Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 07, 2022

US Municipal Bond ESG Recap - Q3 2022

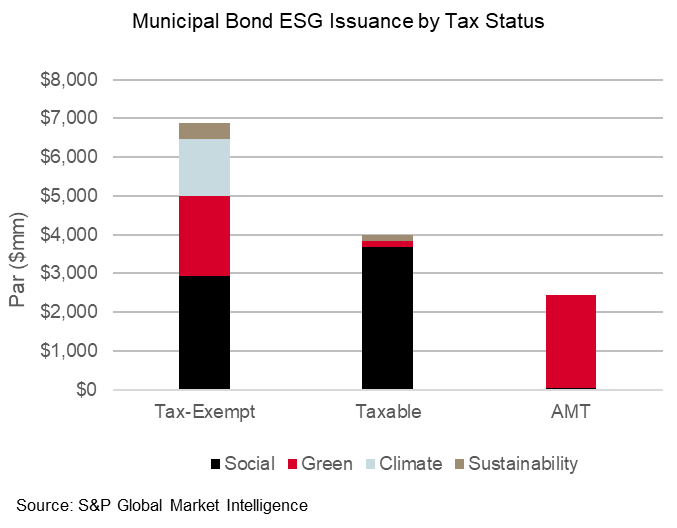

During the third quarter, Municipal issuance with ESG designation has totaled $13.3B (including corporate municipal bond identifiers), out of $101.0B total municipal securities issued.

