Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

WHITEPAPER

Apr 14, 2023

Vessel Ownership, Trade Finance and Regulatory Compliance

Financial institutions are increasingly expected to combat sanctions and financial crime compliance evasion by monitoring suspicious vessel behavior. These expectations are largely in response to the U.S. Department of the Treasury's Office of Foreign Assets Control (U.S. OFAC) and the United Kingdom's Office of Financial Sanctions Implementation (UK OFSI) advisories on shipping published in May and December 2020, respectively. These documents contained a number of recommendations for financial institutions to recognize and implement. While not previously expected of trade finance operations, a nuanced understanding of the maritime shipping industry has become a critical aspect of regulatory compliance, such as identifying commodities and trade corridors where transshipment and ship-to-ship (STS) transfers may occur.

The complexity of the shipping industry, however, has caused some anxiety amongst financial institutions as it requires a level of expertise that may not be reasonable for, or even available to, small or medium sized banks, whether seeking to bring such expertise in-house, or rely on sophisticated service providers.

Helpfully, recent guidance papers have been published to better assist the industry, but the authors considered that a global statistical review of vessel data could further benefit the community. This statistical review is intended to complement those guidance papers and further crystallize the compliance concerns arising from the shipping industry.

This review shares our findings related to the availability of vessel Group Ownership in relation to each vessel's compliance behavior. Recommendations for financial institutions and insurance companies include adding at least one additional check during their risk-based approach. That check could be review of the ownership information of a particular vessel in light of its known compliance status, flag of country and ownership domicile. Put differently, banks should be able to, as a general matter, have a baseline calculation of risk for a given vessel so reasonable decisions may be made in light of the increased regulatory pressure regarding the maritime industry. Additionally, government regulators and port security officials should consider requiring Group Ownership information prior to port calls, and further down the line, establish a beneficial ownership registry to ensure additional transparency.

