Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 23, 2024

Week Ahead Economic Preview: Week of 26 August 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US core PCE, eurozone inflation and China PMI highlights

Inflation readings out of the US and eurozone will be the highlights in the coming week as the market seeks near-term rates guidance. GDP updates will also be eagerly awaited, notably including from the US, Canada, Germany and India. A more up-to-date indication of economic conditions in mainland China will meanwhile be provided by the NBS PMI.

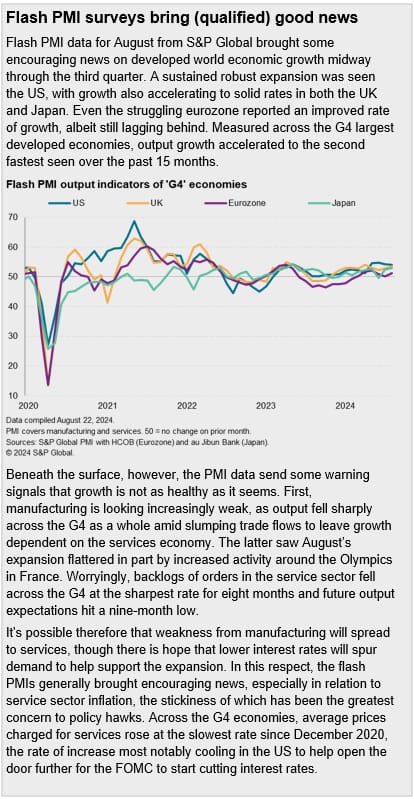

The attention turns back to economic data post the Jackson Hole Symposium, with July's US core PCE data to be especially keenly assessed. This follows prior CPI indications of softening inflationary pressures in the US, while the latest August flash PMI further showed that selling price inflation dipped to a seven-month low to hint at lower readings across official inflation gauges in the coming months. An easing inflation trend, alongside a weakening jobs trend in August (according to flash PMI data) are expected to be supportive of the Fed lowering rates, given recent FOMC meeting minutes showed members were generally supportive of a cut if the data behaved. Uncertainty regarding the size of the September cut remains, but signs of still-solid growth conditions observed via the latest flash PMI err towards 25 rather than 50 basis points. Additionally, the US also updates consumer confidence, personal income and spending data that will help shape the inflation picture and thereby steer monetary policy expectations for the market.

Over in the eurozone, preliminary August inflation figures will also offer insights into the European Central Bank's path forward as expectations gather for a September rate cut. The HCOB Flash Eurozone PMI signalled falling cost inflation, notably in the keenly-watched services sector where the input prices gauge hit a 40-month low.

Following the release of August flash PMI data for major developed economies and India, mainland China's PMI from the National Bureau of Statistics will be due over the weekend ahead of worldwide manufacturing and services PMI releases at the start of September. Growth and inflation conditions updates will be key as central bankers around the world contemplate rate cuts in line with the trajectory expected for the US Fed.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-august-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-august-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+26+August+2024+%7c+IHS+Markit+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-august-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 26 August 2024 | IHS Markit &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-august-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+26+August+2024+%7c+IHS+Markit+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-august-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}