigation satellite system (GNSS) modules

- 8532.21 Tantalum capacitors

- 8532.24 Multilayer ceramic capacitors

- 8548.00 Electrical parts of machinery or apparatus, not specified or included elsewhere, such as electromagnetic interference (EMI) filters

Similar regulation covering goods across HS Codes 84 and 85 have also been implemented by the European Union and United Kingdom.[1]

One of the major challenges to identifying strategic and battlefield goods in international trade is the lack of standardisation when describing products in documents such as a bill of lading, airway bill or invoice. Furthermore, the usage of the HS code in trade documents is low, the associated description of a certain HS code contains phrases not often found in the same documents and many goods and items are described in various ways, making the identification of potential military end-use items a challenge.

Directly incorporating the 9 HS Codes and their descriptions into a risk and compliance screening programme will yield a particular set of results and has the potential for missing some items classified in the High Priority List because the HS Code is not specified or the goods are described in a different manner. The correlation between a HS Code and an Economic Classification Control Number (ECCN) is not always definitive or one-to-one.

In order to assimilate the High Priority List into a screening programme it is necessary to determine the potential ways of describing these items outside of just the HS Code or a single keyword. Similarly, understanding where the key export partners of these items are based and which countries the goods are shipped too will assist in the understanding of how and where risk is likely to be found. This paper will seek to identify certain countries that are recent partners of U.S. exports for High Priority List goods, how they have been described in U.S. export bill of lading documents and how they are shipped.

Key Takeaways

- Since 2022, there are many new countries where U.S. electronics, chips and circuits, described in the FinCEN/BIS High Priority List, are being exported too

- The countries which have become the most prominent U.S. export partners since 2022 are - Kazakhstan, Latvia, Lithuania, Armenia, Estonia, Georgia, Serbia, UAE and Saudi Arabia

- For the entire set of goods classified within the FinCEN/BIS High Priority List, 34 countries have only received U.S. exports of these items post-2022

- The majority of new U.S. export trading partner countries in 2022 and 2023 are receiving goods classified within HS Code 854000, electrical parts of machinery or apparatus

- HS Code 854800 covering electrical parts of machinery or apparatus contains the majority of new U.S. trading partner countries in 2022 and 2023

- For electronic circuits, Kazakhstan and Armenia have increased their U.S. imports of these Items in 2023 by over 95%

- There is very little correlation between the HS Code description and a bill of lading goods description - in many instances the examples on the High Priority List such as microprocessors, amplifiers or EMI filters do not exist or are described differently in bills of lading

- Where there is correlation, such as 'capacitor', numerous versions of this keyword occur. For example, aluminium electrolytic capacitor or start capacitor. Understanding what falls in and outside the High Priority List is a challenge

- Keyword matches for battlefield electronics work for the obvious HS Code descriptions such as semiconductors as there are multiple instances on bill of lading documents but not for the more nuanced items such as transceiver modules where descriptions are usually captured differently

- Brand names for circuits and chips are described in bill of lading documents. These are not described in the High Priority List descriptions, for example, NVIDIA or AMD

- There are differences between the U.S. High Priority List and the EU and UK versions. The former does not specifically mention semiconductors

- Arrivals of container ships at Russian ports in Q2-2023 are reaching a similar level last seen in Q1-2022

- New maritime firms are servicing Russian container trade with a prominent UAE company operating vessels from April and May 2023 onwards

U.S. Exports of High Priority Items

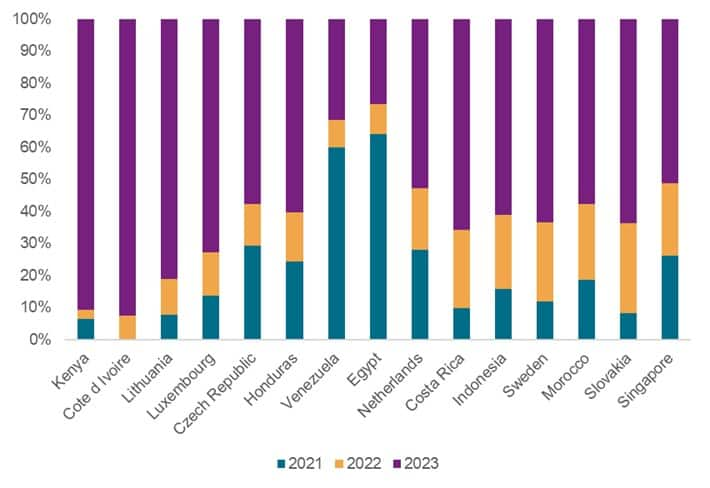

The following charts highlight exports of the 9 HS Codes described in the FinCEN/BIS Alert as being the key items currently used within Russian weapon systems and found on the battlefield in Ukraine.

These charts are categorized by individual HS Code and capture the trade of U.S. exports to the top 15 countries where the percentage change in the growth of trading partners is highest. Percentage change for all the following charts is calculated as the difference between March 2023 and March 2022.

New trading partners for U.S. exports in 2022 and 2023 for High Priority Items can assume the potential for transhipment hubs or reexport zones for goods and items now known as battlefield electronics. As mentioned in the FinCEN/BIS alert, current behavioural or red flag indicators now stress the need to understand entities and individuals shipping goods from the High Priority List for the first time. Individual countries can also offer a general indication to support this hypothesis.

HS Code 854231 (Processors and Controllers, Electronic Integrated Circuits), U.S. Export Destinations

Source: S&P Global Market Intelligence (Global Trade Analytics Suite). Date as of July 10, 2023

For 'Processors and Controllers' defined with HS Code 854231 above, Cote d'Ivoire has emerged as a new U.S. trading partner in 2022 and 2023 despite there being no trade data supporting this corridor in previous years. Kenya and Lithuania also indicate a greater emphasis in 2022 and 2023 for receiving goods in this category.

Click here to read and download the full paper.

------------------------------------------------------------------------------------------------

[1]https://finance.ec.europa.eu/system/files/2023-06/230623-list-high-priority-battlefield-items_en.pdf and https://www.gov.uk/government/publications/russia-sanctions-common-high-priority-items-list

Subscribe to our complimentary Global Risk & Maritime quarterly newsletter, or listen to Maritime and Trade Talk podcast for the latest insight and opinion on trends shaping the shipping industry from trusted shipping experts.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-fincen-bis-high-priority-items-list-russian-trade-patterns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-fincen-bis-high-priority-items-list-russian-trade-patterns.html&text=U.S.+FinCEN+%26+BIS+High+Priority+Items+List+%e2%80%93+Trade+Patterns+for+Russian+Battlefield+Electronics+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-fincen-bis-high-priority-items-list-russian-trade-patterns.html","enabled":true},{"name":"email","url":"?subject=U.S. FinCEN & BIS High Priority Items List – Trade Patterns for Russian Battlefield Electronics | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-fincen-bis-high-priority-items-list-russian-trade-patterns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=U.S.+FinCEN+%26+BIS+High+Priority+Items+List+%e2%80%93+Trade+Patterns+for+Russian+Battlefield+Electronics+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-fincen-bis-high-priority-items-list-russian-trade-patterns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}