Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 15, 2023

US flash PMI ends 2023 at highest since July amid looser financial conditions

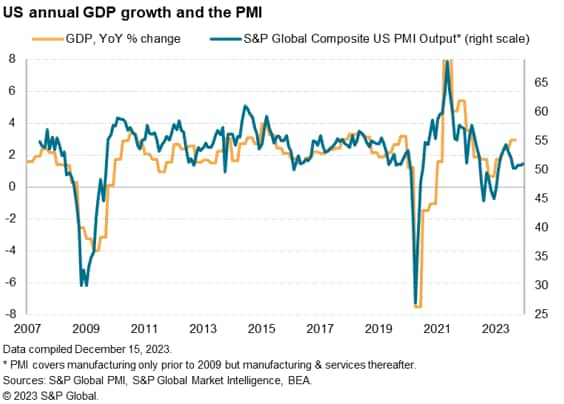

The early PMI data indicate that the US economy picked up a little momentum in December, closing off the year with the fastest growth recorded since July. However, despite the December upturn, the survey therefore signals only weak GDP growth in the fourth quarter.

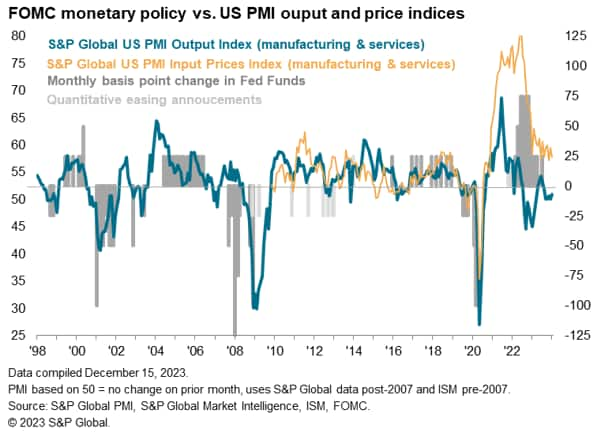

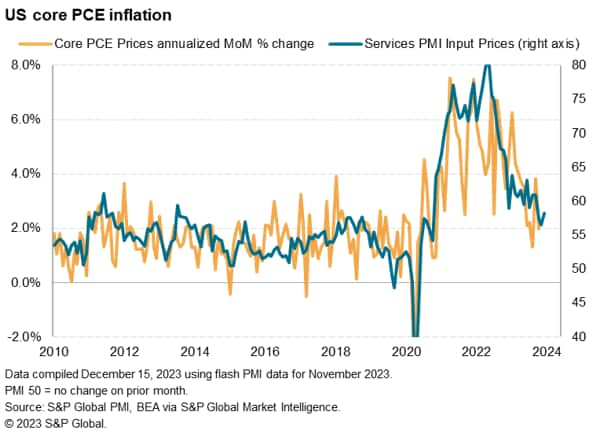

The survey's selling price gauge, which tends to lead changes in consumer price inflation, remains sticky but at a level which is indicative of CPI running only modestly above 2%. Service sector input cost inflation, a key gauge of core inflation, once again remained notably elevated by historical standards, though even here the average rate of increase in the fourth quarter has been the lowest since mid-2020, and falling backlogs of work across the economy hint at further inflation weakness in the months ahead.

Output rises on the back of increased services activity

At 51.0, the headline S&P Global Flash US PMI Composite Output Index was up slightly from 50.7 in November and posted above the 50.0 neutral mark for the eleventh successive month to signal a modest expansion in business activity. The rate of growth, although subdued in the context of the series history, accelerated to the fastest since July.

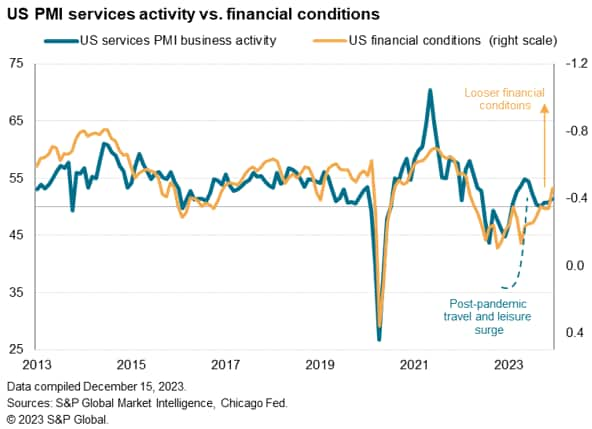

Looking into the details, looser financial conditions have helped boost demand and business activity in the service sector, and have also helped lift future output expectations higher. However, the increased cost of living and cautious approach to spending by households and businesses means the overall rate of service sector growth remains far short of that witnessed during the travel and leisure revival back in the spring and summer.

Manufacturing meanwhile remains a drag on the economy, with a stronger rate of order book decline prompting factories to reduce production and scale back their input buying.