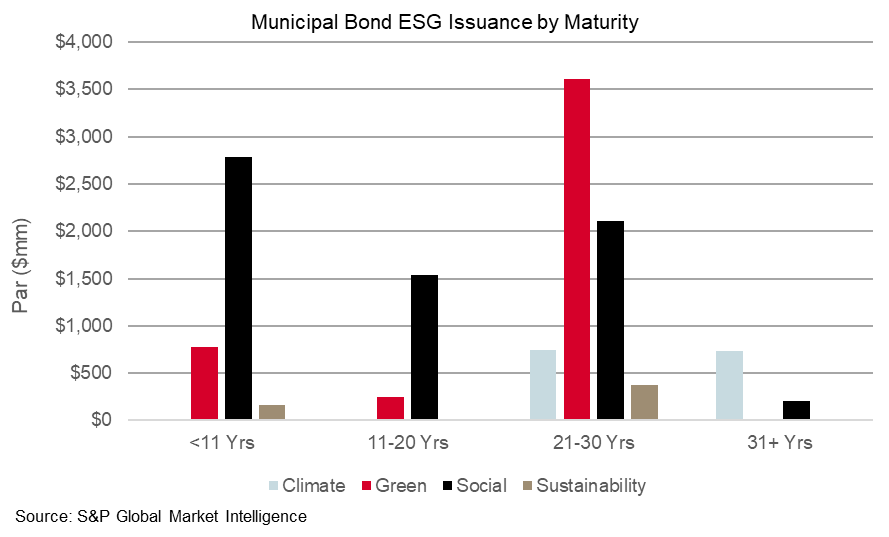

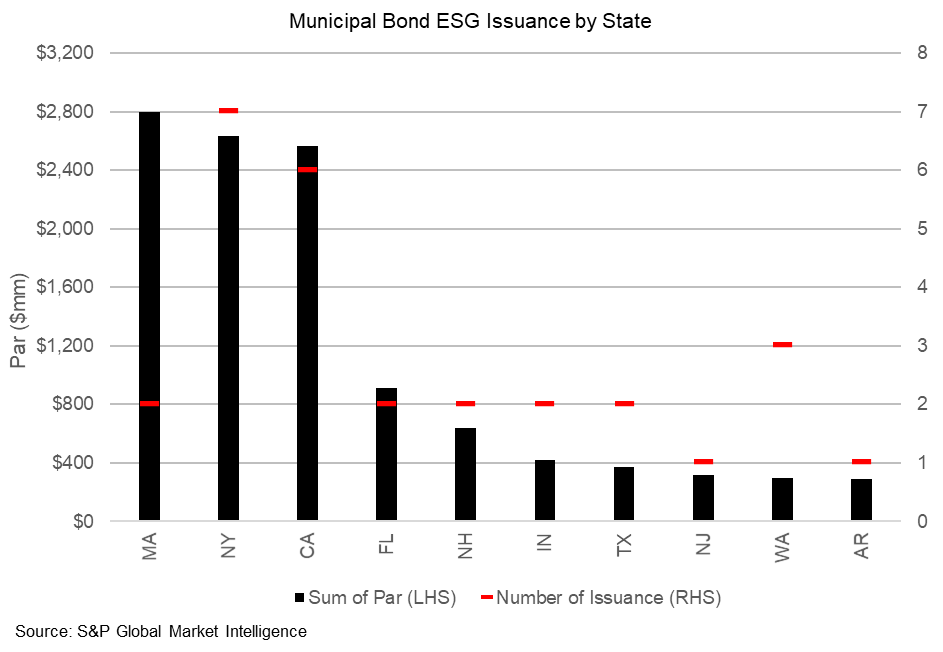

Social Bonds represents the majority of ESG issuance, accounting for $6.63B of par volume or 49.8% of ESG issuance this quarter. The largest social bond issued during 3Q22 was The Commonwealth of Massachusetts' $2.68B Special Obligation Revenue Bonds (Unemployment Insurance Trust Fund) priced on 8/16/2022.

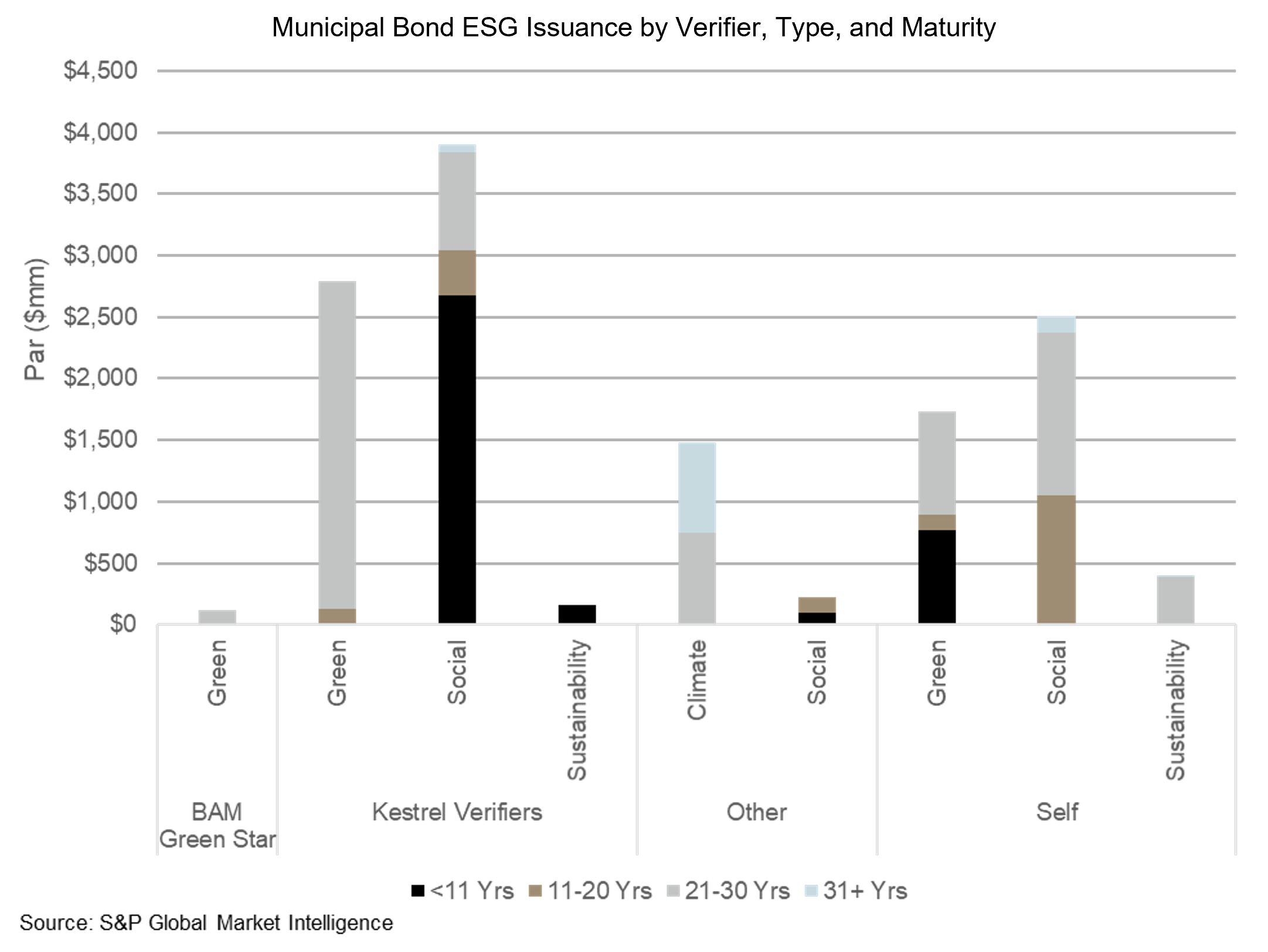

The 21-30 year range maturity green bond was dominated by the Department of Airports of the City of Los Angeles Airport bonds, while the short range spike at social bond was led by The Commonwealth of Massachusetts' Special Obligation Revenue Bonds (Unemployment Insurance Trust Fund), which has its last maturity dated July 2031. Both issuances were verified by Kestrel.

