Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 08, 2023

Week Ahead Economic Preview: Week of 11 September 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

ECB meeting, US CPI, UK GDP and China's data deluge

The week ahead sees the European Central Bank convening to update monetary policy, though the spotlight will also fix on US CPI figures ahead of the Fed FOMC meeting later this month. Activity data such as retail sales and industrial production figures will be eagerly awaited from both the US and mainland China, while the UK releases labour market and monthly GDP data. Special reports including the S&P Global Investment Manager Index and GEP Global Supply Chain Volatility Index will meanwhile provide further insights into key themes being watched by the market at present.

The ECB meeting will be the central bank highlight with policymakers having indicated their flexibility with regards to another rate hike at the September meeting. Between slowing - but still-elevated - inflation and softening growth conditions, there is a lot of uncertainty about whether the ECB might decide to sit on its hands awaiting more data.

While global growth is showing signs of weakening, we are seeing stubborn inflation having persisted into August via PMI price indices. Headline US CPI is hence expected to climb higher, in line with the trend preluded by the S&P Global US PMI Output Prices Index. Some stickiness around the 3% is signalled in the coming months and any surprise to the upside for the upcoming CPI release may trigger a repricing of assets, especially with the market growing less convinced that the Fed will hold rates unchanged until the end of 2023, according to the CME FedWatch tool.

That said, upcoming US activity data may build the case for rates to hold steady. The August S&P Global US Composite PMI revealed slowing growth, which will likely be confirmed with official releases such as retail sales and industrial production numbers. Other major economies such as the UK and mainland China will also update key activity data, all of which are expected to underscore the state of slowing growth momentum if PMI trends are followed.

Against such a backdrop, it will be of interest to examine how sentiment among money managers is shifting, and what is driving sentiment, with the S&P Global Investment Manager Index released. The GEP Global Supply Chain Volatility Index will also be of interest after global producer prices showed nascent signs of rising in August, though with energy prices in part driving this change.

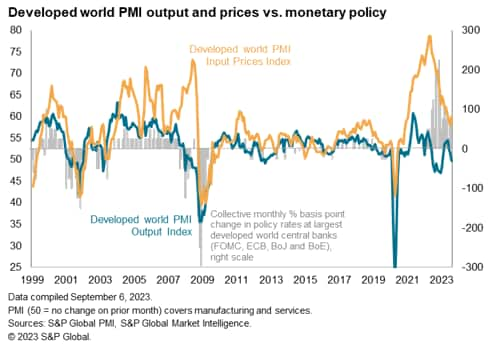

Global PMIs: a whiff of stagflation?

Global economic growth slowed for a third successive month in August, according to the Global PMI data compiled by S&P Global. The headline PMI, fell from to its lowest since the current global economic upturn began in February. The current reading is broadly consistent with annualized quarterly global GDP growth of just under 1% midway through the third quarter, well below the pre-pandemic ten-year average of 3.0%.

The PMI for the developed world was even worse, slipping into contraction for the first time in seven months in August. Falling output in Europe led the deteriorating picture, but the US also came close to stalling.

A third month of falling worldwide factory output amid weakened global trade was accompanied by a further faltering of this year's recent revival of service sector growth. Previously-fast growing consumer services and financial services sectors, which had enjoyed a post-pandemic growth spurt, are now seeing falling demand as interest rates rise.

Global selling price inflation meanwhile remained elevated due to some bottoming-out of manufacturing prices, higher oil prices and stubborn wage-led service sector price gains.

This mix of weak output alongside stubborn price pressures hints at stagflation. However, inflation may soon have further fall, as job markets are cooling. Developed world labour markets came close to stalling in August. An intensifying downturn in companies' backlogs of work meanwhile hints at further near-term downside risks to hiring and output.