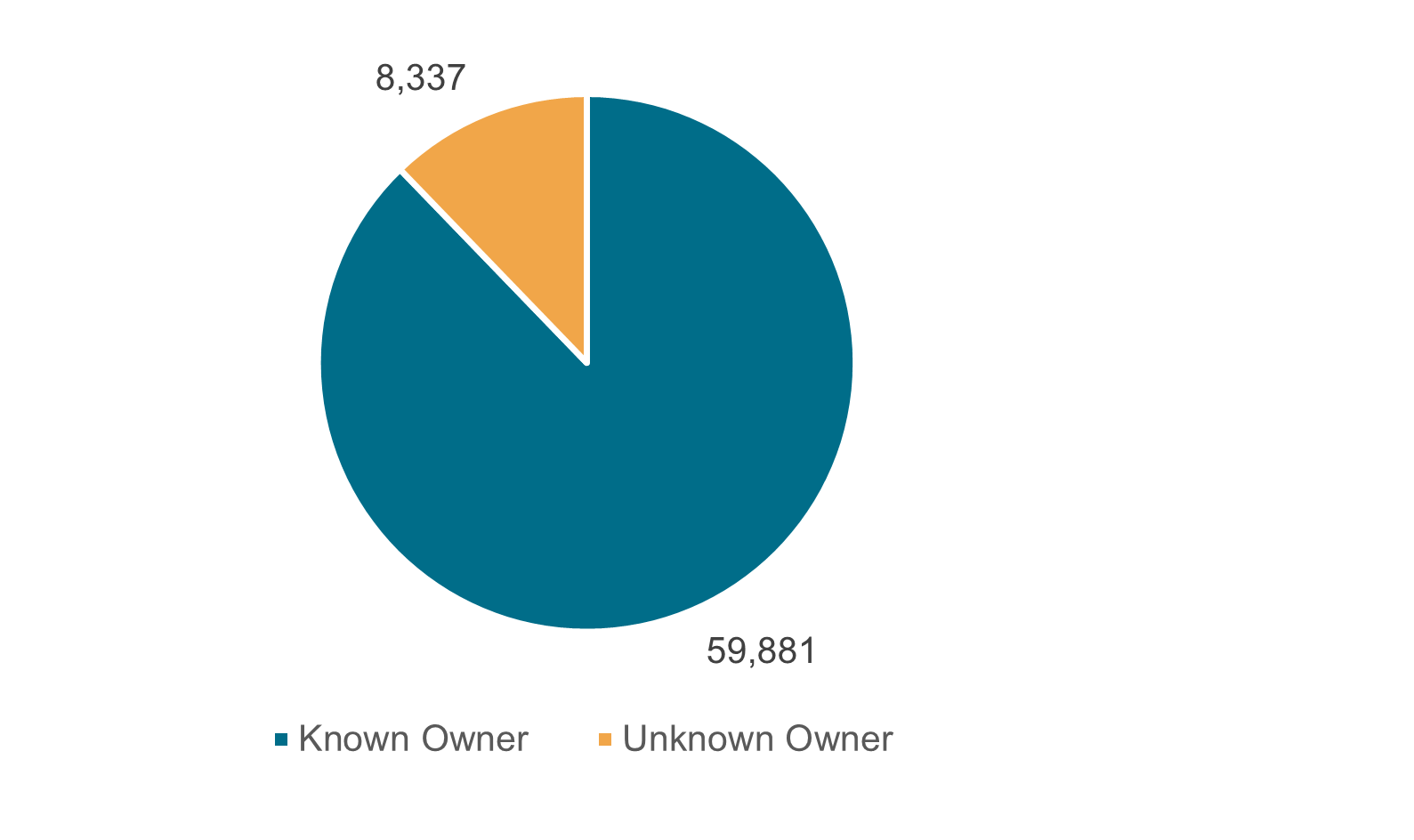

Breakdown of Vessels by Known Group Owner v. Unknown Group Owner

Of the 68,218 total vessels reviewed, 59,881 or 87.8% of the vessels had Known Owner information. Conversely, 8,337 or 12.2% of reviewed vessels had Unknown Owner information.

Vessels by Known v. Unknown Ownership

Source: S&P Global Market Intelligence, Maritime Intelligence Risk Suite (MIRS)

Listing the Group Owner and Domicile is not a requirement to obtain an IMO number, but the absence of that information poses additional challenges for financial institutions and government regulators to find the Group Owner of a vessel.

