Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 15, 2023

Week Ahead Economic Preview: Week of 18 September 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

FOMC, BOE, BOJ meetings and September flash PMI

A series of central bank meetings unfold in the coming week, notably including in the US, UK and Japan, while flash PMI data bookend of the week for early insights into September economic conditions across the major developed economies. Other key economic releases include inflation data from the eurozone, UK and Japan alongside US housing market data.

The Fed is expected to hold rates at their September FOMC meeting, though the latest US CPI data reinforced the view that another rate hike should certainly not be ruled out before the end of 2023. It will therefore be the projections and meeting rhetoric that will be in focus. US PMI price data had indicated sticky inflation persisting into the near-term; a trend confirmed by the latest CPI readings, which showed a larger than expected 0.3% monthly rise in core inflation and an acceleration in the headline annual rate to 3.7%.

While concerns over US recession have receded according to the latest S&P Global Investment Manager Index, worries over the broader global economy have intensified in September. This was linked to the worsening of economic conditions in the eurozone, UK and mainland China. Next week's HCOB Flash Eurozone PMI and S&P Global/CIPS Flash UK PMI will therefore offer the earliest insights into rising European recession risks - notably in struggling Germany - and hence clues to future policy paths, as well as giving updates on price developments.

Any signs of deepening downturns, particularly in Europe, may further bolster near-term greenback strength, as forecasted by participants of the IMI survey.

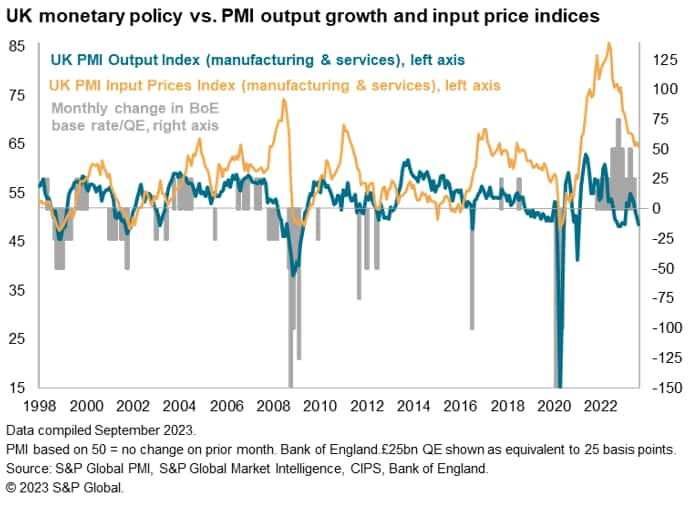

Furthermore, the Bank of England, set to lift rates next week, faces greater uncertainties if further deterioration in economic conditions amid still-elevated inflation continued to be reflected in the flash PMI data (see box).

In APAC, a number of central banks are set to convene though the attention will be on the BOJ after Governor Kazuo Ueda hinted at the possible end of the ultra-loose monetary policy regime. The specifics remain uncertain and could be explored in the meeting next week. The Judo Bank Flash Australia PMI will meanwhile provide updates on one of mainland China's key trading partner ahead of worldwide PMI data due at the start of October.

Bank of England set for difficult decision

After 14 consecutive rate hikes, there is growing speculation than the Bank of England is coming close to pausing its rate hike cycle. The broad consensus appears to be that the MPC will hike again at its September meeting, but that this will represent a peak. A predicted 25 basis point hike will take Bank Rate to 5.5%, its highest since early 2008.

The decision will nevertheless likely be a tough one, and certainly not unanimous among the policy committee. While inflation at 6.8% compared to a target of 2% represents a strong case of more work needing to be done, forward-looking indicators such as the PMI prices gauges shows a path down to 4% in the near-term. Pricing power is deteriorating as the economy slides into a contraction. The Bank's forecasters had anticipated a 0.4% expansion of GDP in the third quarter, but this looks far too optimistic. After the economy contracted 0.5% in July, GDP would have to improve in August and September on its year-to-date levels to avoid a Q3 decline, but with the PMI sliding lower in August, such an acceleration looks unlikely.

Stubborn high wage growth is another major concern to the hawks, but even here there are signs that the labour market is weakening. Job vacancies and employment are now falling and surveys of recruiters hint at worse to come. To set policy on lagging indicators such as wages data looks risky when a recession appears to be looming. Thursday's decision will also be judged almost immediately, to some extent, by the release of flash September PMI data on Friday, setting the scene for a difficult - and unenviable -meeting.

