Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 17, 2023

Week Ahead Economic Preview: Week of 20 February 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI surveys to help assess recession and inflation risks

Flash PMI data will be released in the week ahead for a first look into February economic conditions across the major developed economies. Monetary policy meetings in New Zealand and South Korea will also unfold, while the Fed's January Federal Open Market Committee (FOMC) meeting minutes and appearances by Fed members through the week will further keep us busy on the central bank front. Other economic data releases include revised US Q4 GDP, January personal income, consumption and core PCE data, alongside inflation figures from the eurozone, Germany and Japan.

This week we have gleaned from the latest S&P Global Investment Manager Index (IMI) that risk appetite improved amongst US equity investors in February, reflecting easing perceptions of various market headwinds. This came ahead of the latest US CPI data release which backed the abovementioned view from the inflation perspective, showing that inflation had further cooled in January. That said, the US CPI print of 6.4% remained well above the Fed's target and may keep the FOMC hiking rates higher and for longer, a possibility that would be best examined further with the series of Fed minutes, appearances and US data in the coming week.

At the same time, the IMI survey also revealed a decline in concerns over the macroeconomic environments in the US and abroad midway into the first quarter, hinting at growing expectations of a potential 'soft landing' for the US economy in particular. This was congruent with January PMI indications, whereby the US saw its downturn cooling at the start of 2023. Whether this trend persists into February will be scrutinised with the series of flash PMI figures out in the coming week. Sub-indices such as the New Orders index will be especially important in examining the near-term trajectory for the economy while the Employment index will also be studied for labour market conditions.

Besides the Fed, central bank meetings in South Korea and New Zealand will be highlights with the latter watched for a smaller rate hike after inflation expectations were found to have eased.

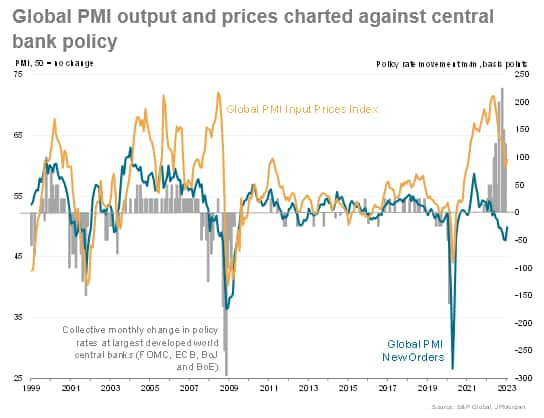

Seeking policy steers from PMI new orders and input cost gauges

Flash PMI data for February are updated in a month which saw further rate hikes having been announced by the FOMC, ECB and Bank of England. These hikes continue a tightening process which has been the most aggressive in recent history, which in turn appears to have had a clear impact on inflation. In particular, a steep descent of the global PMI Input Prices Index clearly hints that consumer price inflation will cool further in the coming months.

Whether the policy tightening has caused a recession remains a central question. Certainly, since late last year the PMIs have moved away from signalling a strong possibility of a meaningful recession to one of a potential 'soft landing'. But it remains to be seen whether the lagged impact of higher interest rates - and likelihood of more hikes to come - has the potential to offset any beneficial impact from lower inflation and a reopening of the Chinese economy. The PMIs New Orders Index will therefore be a key gauge to watch to assess recession risks.

Note also that the PMI price indices also hint that inflation is

not necessarily beaten, with cost growth ticking up again in

January amid rising wage pressures. Any further price worries,

especially from the services PMIs, mean there is a risk of higher

terminal policy rates than previously expected.