Key diary events

Monday 11 Sep

Malaysia Industrial Production (Jul)

Malaysia Retail Sales (Jul)

Turkey Industrial Production (Jul)

United States Consumer Inflation Expectations (Aug)

China (Mainland) M2, New Yuan Loans, Loan Growth (Aug)

Tuesday 12 Sep

United Kingdom Labour Market Report (Jul)

Eurozone ZEW Economic Sentiment (Sep)

India Industrial Production (Jul)

India Inflation (Aug)

Brazil Inflation (Aug)

OPEC Monthly Report

S&P Global Investment Manager Index* (Sep)

Wednesday 13 Sep

South Korea Import and Export Prices (Aug)

South Korea Unemployment Rate (Aug)

Japan PPI (Aug)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Jul)

Hong Kong SAR Industrial Production (Q2)

Eurozone Industrial Production (Jul)

United States CPI (Aug)

Thursday 14 Sep

Japan Machinery Orders (Jul)

Australia Employment (Aug)

Singapore Unemployment Rate (Q2, final)

Japan Industrial Production (Jul, final)

South Africa Inflation (Aug)

India WPI (Aug)

Eurozone ECB Interest Rate Decision

United States Retail Sales (Aug)

United States Jobless Claims

United States Business Inventories (Jul)

GEP Global Supply Chain Volatility Index* (Aug)

Friday 15 Sep

South Korea Trade (Aug)

Singapore Non-oil Domestic Exports (Aug)

China (Mainland) House Prices (Aug)

China (Mainland) Industrial Production (Aug)

China (Mainland) Retail Sales (Aug)

China (Mainland) Unemployment Rate (Aug)

China (Mainland) Fixed Asset Investment (Aug)

Indonesia Trade (Aug)

Germany Wholesale Prices (Aug)

Eurozone Trade (Jul)

India Trade (Aug)

United States Import and Export Prices (Aug)

United States Industrial Production (Aug)

United States Capacity Utilisation (Aug)

United States UoM Sentiment (Sep, prelim)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch

Americas: US CPI, PPI, retail sales, industrial production and UoM sentiment data

The US sees a busy economic calendar in the week ahead, with August CPI data being the highlight. Consensus expectations point to core CPI staying unchanged at 0.2% while headline CPI is expected to rise from 0.2% month-on-month in July. This is in line with price indications from S&P Global US Composite PMI, which suggest that US CPI may rise in the near-term and remain sticky with PMI output price index preceding the trend for US CPI.

Meanwhile retail sales and industrial production numbers will be important to track in the coming week amidst indications of lacklustre production performance and softening services growth, according to early PMI indications.

EMEA: ECB meeting, Eurozone ZEW sentiment, UK monthly GDP and labour market report

Policymakers at the European Central Bank convene in the coming week with a rate hike on the table, though the likelihood of the ECB further tightening financial conditions has ebbed in recent weeks. Current PMI data suggest that eurozone inflation remains on a broadly easing path, though attainment of the ECB's 2% target still looks difficult. Downturn, and recession, risks have meanwhile intensified.

Key releases from the UK meanwhile include July GDP growth and employment figures. While faring better than the eurozone, UK growth near-stalled in July, pre-empting a weaker output figure at the start of the third quarter.

Asia-Pacific: China's retail sales and industrial production data, India inflation

In APAC, the focus will be with a deluge of data from mainland China, including loan growth, house prices, retail sales and industrial production after recent Caixin PMI revealed a further slowdown in August.

India's inflation numbers will also be key after India's PMI figures showed selling price inflation in the private sector rose midway into the third quarter.

Investment Manager and Supply Chain Volatility Indices

Two special reports will be due in the coming week including the S&P Global Investment Manager Index for the latest views from US equity investors and the GEP Global Supply Chain Volatility Index after worldwide producer prices were shown to rise for the first time in four months in August.

Special reports

Global PMI Shows Recovery Fading Further in August as Developed World Output Falls - Chris Williamson

India's GDP Growth Remains Buoyant in 2023 - Rajiv Biswas

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-september-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-september-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+11+September+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-september-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 11 September 2023 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-september-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+11+September+2023+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-september-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}