Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 29, 2022

Vulnerable housing markets in Europe can deepen recessions

- Sharp price corrections would deepen and lengthen the recessions.

- Housing market shock would reduce eurozone GDP by 0.7% and 0.5% in 2023 and 2024, respectively.

- Sweden, Denmark, the UK, Germany, Luxembourg, Norway, and the Netherlands are most vulnerable.

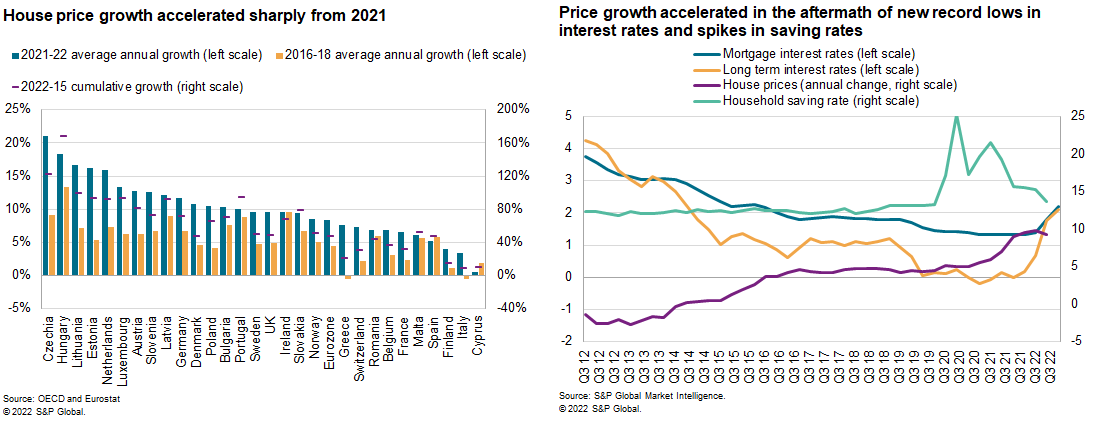

Residential real estate prices have been rising amid low interest rates, boosting affordability and making investments in real estate more attractive.

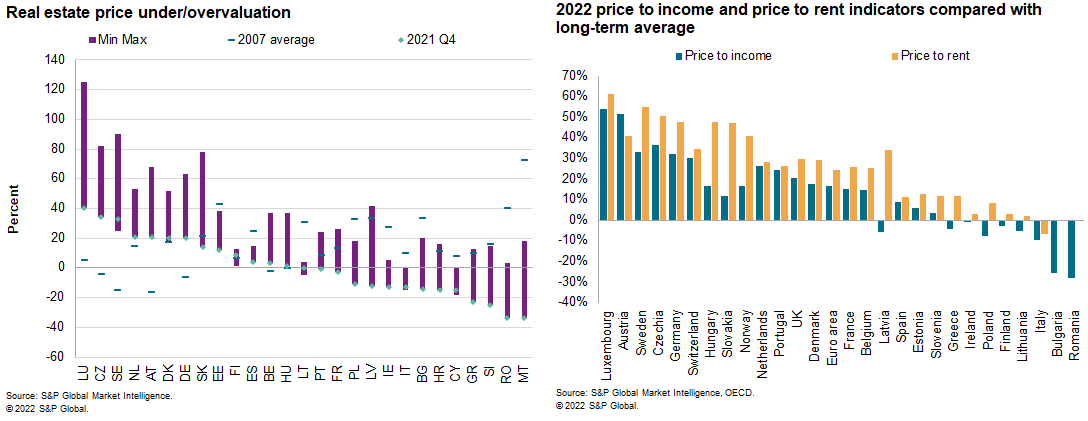

Rapid house price growth in many cases outpaced the increases in income and in rents and led to or exacerbated the overvaluation of housing in Europe. Looming recessions will depress affordability and investments in real estate. Significant overvaluation of housing prices in several European economies increases the possibility of price corrections.

Historically, we have seen a correlation between housing and business cycles. Developments in housing markets are affecting investment and consumption decisions and can affect financial cycles — especially if previous growth was driven by strong expansion in lending and resulted in high indebtedness of households. Research shows that residential investments and, to a lesser extent, residential real estate prices have recession-prediction properties.

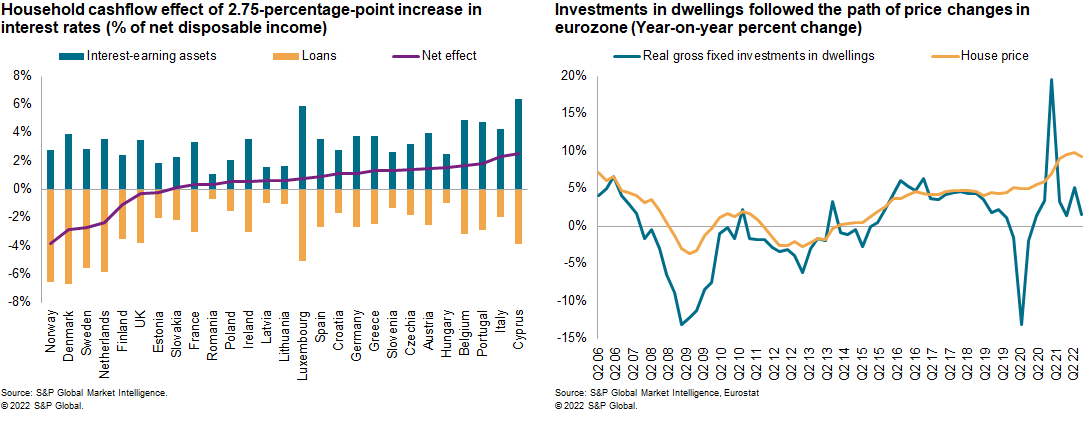

In our housing market shock model scenario simulation, we assume a correction of house price bubbles, depending on the overvaluation estimates, starting at the end of 2022. Falling house prices together with higher financial stress and lower liquidity will lower investments. The net cashflow effect, which measures the changes in interest expenses versus interest income, will gradually impact household disposable income due to changes in net interest income.

