Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 18, 2020

Week Ahead Economic Preview: Week of 21 September 2020

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

- Flash PMI for the US, UK, Eurozone and Japan

- Policy decision in New Zealand and Thailand

- US durable goods orders

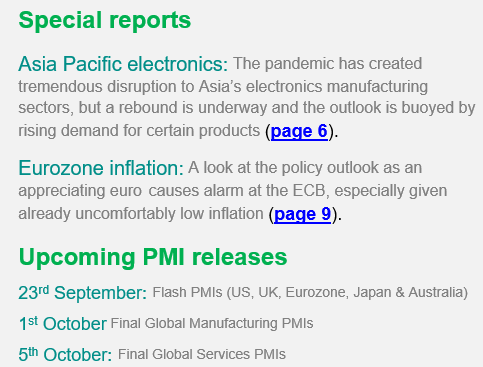

The coming week sees flash PMI surveys released for the US, Eurozone, Japan, UK and Australia, which will provide the first insights into how these economies have ended the third quarter. The August PMI data indicated a further strengthening of the rebound of global business activity from the collapse seen in the second quarter, but many consumer-facing sectors remained in decline and worries over renewed lockdown measures amid fresh waves of infections have hit activity, notably in Europe.

While IHS Markit's PMI surveys have signalled a strong US economic rebound in the third quarter so far, the manufacturing expansion remained lacklustre and consumer services providers continued to report falling activity as virus worries persisted. The September manufacturing and services data will therefore provide a valuable guide to whether momentum is being sustained or lost as we head into the fourth quarter. Additional insight will come from Kansas and Richmond Fed manufacturing surveys. The US also publishes durable goods orders data for August, alongside key housing market metrics for new and existing homes sales, as well as home prices (page 3).

Flash PMI data for the eurozone and UK will be especially eagerly awaited, not least by policymakers seeking a grasp on recovery momentum. While the UK led the PMI growth rankings in August, sub-indices from the survey hinted that the upturn lacked legs, notably with a steepening loss of jobs being reported. Meanwhile, rising COVID infection rates caused renewed economic contractions in Italy and Spain during August, according to the PMIs, raising fears that the eurozone's recovery is fading. IFO and other national sentiment indices are also released (page 4).

Over in Asia Pacific, mainland China's industrial profits are issued as well as industrial production data for Singapore and Taiwan, plus trade numbers for Taiwan, Hong Kong SAR and Thailand. As these data only show the situation to August, it's the timelier PMI numbers for Japan and Australia for September that will likely steer sentiment on recovery trajectories for the region. Policy meetings are meanwhile convened in New Zealand and Thailand (more on page 5).

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-september-2020.html&text=Week+Ahead+Economic+Preview%3a+Week+of+21+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-september-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 21 September 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+21+September+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}