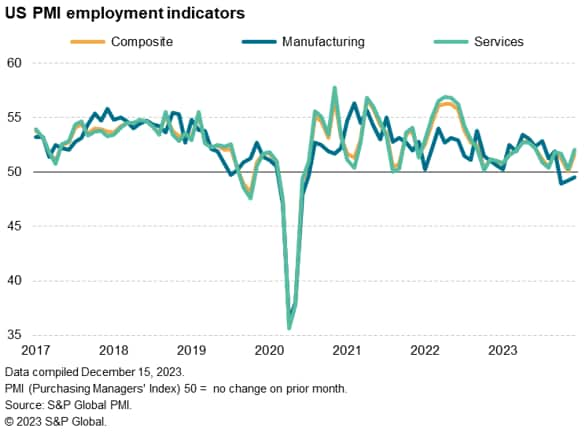

Employment trends diverge

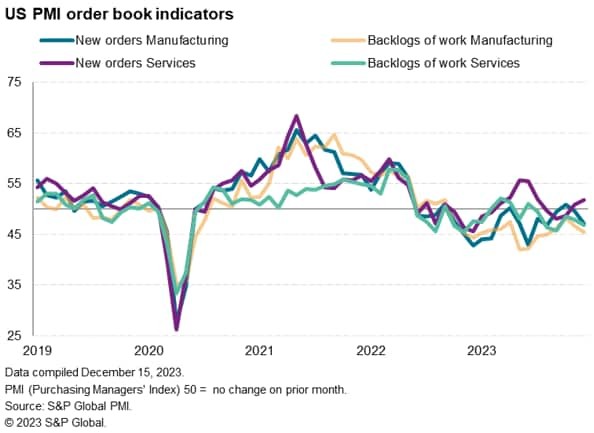

The weakness in the demand situation facing manufacturers prompted factories to reduce their headcounts for a third successive month. Not only are inflows of new orders falling in manufacturing, having now dropped in all bar three of the past 19 months, but factories' backlogs of work also fell sharply, down for a fifteenth straight month.

Service providers, in contrast, stepped up their hiring in December, in many cases to help fill long-standing vacancies. However, this increase in capacity led to a marked fall in backlogs of work, which hints at the development of excess capacity in services alongside the apparent build-up of spare capacity in the manufacturing sector.

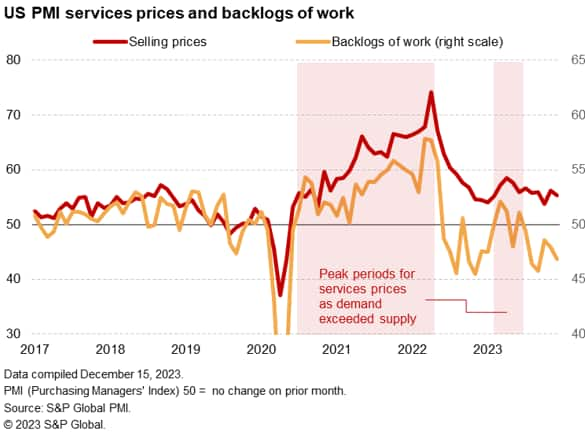

Waning pricing power

While boding ill for output growth in the months ahead, these falls in backlogs of work auger well in the fight against inflation. In our following charts, we plot the backlogs of work indices against selling price indices for goods and services. The charts demonstrate how pricing power moves to the seller at times of rising backlogs of work. Hence higher prices were seen for both goods and services during the pandemic, when firms struggled against the headwinds of raw material and labor shortages. In manufacturing, 2023 has seen the development of excess capacity hand pricing power to buyers, causing output charges to fall (albeit with some upward pressure resuming in December as some prices have hit floors).

In services, a resurgence of demand in the spring and summer, linked in part to pent-up post-COVID travel demand, led to a second leg of historically steep inflation. However, as with manufacturing, backlogs of work are now falling in services, passing some pricing power back to buyers.

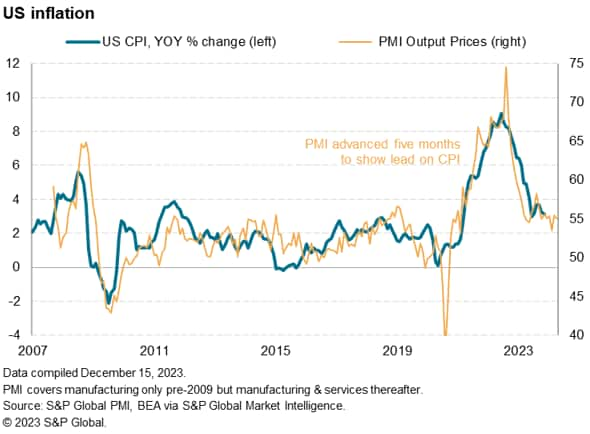

CPI on the wane

Plotting the PMI data on selling prices for goods and services against consumer price inflation illustrates the leading indicator properties of the PMI, with the survey tending to move ahead of CPI by around five months. The survey data correctly anticipated the steep moderation of CPI inflation this year to 3.1% in November, but hints at CPI inflation likely cooling only modestly further, with the Fed's 2% target only briefly coming into view before price pressures lift slightly higher again in the new year.

There's also an indication that core inflation has come close to the Fed's 2% target, with the PMI's input cost index from the service sector running at a level only slightly above 2% in recent months.

Outlook tied to financial conditions

With the backlogs of work data hinting strongly that the PMI's price gauges will fall further over the coming months, the risks to inflation seem further tilted to the downside. But it remains to be seen whether the loosening of financial conditions already evident in the markets will further help stimulate the economy and revive some of these survey gauges, notably in the service sector.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-ends-2023-at-highest-since-july-amid-looser-financial-conditions-Dec23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-ends-2023-at-highest-since-july-amid-looser-financial-conditions-Dec23.html&text=US+flash+PMI+ends+2023+at+highest+since+July+amid+looser+financial+conditions+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-ends-2023-at-highest-since-july-amid-looser-financial-conditions-Dec23.html","enabled":true},{"name":"email","url":"?subject=US flash PMI ends 2023 at highest since July amid looser financial conditions | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-ends-2023-at-highest-since-july-amid-looser-financial-conditions-Dec23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+ends+2023+at+highest+since+July+amid+looser+financial+conditions+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-ends-2023-at-highest-since-july-amid-looser-financial-conditions-Dec23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}