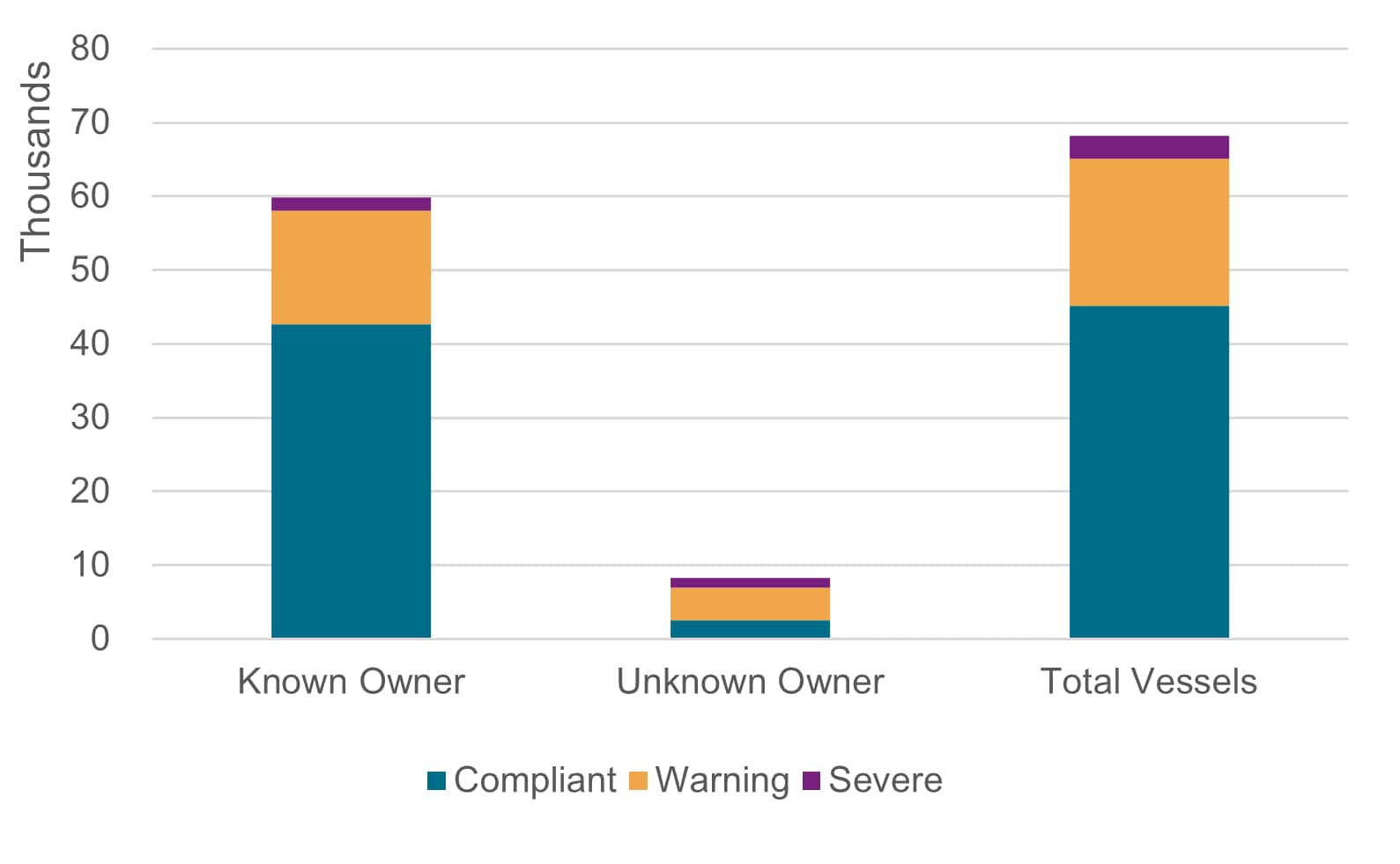

Comparing Known and Unknown Ownership to Total Vessels

In comparing the compliance status for vessels with a Known versus an Unknown Owner, the data is clear that Unknown Owner vessels occupy a larger share of the Warning and Severe assessments than those that are otherwise Compliant.

Vessel Ownership Overview

Source: S&P Global Market Intelligence, Maritime Intelligence Risk Suite (MIRS)

As nearly 70% of vessels with Unknown Owners carry either a Warning or Severe compliance assessment, financial institutions, insurance companies and port security agencies should exercise due diligence when met with Unknown Owner vessels.

Download and read the complete complimentary paper: Vessel Ownership, Trade Finance and Regulatory Compliance. The paper explores vessel risk based upon whether Group Ownership information is known or unknown for each vessel alongside identified compliance behavior. Recommendations for financial institutions regarding their risk and compliance screening programs are offered, as well as policy proposals for regulators to bolster port security and overall transparency of the maritime industry.

This paper is written by Byron McKinney from S&P Global Market Intelligence in collaborations with the Institute of International Banking Law and Practice, and Global Financial Integrity.

Subscribe to our complimentary Risk & Compliance quarterly newsletter, or subscribe to Maritime and Trade Talk podcast for the latest insight and opinion on trends shaping the shipping industry from trusted shipping experts.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvessel-ownership-trade-finance-and-regulatory-compliance.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvessel-ownership-trade-finance-and-regulatory-compliance.html&text=Vessel+Ownership%2c+Trade+Finance+and+Regulatory+Compliance+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvessel-ownership-trade-finance-and-regulatory-compliance.html","enabled":true},{"name":"email","url":"?subject=Vessel Ownership, Trade Finance and Regulatory Compliance | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvessel-ownership-trade-finance-and-regulatory-compliance.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Vessel+Ownership%2c+Trade+Finance+and+Regulatory+Compliance+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvessel-ownership-trade-finance-and-regulatory-compliance.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}