Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 16, 2022

Week Ahead Economic Preview: Week of 19 September 2022

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Three of the largest five economies will hold their central bank meetings this week, including the US, Japan and the UK. Attention very much focuses on the Fed after last week's higher than anticipated inflation figure. Other scheduled central bank meetings include the Philippines, Indonesia, Hong Kong SAR, Switzerland, Brazil and Taiwan. The week will end with flash PMIs for the UK, US, Japan, Eurozone and Australia, which will give a key indication into economic performance at the end of the third quarter.

The US FOMC meeting returns as falling energy costs failed to offset surging prices in other categories, meaning inflation held higher than expected at 8.3%. Subsequently, the Fed's aggressive stance is expected continue with markets pricing in a third consecutive 75 bp hike, though a 100-point rise is also on the table. Interest rates are expected to reach 4.25% by the end of 2022.

Havin been postponed due to the death of Her Majesty Queen Elizabeth II, the Bank of England meeting will take place for which markets will be eager to see the assessed impact of the energy price cap on the bank's inflation projections. That said, the cap is unlikely to impact the bank's immediate policy decision, for which markets are predicting a 50-basis point hike. In contrast to the US, UK inflation figures came in lower than expected amid falls in fuel costs, resulting in the first CPI dip on an annual basis for almost a year. UK inflation none the less remain close to 40-year highs, with rising food costs a particular concern.

Flash PMIs will eagerly awaited amid growing recession concerns. Latest IMI data released last week signalled almost 80% of US investors fear a recession. Flash PMIs will not only provide updates in demand, supply conditions and growth, but will also give an update on the inflation front. PMI price indices have retreated across the board in recent months amid easing supply delays and cooling demand, though remain elevated by historical standards. Also watch out for updated consumer confidence figures in Europe.

Finally, inflation figures for Japan will accompany BoJ policy decision, while Canada's retail sales and inflation data will also be released.

Corporate earnings come under pressure amid economic slowdown and sustained inflation

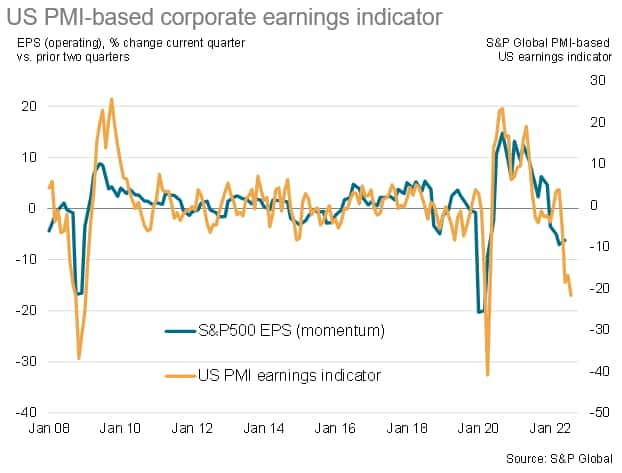

The coming week sees the updating of flash PMI data for the major developed economies, and as usual a key focus will be on the macroeconomic signals from the surveys in terms of GDP, production, employment and inflation. However, the surveys can also provide powerful tools for understanding corporate earnings momentum. By capturing changes in key business metrics such as sales, demand, pricing power, margins and productivity, the PMI surveys can provide very timely signals on underlying trends in profits and earnings, as the chart below illustrates for the US.

This chart plots a simple composite indicator of earnings drawn from S&P Global's PMI data for the US against earnings per share growth momentum. The indicator, updated in this graphic to August, is currently pointing to the sharpest downward pressure on earnings since the global financial crisis, excluding the initial pandemic lockdown months. This reflects falling demand for goods and services, a margin squeeze from waning demand, declining productivity and a broad reduction of pricing power as supply runs ahead of demand for a wide variety of products and services.

The advantage of the PMI is that earnings indicators such as the above can be compiled for each country and major market sectors, making the upcoming PMI data for September all the more important to watch. Read more in our special report.

