Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 09, 2024

Week Ahead Economic Preview: Week of 12 August 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US CPI, UK, Eurozone and Japan Q2 GDP updates and China data

US CPI will be the key data release in the fresh week in addition to a series of GDP updates including across major developed economies such as the UK, Eurozone and Japan. A central bank meeting also unfolds in New Zealand. Meanwhile, key data updates will be due from APAC economies such as mainland China and India.

The highlight in the fresh week will be US CPI data as the market await further indications that rate cuts will be coming along into the end of 2024 (see box). That said, with the monetary policy decision watch shifting focus towards the labour market and other high frequency data, the focus may instead be with updates such as US retail sales and industrial production numbers in the absence of any surprise on the CPI end.

Additionally, we will also be anticipating the August S&P Global Investment Manager Index (IMI)for a sense of how risk sentiment has changed especially after the latest market turmoil. The survey will also shed light on the expected drivers for US equity returns and sector preference among investors, while also providing insights into sentiment around earnings after the second quarter releases.

Amidst rising concerns over recession in the US, we will also be studying growth conditions via the release of second quarter GDP readings, including preliminary updates in the UK and eurozone. Improvements in growth conditions from the first quarter are expected for both the UK and Eurozone and even Japan based on PMI data.

Meanwhile the Reserve Bank of New Zealand convene mid-August with speculations of a rate cut starting to gather just ahead of the meeting. This takes place amidst rising concerns surrounding economic growth around the world, though the RBNZ's stance earlier in May had clearly been nowhere near dovish.

Other noteworthy releases in the week include activity data from Mainland China with the release of industrial production and retail sales to be released on Thursday. Official industrial production figures will be scrutinised after PMI data, including both the NBS and Caixin survey, having pointed to a relatively weaker manufacturing sector as compared with services.

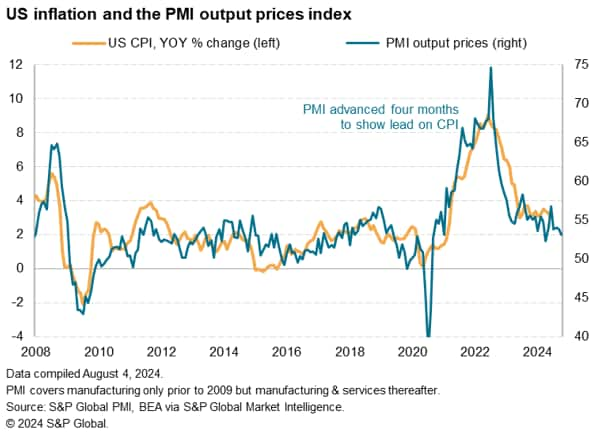

US inflation moving towards target

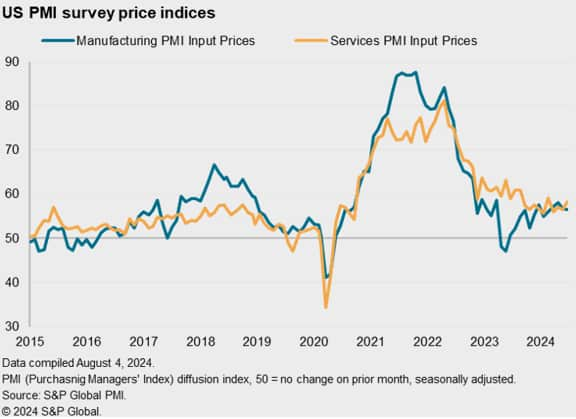

July's US CPI data will be watched for official confirmation that inflation is moving further in the right direction especially amidst widespread expectations for the US Fed to lower rates into the latter half of the year. According to the S&P Global US PMI data, selling price inflation further eased in July, giving clear indications that CPI will be moving closer to the Fed's target.

That said, risks remain on the cost side with still-elevated input price inflation, and this should not be overlooked. Policymakers are likely eager to see these cost pressures soften in the near-term before gaining greater confidence of falling inflation.

