Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 05, 2020

Value stalls on its road to recovery

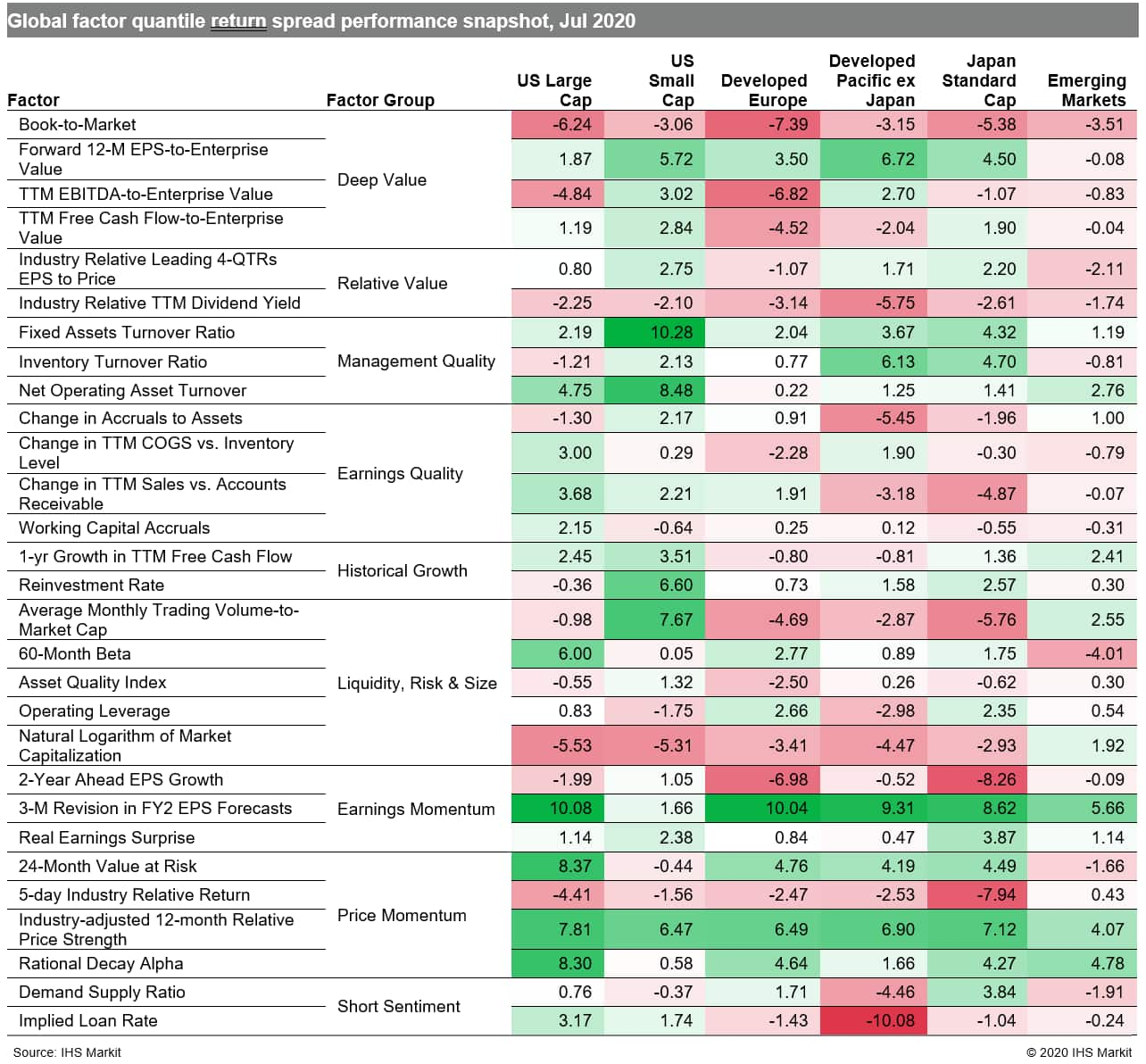

After staging a comeback in Europe and the US in June, value could not fend off infectious optimism for momentum strategies in July (Table 1), as markets celebrated strong big tech earnings results, several positive early stage COVID-19 vaccine trials and increased expectations for additional government stimulus. Other positive data points include the first expansion in the J.P.Morgan Global Manufacturing PMI since January. However, the employment PMI has not recovered and, coupled with the virus's resurgence in several countries, could create bumps in the road to recovery resulting from slowdowns in consumer spending and business activity.

- US: Industry-adjusted 12-month Relative Price Strength outperformed Book-to-Market by a spread of 14.1 percentage points among large caps, a sharp reversal of the prior month's 5.0 spread of the value signal over momentum

- Developed Europe: Investors demonstrated high conviction towards momentum strategies including Rational Decay Alpha and 3-M Revision in FY2 EPS Forecasts

- Developed Pacific: Momentum remained a highly favored investment style, with strong performance recorded by Industry-adjusted 12-month Relative Price Strength

- Emerging markets: Investors remained out on the risk curve, with 60-Month Beta posting negative spreads for a fourth consecutive month

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-stalls-on-its-road-to-recovery.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-stalls-on-its-road-to-recovery.html&text=Value+stalls+on+its+road+to+recovery+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-stalls-on-its-road-to-recovery.html","enabled":true},{"name":"email","url":"?subject=Value stalls on its road to recovery | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-stalls-on-its-road-to-recovery.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Value+stalls+on+its+road+to+recovery+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-stalls-on-its-road-to-recovery.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}