Key diary events

Monday 19 September

Japan Market Holiday / UK Market Holiday

Hong Kong SAR Unemployment Rate (Aug)

Eurozone Construction Output (Jul)

United States NAHB Housing Market Index (Sep)

Tuesday 20 September

Japan Inflation (Aug)

Australia RBA Meeting Minutes

Switzerland Balance of Trade (Aug)

Poland Employment Growth (Aug)

Spain Balance of Trade (Jul)

Canada Inflation Rate (Aug)

United Sates Building Permits (Aug)

Wednesday 21 September

Australia Westpac Leading Index (Aug)

Netherlands Consumer Confidence (Sep)

United Kingdom Public Sector Net Borrowing (Aug)

Eurozone ECB Non-Monetary Policy Meeting

United States Fed FOMC Interest Rate Decision, MBA Mortgage Applications (16/Sep), Existing Home Sales (Aug)

Brazil Interest Rate Decision

New Zealand Balance of Trade (Aug)

Thursday 22 September

Japan BoJ Interest Rate Decision, Foreign Bond Investment (Sep)

United Kingdom BoE Interest Rate Decision

Hong Kong SAR Interest Rate Decision, Inflation (Aug)

France Business Confidence (Sep)

Eurozone ECB General Council Meeting

Switzerland SNB Interest Rate Decision

Taiwan Interest Rate Decision

Philippines Interest Rate Decision

Norway Norges Bank Interest Rate Inflation Decision

Indonesia Interest Rate Decision

Thailand Balance of Trade

Canada New Housing Prices Index (Aug)

United States Continuing Jobless Claims (10/Sep)

Eurozone Consumer Confidence Flash (Sep)

Friday 23 September

Japan Market Holiday

S&P Global Worldwide Flash PMIs*

United Kingdom Gfk Consumer Confidence (Sep)

Netherlands GDP (Q2)

Singapore Inflation (Aug), Industrial production (Aug)

Spain GDP (Q2)

Switzerland Current Account (Q2)

Poland Unemployment Rate (Aug)

Canada Retail Sales (Jul)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

Americas: US FOMC meeting, PMIs, housing data, jobless claims, plus Canada retail sales and inflation

The FOMC meeting is the highlight of the week with the Fed expected to announce yet another super-sized hike. Markets are pricing in another 75-bp addition to the Fed Funds Rate. Expectations on the pace of further hikes may, however, be affected by the flash PMIs, which indicated a marked downturn in business activity in August. Also watch the housing market data, including the NAHB index, which has weakened in recent months, and building permits data - where forecasts point to a third monthly contraction.

In Canada, retail sales and inflation will provide an update on the impact of recent aggressive Bank of Canada rate rises. Retail sales growth eased last month while falling gasoline prices relieved some pressure on the prices front.

The Central Bank of Brazil is also expected to implement another hike. The selic rate currently stands at 13.75%.

Europe: UK and eurozone PMIs and consumer sentiment, Spain & Netherlands Q2 GDP

Final Q2 GDP readings for Spain and the Netherlands will come to light on Friday, but it's the more up-to-date September flash PMIs for the UK and Eurozone which will garner most interest, as well as consumer confidence data. The latter is likely to indicate weak consumer sentiment amid the ongoing cost of living crisis. From a policy perspective, the Bank of England will inevitably hike aggressively again, but the rhetoric will be watched closely amid growing signs, not least from the PMI, of a potential recession.

Asia-Pacific: BoJ meeting, Japan and Singapore inflation figures, plus Hong Kong SAR policy rate

Japan and Singapore inflation figures will likely remain elevated. A central bank policy decision in Japan accompanies the inflation update, and the BoJ is expected to maintain ultra-low interest rates despite inflation rising above the target 2% rate (2.6% in August). Meanwhile, in Singapore, inflation is expected to run above-trend between 5-6% this year, with data last month pointing to a 7% rise. This increases the likelihood of a tightening of monetary policy in next month's review.

While Bank Indonesia's (BI) 25bp hike last month went against polls, this month a second consecutive increase is anticipated in efforts to keep inflation under control. It's southern-eastern counterpart - the Philippines - will likely see a 50-bps hike with the Bangko Sentral ng Pilipinas (BSP) set to retain its hawkish tone.

Special reports:

US - Chris Williamson

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-september-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-september-2022.html&text=Week+Ahead+Economic+Preview%3a+Week+of+19+September+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-september-2022.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 19 September 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-september-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+19+September+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-september-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}