Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 18, 2023

US Weekly Economic Commentary: Growth above trend as FOMC meets

On balance, good news arrived last week, suggesting that the recent slowing in price inflation remains intact and real growth continues at a solid, above-trend pace. If growth were not "too strong," we would characterize this as a Goldilocks outcome we'd like to see continue.

We suspect core PCE inflation will rise again before it cruises down to the Fed's 2% target. Labor markets remain very tight, and wage inflation is too high. Energy prices have turned up recently, and they have a way of permeating into core price measures through materials and transportation costs. So, while price inflation is slowing, it is doubtful that slowing can be sustained unless wage growth moderates significantly.

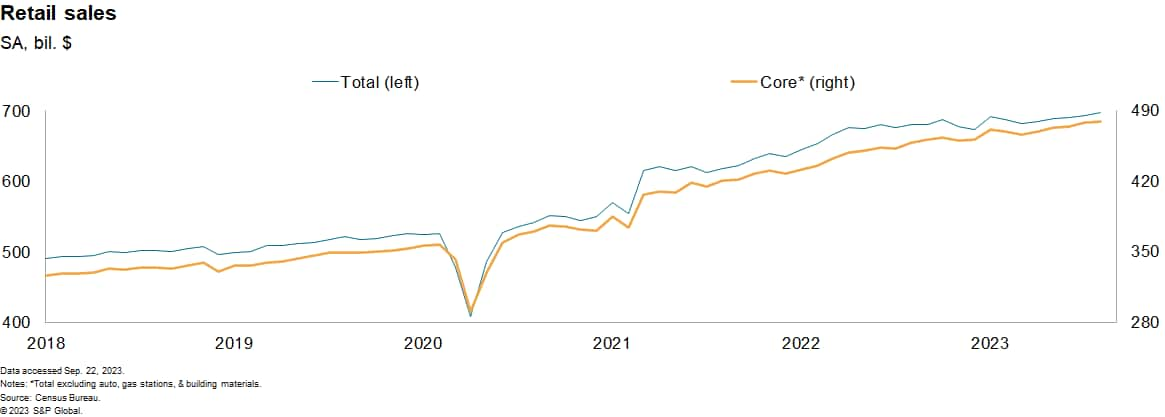

Retail sales through August are consistent with very solid growth of real PCE of 3.2% (annual rate) in the third quarter. US consumers are apparently feeling good about their financial security. Industrial production rose a solid 0.4% in August, with increases seen in manufacturing, mining, and utilities industries. Rising backlogs in manufacturing may finally be passing through into a firming in production.

There is a pothole on the manufacturing road ahead: The UAW struck US automakers last week. The impact on third and fourth quarter growth will depend on the breadth and duration of the strike.

Additional headwinds include the potential for a federal government shutdown if the parties cannot agree on a path forward, the negative impact of higher energy prices which erode real income and wealth, and the elevated level of interest rates. The current level of mortgage rates is squeezing existing sales and new home construction. More generally, low interest corporate debt is rolling over at higher rates, which is squeezing earnings, at the same time as the high level of rates discourages business investment.

Against this backdrop, the Federal Open Market Committee (FOMC) meets next week when we, along with financial markets, expect it to maintain its policy rate in the range of 5.25% - 5.50%. This would allow it to assess the impacts of monetary tightening thus far. We expect the FOMC to signal that they remain open to hiking rates again this year. Of course, they will emphasize that the approach going forward will remain data-dependent, but with inflation still above their target this should be understood to mean that the Committee continues to see their job as unfinished.

We expect another 25-basis point hike at the November meeting, bringing the policy rate to a range of 5.50% - 5.75%. Thereafter, they will pause the tightening cycle. There is a risk that if inflation does not soften further towards their target, the Committee will be compelled to hike further still.

This week's economic releases:

- New residential construction (Sept. 19): We estimate the annualized pace of housing starts declined in August to 1,444 thousand units.

- Existing home sales (Sept. 21): We estimate existing home sales rose in August to an annual rate of 4,235 thousand units. Elevated mortgage rates are weighing on sales and keeping the inventory of homes for sale lean.

- Leading economic index (Sept. 21): A drop in the Conference Board's Leading Economic Index would continue a run of steady declines that began over a year ago. It would be unusual for such a run of declines to coexist with continued broad expansion of the US economy, but these are unusual times, and this is what we expect will occur. Absent an unforeseen macroeconomic shock, we expect the US economy to continue to expand, albeit at a below-trend pace.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary.html&text=US+Weekly+Economic+Commentary%3a+Growth+above+trend+as+FOMC+meets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary.html","enabled":true},{"name":"email","url":"?subject=US Weekly Economic Commentary: Growth above trend as FOMC meets | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Weekly+Economic+Commentary%3a+Growth+above+trend+as+FOMC+meets+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-weekly-economic-commentary.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}