Key diary events

Monday 20 February

US, Canada Market Holiday

China (Mainland) 1Y and 5Y Loan Prime Rate (Feb)

Malaysia Trade (Jan)

Taiwan Export Orders (Jan)

Eurozone Consumer Confidence (Feb, flash)

Thailand Customs-Based Trade Data (Jan)

Tuesday 21 February

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash Manufacturing PMI*

UK S&P Global/CIPS Flash PMI, Manufacturing &

Services*

Germany S&P Global Flash PMI, Manufacturing &

Services*

France S&P Global Flash PMI, Manufacturing &

Services*

Eurozone S&P Global Flash PMI, Manufacturing &

Services*

US S&P Global Flash PMI, Manufacturing & Services*

Australia RBA Meeting Minutes (Feb)

New Zealand PPI (Q4)

Germany ZEW Economic Sentiment (Feb)

Canada CPI (Jan)

Canada Retail Sales (Dec)

United States Existing Home Sales (Jan)

Wednesday 22 February

New Zealand Trade Balance (Jan)

Japan Service PPI (Jan)

Australia Composite Leading Index (Jan)

Australia Wage Price Index (Q4)

New Zealand Cash Rate (22 Feb)

Germany CPI (Jan, final)

Taiwan Jobless Rate (Jan)

Germany Ifo Business Climate New (Feb)

Germany CPI Prelim MM (Feb)

United Kingdom House Prices (Feb)

United States FOMC Meeting Minutes (Feb)

Thursday 23 February

Australia Capital Expenditure (Q4)

South Korea Bank of Korea Base Rate (Feb)

Singapore Consumer Price Index (Jan)

Taiwan Industrial Output (Jan)

Eurozone HICP (Jan, final)

United States GDP (Q4, 2nd estimate)

United States Initial Jobless Claims

Thailand Manufacturing Prod YY (Jan)

Friday 24 February

Japan CPI (Jan)

United Kingdom GfK Consumer Confidence (Feb)

Singapore Manufacturing Output (Jan)

Germany Detailed GDP (Q4)

Germany GfK Consumer Sentiment (Mar)

United States Personal Income and Consumption (Jan)

United States Core PCE Price Index (Jan)

United States UoM Sentiment (Feb, final)

United States New Home Sales (Jan)

Canada Current Account C$ (Q4)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

February flash PMI

Flash PMI figures for February will be released on Tuesday and will be eagerly awaited for updates on economic conditions across major developed economies including the US, UK, eurozone, Japan and Australia. This comes after January PMI data revealed that global recession risk eased at the start of the year. While the eurozone and Japan saw signs of reviving growth, downturns cooled in US and remained only modest in the UK, collectively supportive of global business activity steadying. Overall business sentiment was also buoyed by lower inflation expectations and the reopening of the Chinese economy. As such, the February flash PMI data will be tracked to assess whether these trends persisted into the second month of the year and for further indications that the risks of recession have eased.

Americas: Fed minutes and comments, US Q4 2022 GDP (2nd est), January personal income and consumption, core PCE data, Canada CPI

Fed updates will be in abundance in the coming week with January's Fed Federal Open Market Committee (FOMC) meeting minutes and comments from various Fed members to watch. The January Fed FOMC meeting saw the central bank hike rates as expected but also acknowledge that inflation has been coming down, which enthused the market. It will be of interest to observe the Fed's positioning through the more extensive meeting minutes while to also hear the latest from Fed members, especially after the latest January CPI print. Meanwhile the second estimate of Q4 GDP and January core PCE data will be key US economic releases.

Europe: Eurozone CPI, consumer confidence figures, German Q4 GDP, CPI, ZEW survey, Ifo business climate

Beside the PMIs, data releases from Europe include the Ifo survey and inflation figures from the eurozone and Germany, albeit these being final figures. February eurozone flash consumer confidence numbers will also be watched.

Asia-Pacific: RBNZ, BoK meetings, China Loan Prime Rate, Japan CPI

In APAC, central bank meetings unfold in New Zealand and South Korea with a further tightening of interest rates not ruled out. Japan also updates January inflation figures after the au Jibun Bank Japan Composite PMI showed output price inflation having eased at the start of year.

Special reports:

Global Sector PMI Present Mixed Picture for Global Growth at the Start of 2023 - Jingyi Pan

Malaysia Records Buoyant GDP Growth in 2022 - Rajiv Biswas

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-february-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-february-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+20+February+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-february-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 20 February 2023 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-february-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+20+February+2023+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-february-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}