.

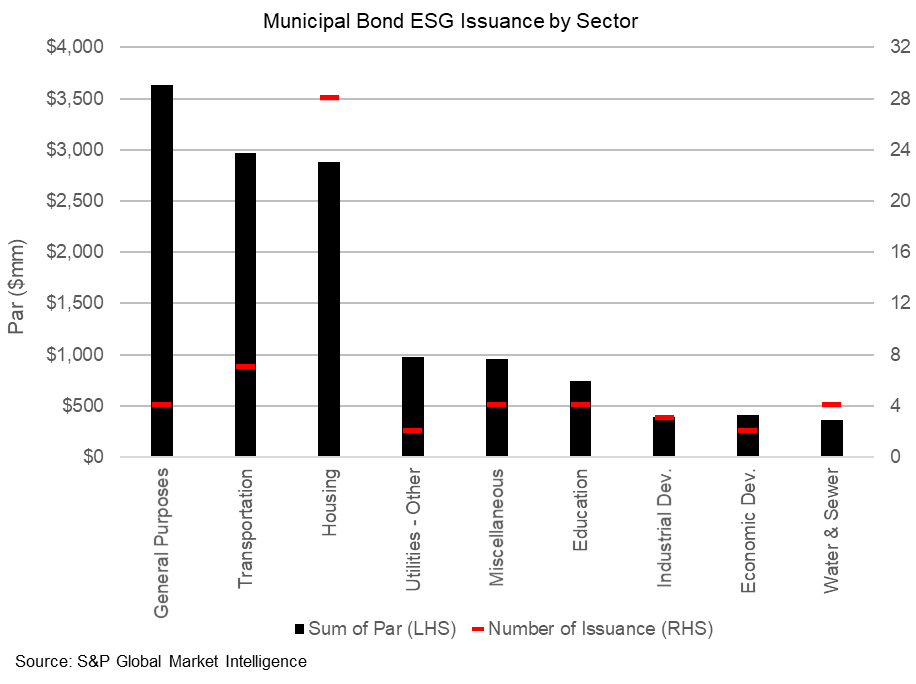

General purpose, led by Massachusetts Special Obligation Revenue Bonds, represents the largest use of proceed at $3.63B amongst ESG issuance this quarter, followed by Transportation, which accounts for $2.97B.

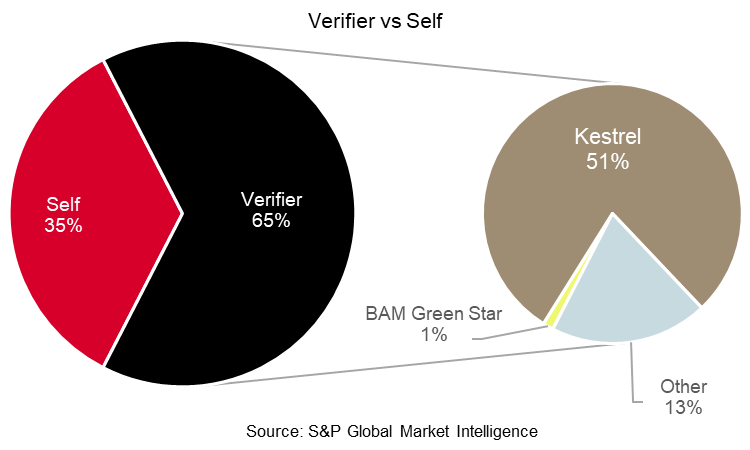

Majority of ESG issuance in the third quarter of 2022 has used a verifier. $8.67B of issuance had a third party verification agency with Kestrel Verifiers accounts for the bulk of it at $6.85B.

IHS Markit provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-municipal-bond-esg-recap-q3-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-municipal-bond-esg-recap-q3-2022.html&text=US+Municipal+Bond+ESG+Recap+-+Q3+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-municipal-bond-esg-recap-q3-2022.html","enabled":true},{"name":"email","url":"?subject=US Municipal Bond ESG Recap - Q3 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-municipal-bond-esg-recap-q3-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Municipal+Bond+ESG+Recap+-+Q3+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-municipal-bond-esg-recap-q3-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}