Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 17, 2025

Week Ahead Economic Preview: Week of 17 March 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Rate setters mull growth and inflation outlooks in US, UK and Japan

Central bank meetings in the US, UK and Japan are likely to see rates on hold, but will be eagerly watched for clues as the next moves as policymakers juggle differing signals for growth and inflation.

The FOMC decision is due on Wednesday and comes as most nowcast models indicate GDP growth slowing in the first quarter, with some such as the Atlanta Fed's GDPNowcurrently even pointing to a 2.4% annualized contraction. This looks like it is overstating the weakness, and survey data such as the S&P Global PMI point to a more moderate slowdown, though even the PMI data have fallen sharply to an extent now consistent with a mere 0.6% rate of growth in February. Surveyed companies report demand weakness from federal budget cutting and tariff-related uncertainty.

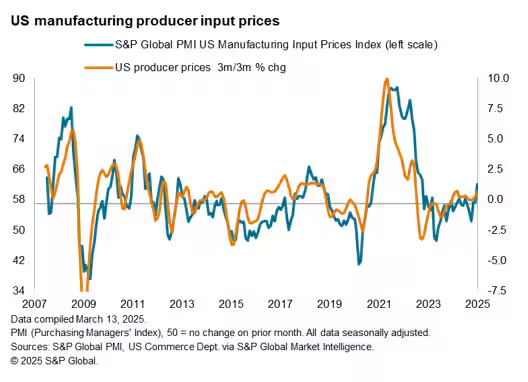

Meanwhile, lower than expected US CPI readings for February masked a worrying stickiness of underlying inflation, notably in core goods prices, which followed news from the PMI of factory goods prices rising at the sharpest rate for two years. Additional tariffs announced in March will only add to the concerns that the inflation trajectory is heading north. With the Fed still smarting from underestimating inflation after the pandemic, and non-farm payrolls pointing to resiliency in the job market, the markets think there's a high bar to imminent US rate cuts.

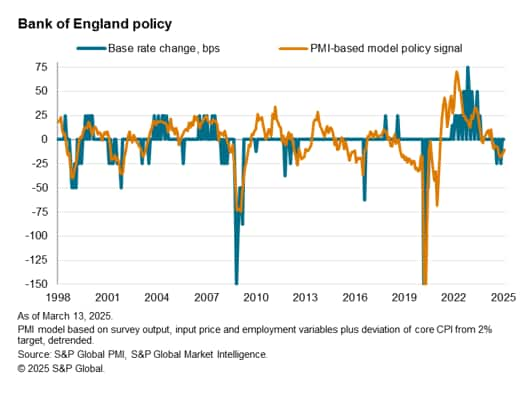

In the UK, the Bank of England is also expected to hold rates steady, having reduced its policy rate to 4.5% via a 25 basis point cut in February. The Bank also halved its economic growth forecast for 2025 to just 0.75% in a sign of rising concern about the weaker business and consumer sentiment seen since the tax hikes of the Autumn Budget and global tariff developments. These same factors are, however, also likely to pull inflation higher, meaning that the Bank of England's rate setters also face a juggling act between signs of weaker economic growth and rising inflation expectations.

While the Bank of Japan is also like to be on hold, the next move is expected to be a hike amid signs of higher wage growth. However, concerns are growing about a potential slowing of the Japanese economy amid tariff uncertainty. The February PMI, for example, showed business confidence sliding to a four-year low despite robust current output growth. A weakening of S&P Global's Business Outlook survey likewise underscored the heightened uncertainty facing businesses around the world.

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-march-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-march-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+17+March+2025+%7c+IHS+Markit+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-march-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 17 March 2025 | IHS Markit &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-march-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+17+March+2025+%7c+IHS+Markit+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-march-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}