Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 01, 2023

Time to level up: Videogame console supply chains

Videogame consoles have highly seasonal supply chains, with product launches and peak buying typically occurring in the fourth quarter each year due to holiday gift-giving.

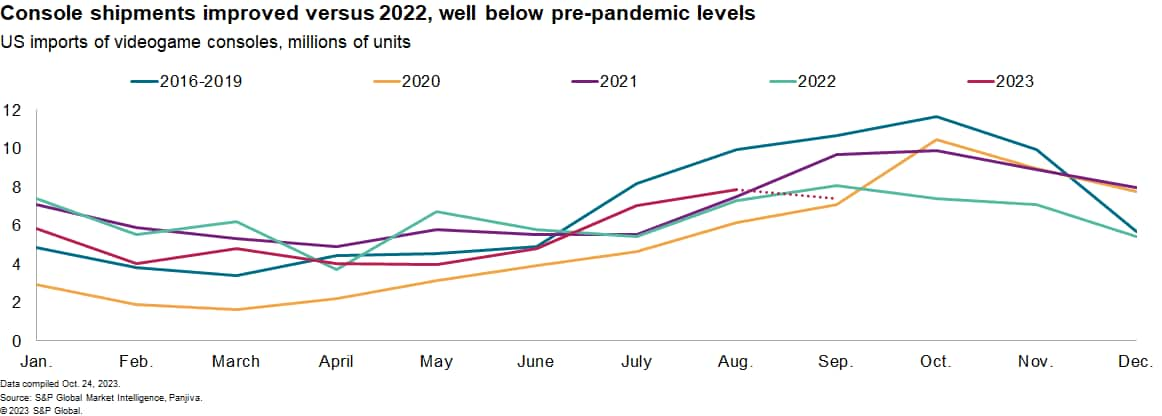

The seasonality can be seen in historical US import shipping patterns. An average 54% of US imports of games consoles have arrived in the August through November period each year, our data shows, with a peak in September and October. During the pandemic, shipping patterns were disrupted by a mixture of component availability and logistics network disruptions. An absence of major new systems in 2022 may explain the apparent lack of a peak season. Shipment patterns in 2022 and early 2023 also were distorted by pent-up deliveries resulting from supply chain shortages.

Shipments to the US climbed 7.5% year over year in the third quarter of 2023. That may factor in early shipping, with imports in September by sea below the August level whereas historically they have been higher. Both the pattern and level of shipments indicate trade in consoles is far from its pre-pandemic norms.

S&P Global Market Intelligence's TMT group expects strong sales with the launch of refreshed and themed consoles from leading video game companies. Bill-of-lading data can provide a proxy for brand-level performance by looking at seaborne shipments of consoles as well as peripherals.

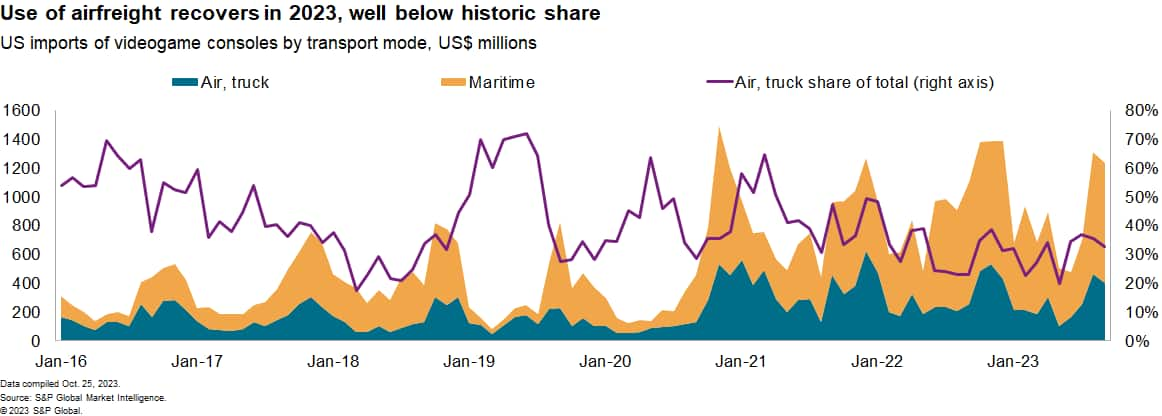

While these companies control their brands and software, they have large supplier ecosystems, which mean they are not wholly in control of their supply chain conditions. These companies rely on outside manufacturers and suppliers for parts and have had to contend with shortages of semiconductors in 2020 through 2022. The resulting backlogs had to be cleared using airfreight during 2021 — airfreight's share of shipments fell to 35% in the third quarter of 2023 from 46% in 2021 and 41% in the 2016 to 2019 period. The reduced need for airfreight indicates most challenges have cleared.

Reshoring for resilience

The companies' supply chains remain complex, with product teardowns showing there are 34 suppliers across their respective consoles. One way to address complexity is with resilience, including reshoring to mitigate geopolitical risk.

Malaysia and Singapore have emerged as alternative supply locations for consoles and offer lower operational, legal and political risks than other alternatives including Mexico and Vietnam. Exports from Malaysia and Singapore have increased to 2.3% and 1.1%, respectively.

There's also a risk from not diversifying, particularly in technology given the recent revised range of US semiconductor export restrictions and mainland China's new rulings on graphite supplies. The new US chip export rules are unlikely to have a direct impact given the current generation's graphics processors are below the export restrictions in terms of computing power and density.

Potential sourcing locations can be ranked using an attractiveness score from Market Intelligence's Supply Chain Console. This attractiveness score compares supply regions on a relative scale ranging from 0 to 10, based on export dynamics (value, growth and unit value), country risk, economic outlook and supplier dynamics. Using a combination of risk and economic dynamics scores suggests Malaysia and Vietnam may be the most attractive alternate sourcing locations.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvideogame-console-supply-chains.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvideogame-console-supply-chains.html&text=Time+to+level+up%3a+Videogame+console+supply+chains+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvideogame-console-supply-chains.html","enabled":true},{"name":"email","url":"?subject=Time to level up: Videogame console supply chains | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvideogame-console-supply-chains.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Time+to+level+up%3a+Videogame+console+supply+chains+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvideogame-console-supply-chains.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}