Key diary events

Monday 12 Aug

Japan, Thailand Market Holiday

Singapore GDP (Q2, final)

India Industrial Production (Jun)

India Inflation (Jul)

China (Mainland) New Yuan Loans, M2, Loan Growth (Jul)

United States Monthly Budget Statement (Jul)

United Kingdom Regional Growth Tracker* (Jul)

Tuesday 13 Aug

Japan PPI (Jul)

United Kingdom Labour Market Report (Jun)

Spain Inflation (Jul, final)

Eurozone ZEW Economic Sentiment (Aug)

Germany ZEW Economic Sentiment (Aug)

United States PPI (Jul)

S&P Global Investment Manager Index* (Aug)

GEP Global Supply Chain Volatility Index* (Jul)

Wednesday 14 Aug

New Zealand RBNZ Interest Rate Decision

United Kingdom Inflation (Jul)

India WPI (Jul)

France Inflation (Jul, final)

Eurozone GDP (Q2, prelim)

Eurozone Industrial Production (Jun)

United States CPI (Jul)

Thursday 15 Aug

India, Italy, South Africa Market Holiday

Japan GDP (Q2, prelim)

Australia Employment Change (Jul)

China (Mainland) Industrial Production, Retail Sales, Fixed Asset Investment (Jul)

Indonesia Trade (Jul)

Japan Industrial Production (Jun, final)

United Kingdom monthly GDP, incl. Manufacturing, Services and Construction Output (Jun)

United Kingdom GDP (Q2, prelim)

Philippines BSP Interest Rate Decision

United States Retail Sales, Industrial Production (Jul)

United States Business Inventories (Jun)

Friday 16 Aug

Singapore Non-oil Domestic Exports (Jul)

Malaysia GDP (Q2)

Germany Wholesales Prices (Jul)

United Kingdom Retail Sales (Jul)

Switzerland Industrial Production (Q2)

Hong Kong SAR GDP (Q2, final)

Eurozone Balance of Trade (Jun)

Canada Housing Starts (Jul)

United States Building Permits (Jul, prelim)

United States Michigan Consumer Sentiment (Aug, prelim)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: US CPI, PPI, retail sales, industrial production, building permits and UoM sentiment data

The key data to watch in the coming week will be US inflation figures after the Fed signalled that interest rate cuts are coming at their end-July meeting. According to the latest S&P Global US PMI data, a further cooling of selling price inflation in July is indicative of consumer price inflation moving closer towards the Fed's 2% target, supporting the Fed in their endeavour to lower rates.

Additional data to observe in the week include retail sales, industrial production, building permits and UoM sentiment figures, with the latest S&P Global US Manufacturing PMI indicating that the expansion in production softened in July.

EMEA: UK GDP, labour, inflation reports and retail sales data, Eurozone Q2 GDP, German ZEW survey

The UK releases a series of tier-1 data including the preliminary Q2 GDP reading and July payrolls and inflation updates. Recent PMI data have pointed to the easing of inflationary pressures in the UK. The latest composite PMI price charged index further pointed to CPI easing to around 2.5% as services selling price inflation fell. Meanwhile a slightly stronger Q2 expansion is expected for the UK based on PMI data while jobs growth conditions improved at the start of the second half of 2024.

A positive GDP print is also expected for the eurozone in Q2, though the more up-to-date July HCOB Eurozone PMI data pointed to the eurozone economy stalling at the start of the second half of 2024.

APAC: RBNZ meeting, Japan, Singapore, Malaysia GDP, India Inflation, China industrial production, retail sales data, Australia employment

The Reserve Bank of New Zealand (RBNZ) convenes in the new week amid rising expectations for rate cuts from major central banks around the world. The focus will also be with data releases including Japan's Q2 GDP, which is forecasted to show improved performance in the second quarter. Meanwhile Mainland China's industrial production will be closely watched after latest PMI data indicated that manufacturing output growth slowed in July.

S&P Global Investment Manager Index and GEP Global Supply Chain Volatility Index

Following the latest market turmoil, the S&P Global Investment Manger Index will provide insights into investor sentiment and key market drivers. Additionally, the GEP Global Supply Chain Volatility Index will shed light on supply conditions amidst increased reports of shipping delays impacting global supply chains and exports in July.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-august-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-august-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+12+August+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-august-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 12 August 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-august-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+12+August+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-august-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}