Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 04, 2020

Volatility outbreak

Research Signals - February 2020

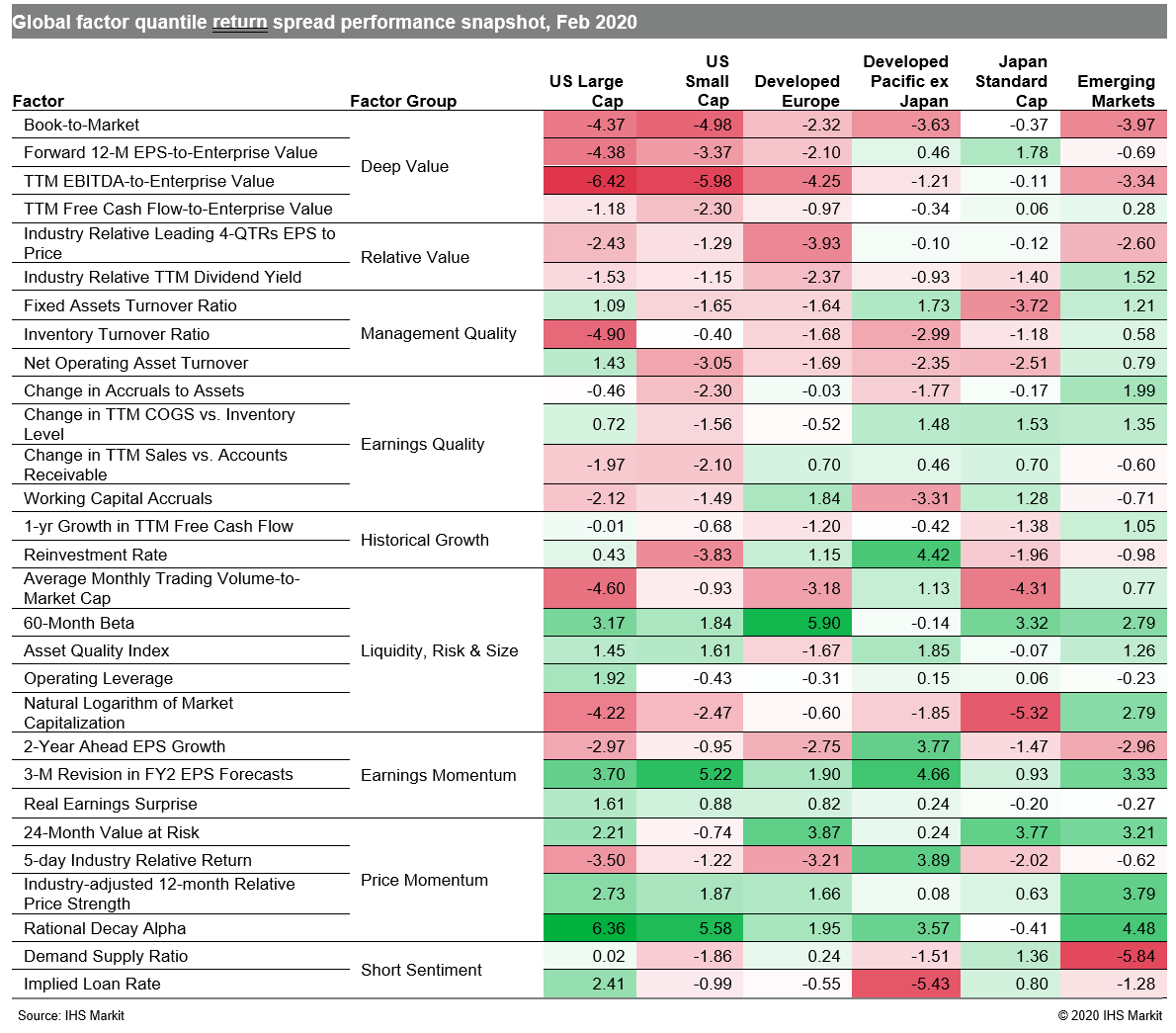

The shot of volatility that investors received in equity markets in the second half of January paled in comparison to the dose injected into stocks in late-February, with many regional markets experiencing their worst weekly loss since the financial crisis amid intensifying fears surrounding the coronavirus' impact on the global economy. Indeed, the J.P.Morgan Global Manufacturing PMI suffered its steepest contraction since May 2009, as the coronavirus outbreak disrupted demand, international trade and supply chains, with China the hardest hit as output and new business fell at survey-record rates. Investors, meanwhile, continued to inoculate their high momentum stock exposure with low beta trades (Table 1).

- US: Amid uncertainty surrounding the impact of the coronavirus on corporate financials, investors favored firms with the highest analyst outlook, as gauged by 3-M Revision in FY2 EPS Forecasts, particularly for small caps

- Developed Europe: The risk-off trade was prevalent in equity markets, confirmed by 60-Month Beta's top tier performance

- Developed Pacific: Small cap stocks in Japan suffered the weakest returns during the market rout, as captured by Natural Logarithm of Market Capitalization

- Emerging markets: High momentum stocks, as measured by Rational Decay Alpha, continued to briskly outpace the most undervalued names, as measured by Book-to-Market

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvolatility-outbreak.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvolatility-outbreak.html&text=Volatility+outbreak+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvolatility-outbreak.html","enabled":true},{"name":"email","url":"?subject=Volatility outbreak | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvolatility-outbreak.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Volatility+outbreak+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvolatility-outbreak.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}