Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 17, 2020

Week Ahead Economic Preview: Week of 20 July 2020

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report (including Special Reports) please click on the 'Download Full Report' link.

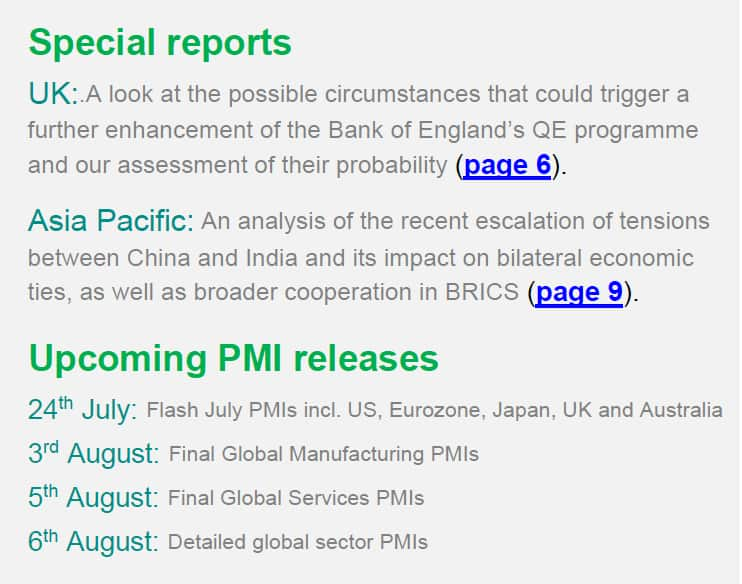

- Flash PMI surveys for July covering manufacturing and services for the US, Eurozone, UK, Japan and Australia

- US jobless claims and home sales

- South Korea GDP updates

- RBA meeting minutes and BoJ summary of opinions

Flash PMI updates for the US, Europe and Japan in the coming week will be scrutinised eagerly for further recovery signs at the start of the third quarter, though markets will also parse the survey data to gauge the degree to which the recent backtrack of lockdown measures in some countries affect their recovery paths.

Global business outlook surveys, compiled by IHS Markit, showed that sentiment regarding business activity in the year ahead fell, with profits set to be hit and hiring and investment projected to be stagnant over the coming year. While June PMI surveys hinted at a return of global business activity, adding to signs of a sharp rebound since the height of the COVID-19 lockdowns in April, underlying demand conditions remained frustratingly subdued, with global exports still acting as a key drag on the global economy. The current demand environment also reflects emergency stimulus measures, with fiscal support and employment support schemes temporarily buttressing consumption and job retention.

In the US, with the June PMI having shown signs of business activity nearing stabilisation, focus now shifts to the July flash survey data to gauge if a return to growth for the economy in the third quarter could be on the cards. In addition to IHS Markit PMI surveys, US data will include jobless claims, home sales and regional manufacturing surveys (page 3).

In Europe, the flash PMI data for the Eurozone, Germany, France, and the UK are accompanied by national sentiment surveys in Germany, France and Italy as well as retail sales and household finance figures in the UK (page 4).

In Asia Pacific, flash PMI data are supplemented by key official releases, including South Korea GDP updates, trade figures in Taiwan and Thailand, alongside employment data for Singapore, Hong Kong SAR, and Taiwan. Central bank documents in Australia and Japan will be keenly watched for policymakers' latest assessments of the economic outlook (page 5).

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-july-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-july-2020.html&text=Week+Ahead+Economic+Preview%3a+Week+of+20+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-july-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 20 July 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-july-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+20+July+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-july-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}