Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 05, 2021

US sector data show economic growth slowing across consumer, tech and financial sectors

The latest IHS Markit US Sector PMI™ indicated a slowdown in growth across four of the seven sectors tracked, led by the technology sector. This was consistent with the broad picture whereby the US remained adversely affected by the ongoing COVID-19 Delta wave, despite the decline in case numbers in recent weeks. Meanwhile the US bond market has shown signs of converging with economic conditions.

Technology sector led slowdown in output growth in the US

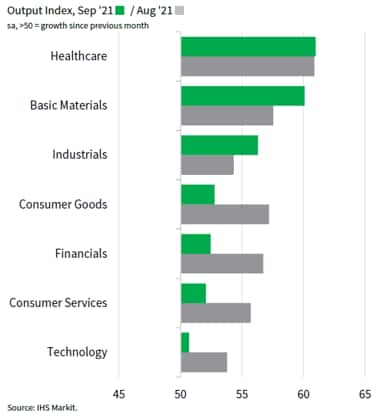

US Sector PMI™, compiled by IHS Markit, showed that all seven broad categories monitored by the surveys expanded in September, although four saw growth slow when compared to August. The decline in growth momentum had been the most apparent for the technology and consumer service sectors, with the former falling to a 14-month low.

On the other hand, pandemic-related demand continued to support the healthcare sector. Basic material output growth also accelerated as firms sought to counter the ongoing supply crunch.

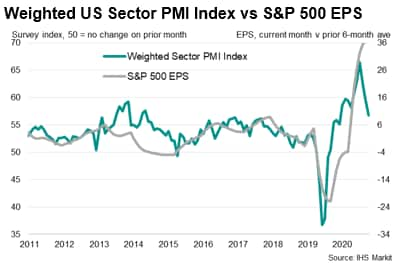

Taking a big-picture view of the US Sector PMI data, one would find that the broad slowdown had been a couple of months in the making. Arguably, the decline takes place from a point of very strong growth by historical standards. However, the pace at which growth momentum had eased had been rapid and especially so for heavyweights such as the technology sector. This places the focus on how the upcoming earnings season would fare for the broader market.

Weighting the US Sector PMI data in accordance to the US S&P 500 index sector composition, and proxying for sectors where the Sector PMI data does not have an exact match for, the resulting indicator suggests that earnings growth momentum has peaked and will moderate moving into late 2021. This is consistent with the Street's view whereby FactSet polls pointed to Q3 2021 EPS growth at 27.6% ahead of the start of the season. At the same time, this perhaps contributes to some of the concerns within the equity market, particularly in backing how the softer earnings growth might affect shareholder returns and fundamentals moving forward. (An update on US equity investor sentiment will be available mid-October through the PMI commentary and analysis page.)

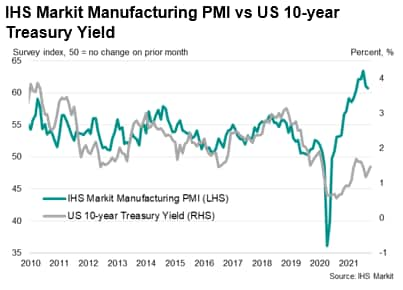

US Treasury yields climb with inflation worries

Separately, US Treasury yields had been capturing the market's attention amid the recent bond market sell-off. The US 10-year Treasury yield can generally be seen moving in tandem with the IHS Markit Manufacturing PMI, reflective of economic conditions. That close relationship appears to have broken down since 2020, however, with bond yields suppressed amid the Fed's interventions and reassurances. Some of this optimism has dulled with the Fed moving towards imminent tapering, while above-target inflation has fanned fears that elevated consumer prices may be less transitory that earlier expected.

While the 'transitory' outlook towards inflation continues to hold for now, the expectation remains one of the Fed being on the path, albeit a long one, towards eventual lift-off that could keep Treasury yields biased upwards. Alongside the easing of the elevated growth momentum signalled by the PMI, we may continue to find attempts at convergence between yields and the PMI going forward.

Jingyi Pan, Economics Associate Director, IHS Markit

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-data-show-economic-growth-slowing-across-consumer-tech-and-financial-sectors-Oct21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-data-show-economic-growth-slowing-across-consumer-tech-and-financial-sectors-Oct21.html&text=US+sector+data+show+economic+growth+slowing+across+consumer%2c+tech+and+financial+sectors+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-data-show-economic-growth-slowing-across-consumer-tech-and-financial-sectors-Oct21.html","enabled":true},{"name":"email","url":"?subject=US sector data show economic growth slowing across consumer, tech and financial sectors | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-data-show-economic-growth-slowing-across-consumer-tech-and-financial-sectors-Oct21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+sector+data+show+economic+growth+slowing+across+consumer%2c+tech+and+financial+sectors+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-data-show-economic-growth-slowing-across-consumer-tech-and-financial-sectors-Oct21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}