Key diary events

Monday 18 Sep

Japan Market Holiday

Singapore Non-oil Domestic Exports (Aug)

Canada PPI and Housing Starts (Aug)

Tuesday 19 Sep

India Market Holiday

Australia RBA Meeting Minutes (Sep)

Malaysia Trade (Aug)

Hong Kong SAR Unemployment Rate (Aug)

Eurozone Current Account (Jul)

Eurozone Inflation (Aug, final)

Canada Inflation (Aug)

United States Building Permits (Aug, prelim)

United States Housing Starts (Aug)

Wednesday 20 Sep

New Zealand Current Account (Q2)

Japan Trade (Aug)

China (Mainland) Loan Prime Rates (Sep)

Germany PPI (Aug)

United Kingdom Inflation (Aug)

Taiwan Export Orders (Aug)

South Africa Inflation (Aug)

United States FOMC Interest Rate Decision

Thursday 21 Sep

New Zealand GDP (Q2)

Brazil BCB Interest Rate Decision

Hong Kong SAR HKMA Interest Rate Decision

Philippines BSP Interest Rate Decision

Indonesia BI Interest Rate Decision

Switzerland SNB Interest Rate Decision

Sweden Riksbank Rate Decision

Norway Norges Bank Interest Rate Decision

Taiwan CBC Interest Rate Decision

Turkey TCMB Interest Rate Decision

United Kingdom BOE Interest Rate Decision

South Africa SARB Interest Rate Decision

Hong Kong SAR Inflation (Aug)

Eurozone Consumer Confidence (Sep, flash)

United States Existing Home Sales (Aug)

Friday 22 Sep

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash Manufacturing PMI*

UK S&P Global/CIPS Flash PMI, Manufacturing &

Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Japan BOJ Interest Rate Decision

Japan CPI (Aug)

Malaysia CPI (Aug)

Singapore CPI (Aug)

United Kingdom Retail Sales (Aug)

Canada Retail Sales (Jul)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch

September flash PMI releases

Flash PMI numbers for September will be released in the coming week for the earliest look into economic conditions in the final month of Q3 2023. Market confidence was undermined after flash PMI from August showed surprising weakness in US and European economies on the back of higher interest rates. The UK joined the eurozone in contraction while the US near-stalled in August, though Japan backed the trend with sustained solid expansion. Should this deterioration in western economic conditions sustain into September alongside sticky inflation, further uncertainties on the monetary policy front may gather.

Americas: FOMC meeting, US housing data, Canada CPI

The September Fed FOMC meeting unfolds next week with projection materials and the Fed chair's press conference due after the meeting concludes on Wednesday. Consensus expectations, according to the CME FedWatch tool, firmly indicate no change at the upcoming meeting, though it will be the projections and the Fed chair Jerome Powell's rhetoric that will be closely studied. Markets are pricing in a roughly 40% chance of a further hike in the current rate cycle. As well as the S&P Global PMI data, there's also a clutch of housing market data to watch in the US.

Separately, Canada releases inflation figures on Tuesday after the numbers surprised on the upside in July.

EMEA: BOE meeting, Eurozone, UK inflation

The Bank of England will be another major central bank to update policy with a 25 basis points (bps) hike being pencilled in by forecasters. Relatively elevated inflation is expected to drive the BOE to raise rates for a 15th consecutive meeting, though weakness in GDP to match recent downbeat PMI surveys hints at a possible pause. Meanwhile August inflation figures will be updated in the eurozone and UK in addition to flash PMI readings on Friday.

APAC: BOJ, BI, BSP, CBC, HKMA meetings, China Loan Prime Rate, Japan inflation and trade

A series of central bank meetings take place in Asia with special focus on the Bank of Japan after Governor Kazuo Ueda hinted at ending the ultra-accommodative monetary policy settings. Guidance will be sought on the potential path forward for the BOJ. Additionally, Japan's trade and inflation will also be important data highlights.

Special reports

Renewed Fall in Demand for Consumer Services Bodes Ill for Growth but Will Pull Inflation Lower - Chris Williamson

Vietnam Strengthens Economic Ties with US During President Biden's Visit - Rajiv Biswas

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-september-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-september-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+18+September+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-september-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 18 September 2023 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-september-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+18+September+2023+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-september-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}