Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 13, 2024

Week Ahead Economic Preview: Week of 16 December 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Central bank meetings and flash PMIs

A clutch of high-profile central bank meetings in the coming week is accompanied by a slew of tier-one data releases to provide guidance on economic conditions and likely policy paths in the new year.

Markets are anticipating a further 25 basis point rate cut from the US Federal Reserve in the coming week, adding to the policy easing after the ECB also cut rates by 25 basis points at its December meeting. However, the cutting cycle is by no means universal: the Bank of England is expected to sit on its hands amid concerns over sticky inflation and some are betting on the Bank of Japan hiking rates.

The FOMC meeting will also be scrutinised for any forward guidance on rates, as markets have pared back expectations of US rate cuts over 2025 due to the new administration. Many forecasters anticipate that higher inflation will ensue later in 2025 once proposed trade tariffs take effect, which could see the FOMC's policy easing halt by mid-year.

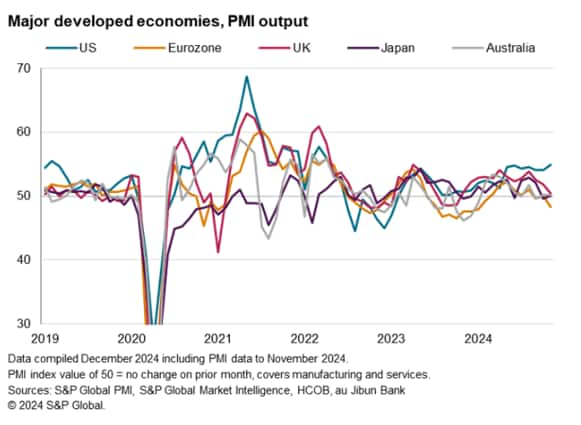

A timely handle on economic trends in the major economies will meanwhile be provided by the flash PMIs. Prior data showed the US outperforming other developed market peers, not least the eurozone, which slipped into contraction in November. However, more or less stalled growth pictures were seen in the UK, Australia and Japan.

A key development to watch with the upcoming flash PMI data has been a heightening of uncertainty in Europe, linked to political instability in the EU as well as the threat of US protectionism, which contrasts with a corresponding surge in optimism amongst US manufacturers. The latter had, however, yet to feed through to higher US production, so December's data will be eyed to see if there is any impact yet beyond the purchasing of imports ( notably from mainland China) as US firms seek to front-run threatened tariffs.

The UK flash PMI data will also provide an important update on how businesses are reacting to the recent Budget, which saw an employee-based tax hike that has shown signs of dampening business confidence and subduing demand for labour, but which could also push prices higher.

Other key data releases include retail sales and industrial production for the US and mainland China, plus PCE prices for the US and CPI inflation for the UK, eurozone and Japan.

Key diary events

Monday 16 Dec

South Africa Market Holiday

Australia S&P Global Flash PMI, Manufacturing &

Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Japan Machinery Orders (Oct)

China (Mainland) Industrial Production, Retail Sales, Fixed Asset

Investment, 1-Year MLF Announcement (Nov)

Indonesia Trade (Nov)

India Trade (Nov)

Italy Inflation (Nov, final)

Canada Housing Starts (Nov)

Tuesday 17 Dec

United Kingdom Labour Market Report (Oct)

Germany Ifo Business Climate (Dec)

Eurozone Balance of Trade (Oct)

Germany ZEW Economic Sentiment Index (Dec)

Canada Inflation (Nov)

Canada New Housing Price Index (Nov)

United States Retail Sales and Industrial Production (Nov)

United States Business Inventories (Nov)

Wednesday 18 Dec

Australia Westpac Consumer Confidence (Dec)

Japan Trade (Nov)

Thailand BoT Interest Rate Decision

United Kingdom Inflation (Nov)

Indonesia BI Interest Rate Decision

Eurozone Inflation (Nov, final)

United States Building Permits and Housing Starts (Nov)

United States FOMC Interest Rate Decision

Thursday 19 Dec

New Zealand GDP (Q3)

Japan BoJ Interest Rate Decision

Germany GfK Consumer Confidence (Jan)

Philippines BSP Interest Rate Decision

United Kingdom BoE Interest Rate Decision

United States GDP (Q3, final)

United States Existing Home Sales (Nov)

United States CB Leading Index (Nov)

Mexico Banxico Interest Rate Decision

Friday 20 Dec

Japan Inflation (Nov)

China (Mainland) Loan Prime Rate (Nov)

Malaysia Inflation (Nov)

United Kingdom Retail Sales (Nov)

United States Core PCE (Nov)

United States Personal Income and Spending (Nov)

Eurozone Consumer Confidence (Dec, flash)

United Staes UoM Sentiment (Dec, final)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

December flash PMI releases

Flash PMIs for the major economies, based on data collected from around the 5th December onwards, will be published on Monday. Following mixed regional performance observed in November, driven partially by changes in behaviour amidst US tariffs threat, economic conditions across major developed economies and India will be keenly tracked with the upcoming release.

Americas: FOMC meeting, US Q3 GDP, core PCE, industrial production, retail sales, personal income and spending, existing home sales data; Canada inflation

The final Federal Open Market Committee (FOMC) meeting of the year unfolds with the consensus pointing to another 25 basis point cut in interest rates. Focus will rest on the Fed's outlook amidst rising uncertainties over the path forward for interest rates as the new US administration steps into office in 2025. December's S&P Global Investment Manager Index found that the most common expectation among money manager thus far is for the Fed to lower rates by between 51 and 100 basis points over the course of 2025.

Separately, data releases to watch include the final reading of US Q3 GDP, November's core PCE data and monthly activity data. Canada's inflation data will also be updated.

EMEA: BoE meeting, UK CPI, retail sales and labour market data; Eurozone CPI; Germany Ifo & ZEW surveys

The Bank of England (BoE) is expected to keep rates unchanged in December after lowering the bank rate in November. Focus will also be on UK inflation and employment data released for official confirmation of the softening trend observed in PMI data.

Following the December flash PMI releases on Monday, final November inflation data out of the eurozone and various Germany sentiment surveys will also be published.

APAC: BoJ, BoT, BI, BSP meetings; Japan inflation and trade data, China industrial production, retail sales data; New Zealand GDP

Expectations for the Bank of Japan (BoJ) to hike at their December meeting has risen in the lead up to the 19th December announcement, though odds are tilted towards a hold. Rising selling price inflation in November, according to the au Jibun Bank Japan PMI, provided some support for a rate hike though subdued growth calls for some caution. Ahead of the meeting, we will also see the release of December's set of flash PMI data.

Additionally, key releases in the region include Japan's inflation and activity data out of mainland China.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-december-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-december-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+16+December+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-december-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 16 December 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-december-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+16+December+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-december-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}