The model results show that the shock will trigger a decrease in gross fixed capital formation by 2.0% in 2023 and 1.7% in 2024 compared with the baseline in the eurozone. Consumption will decline by less—0.1% and 0.2%, respectively—due to a positive net cashflow effect on some countries.

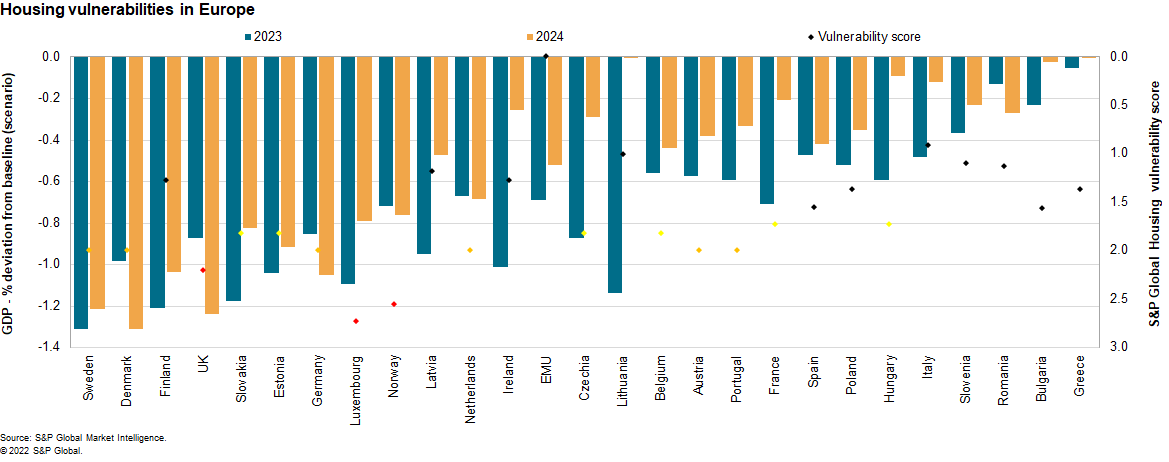

Model simulations show that eurozone GDP will decline by 0.7% in 2023 and by 0.5% in 2024 compared with the baseline. The United Kingdom economy is expected to be affected more significantly, especially in 2024, when GDP is expected to be 1.2% below the baseline.

Sweden, Finland, Denmark, the United Kingdom, Slovakia, Estonia, and Germany will have the largest losses of GDP, explained by the overvaluation of their housing markets or negative net cashflow effect. Greece, Bulgaria, Romania, Slovenia, Hungary, and Italy are likely to be least affected as they show fewer signs of overvaluation in their housing markets and positive net cashflow effects. Italy has the strongest positive net cashflow effect.

The model is useful in seeing the numerical effects on countries' GDP, although it has limitations. Some simplifications and the inability to incorporate all of the specifics regarding residential real estate market financing and household finances are likely resulting in smaller negative effects in some of the countries.

Our housing vulnerability score shows which countries are most likely to experience price corrections. The score also indicates which economies are most vulnerable to price corrections amid rising interest rates by incorporating the variables measuring price metrics, mortgage markets and household finances.

The highest risk scores combining these variables are assigned to Luxembourg, Norway, and the UK. The risk is average in Austria, Denmark, Germany, the Netherlands, Portugal, and Sweden. The risk is lower in Belgium, Czechia, Estonia, Slovakia, France, and Hungary. The lowest risk scores are assigned to Italy, Lithuania, Slovenia, and Romania.

Those vulnerabilities indicate that the flagged countries are likely to face stronger and longer-lasting negative impacts on their economies than the model simulations indicate. That is because of higher probabilities of both price corrections and negative effects on household finances and the financial system, further amplifying the impacts on consumption, expectations, and investments.

In general, our model scenario results and vulnerability analysis show that Sweden, Denmark, the UK, Germany, Luxembourg, Norway, and the Netherlands are likely to be most vulnerable.

In our baseline, we expect only a significant slowdown in house price growth or moderate declines owing to the relative strength of European labor markets, fiscal support to alleviate the cost-of-living crisis, and an expected deceleration in inflation. However, the risk has increased, especially in the most vulnerable markets. In the worst-case scenario, those markets could face deeper and longer-lasting recessions amid decreasing investments and consumption exacerbated by the negative impact on the financial sector due to its links to residential real estate markets. A need for higher interest rates to counteract persistent above-target inflation or a significant increase in unemployment would increase that risk substantially.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvulnerable-housing-markets-in-europe-can-deepen-recessions.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvulnerable-housing-markets-in-europe-can-deepen-recessions.html&text=Vulnerable+housing+markets+in+Europe+can+deepen+recessions+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvulnerable-housing-markets-in-europe-can-deepen-recessions.html","enabled":true},{"name":"email","url":"?subject=Vulnerable housing markets in Europe can deepen recessions | S&P Global&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvulnerable-housing-markets-in-europe-can-deepen-recessions.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Vulnerable+housing+markets+in+Europe+can+deepen+recessions+%7c+S%26P+Global http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvulnerable-housing-markets-in-europe-can-deepen-recessions.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}