Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 26, 2022

Week Ahead Economic Preview: Week of 26 September 2022

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMIs last week provided a much-anticipated insight into the macroeconomic environment for the US, UK, Eurozone and Australia. The flash Japan PMI released this week completes the set while PMI data for mainland China - released at the end of the week - will be the first of September's final manufacturing survey releases. The US will once again be in the spotlight with GDP, consumer sentiment, durable goods orders, housing market and jobless claims data on the agenda. Sentiment data for Germany, France, South Korea, Italy and the Eurozone will also be eyed.

The latest flash PMIs revealed promising signs for the US, where the fall in output eased notably from August amid cooler price pressures, while in Australia output growth quickened. Conditions in Europe were more concerning, however, with the downturn deepening in both the Eurozone and the UK and price pressure showing greater persistence. Concerns over the availability and prices of energy have added to fears of energy rationing in Europe, with an emergency euro area energy meeting pencilled in for Friday, alongside unemployment and inflation releases.

In the UK, final Q2 GDP figures will be announced where sharp moderations in growth are expected by markets. Last week, the BoE hiked rates by another 50 bps, the UK government has since announced large stimulus packages to boost UK growth. Nevertheless, sterling and gilts have plunged, concerned about the effectiveness and cost of the government's new measures.

In the US, last week saw the FOMC hike by another 75 bp, pushing US interest rates at a 14-year high. This week, US durable goods orders will likely reveal a 1.1% contraction. Final Q2 GDP numbers are also due, with a 0.6% contraction forecast, which follows a 1.6% fall in Q1. The downward trend is expected continue with inflation near 40-year peaks. Sentiment and PCE price data on Friday will bring an end to this week's US data releases.

Also watch out for German sentiment data, Japanese industrial production figures, China's industrial profits and Australian retail sales.

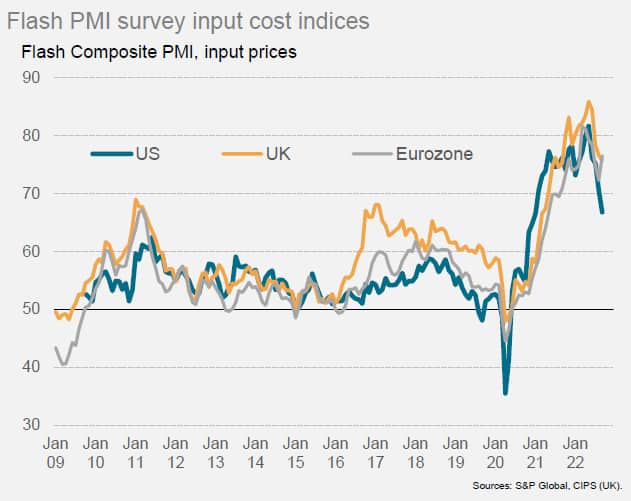

Inflation trends diverge

Flash PMI survey data showed a broad-based economic malaise across Europe and the US in September. Output trends worsened in the Eurozone and UK, suggesting both economies are in recession, with forward-looking indicators such as new orders and future expectations pointing to worsening trends in the fourth quarter. However, while the output gauges for US manufacturing and services also remained in contraction territory, rounding off one of the worst quarters snice the global financial crisis, the rate of contraction moderated.

This divergence between worsening output trends in Europe and signs of the downturn easing in the US can be at least in part traced to differences in inflationary pressures.

In particular, input cost inflation accelerated in the Eurozone and remained worryingly high in the UK, the latter notably seeing a sharp upward spike in manufacturing raw material prices. In contrast, input cost inflation in the US cooled sharply to a 20-month low. These cost differentials point to an easing in the impact of the recent cost of living crisis in the US while the situation seems to be worsening in Europe, where energy prices have soared far higher than in the US. Notably, the only sign of improved conditions in Europe was seen in France, where the government has taken the greatest action in softening the blow of soaring European energy costs on households.

Key diary events

Monday 26 September

S&P Global au Jibun Flash Japan PMI (Sep)

Singapore Industrial Production (Aug)

Germany Ifo Business Climate (Sep)

Hong Kong Balance of Trade (Aug)

Mexico Economic Activity (Jul)

United States Chicago Fed National Activity Index (Aug)

South Korea Consumer Confidence (Sep)

Tuesday 27 September

China Industrial Profits YTD (Aug)

France Unemployment Benefits Claims (Aug)

Brazil Copom Meeting minutes

Mexico Balance of Trade (Aug), Unemployment Rate (Aug)

United States Durable Goods Orders (Aug), House Price Index (Jul), CB Consumer Confidence (Sep)

Wednesday 28 September

BoJ Monetary Policy Meeting Minutes, Coincident Index (Jul)

Australia Retail Sales (Aug)

Germany GfK Consumer Confidence (Oct)

France Consumer Confidence (Sep)

Thailand Interest Rate Decision

Italy Business Confidence (Sep), Industry Sales (Jul)

United Sates MBA Mortgage Application (Sep), Goods Trade Balance (Aug), Retail Inventories Ex Autos (Aug), Pending Home Sales (Aug)

Russia Unemployment Rate (Aug)

South Korea Business Confidence (Sep)

Thursday 29 September

Japan Foreign Bond Investment (Sep)

New Zealand ANZ Business Confidence (Sep), Building Permits (Aug)

Thailand Industrial Production (Aug)

Spain Inflation Rate (Sep), Business Confidence (Sep)

Euro Area Consumer Confidence (Sep)

Germany Inflation Rate (Sep)

Canada Average Weekly Earnings (Jul), GDP (Jul)

United States GDP (Q2), Jobless Claims (Sep), PCE Prices (Q2), GDP Price Index (Q2)

Friday 30 September

Japan Unemployment Rate (Aug), Industrial Production (Aug), Retail Sales (Aug)

Eurozone Emergency Energy Meeting, Inflation Rate (Sep), Unemployment Rate (Aug)

China Caixin Manufacturing PMI (Sep)

Indonesia Inflation Rate (Sep)

Japan Consumer Confidence (Sep), Housing Starts (Aug)

Germany Retail Sales (Aug), Unemployment Change (Sep)

United Kingdom GDP (Q2), Mortgage Approvals (Aug)

France Inflation Rate (Sep)

Italy Unemployment Rate (Aug), Inflation Rate (Sep)

Poland Inflation Rate (Sep)

United States Core PCE Price (Aug), Michigan Consumer Sentiment (Sep)

What to watch

Americas: US National activity Index, Durable goods orders, Sentiment and Canada GDP

A number of releases for the US will add colour to last week's flash PMI releases. US durable goods orders will reveal the impact of high inflation on demand after flash PMIs revealed a struggling manufacturing sector, albeit with easing supply delays. The Chicago Fed activity index - out Monday - is also likely to indicate a subdued economic environment. The week ends with the University of Michigan consumer sentiment data where the recovery is expected to continue from June's recent low, preceded by Conference Board data on the Monday.

Elsewhere, policymakers in Canada will watch GDP readings for July with a particularly close eye. Final Q2 GDP figures for the US will likely confirm a mild decline.

Europe: Germany, France, Italy sentiment data, Spain, France, Italy and Eurozone Inflation, UK GDP

The ongoing war in Ukraine and the profound impacts on European nations will likely have continued to weigh on sentiment. Data for Germany, France and Italy will be followed by markets to gauge an understanding in confidence.

Inflation figures will be widely anticipated, however, with attention very much focusing on the Eurozone. The intensification of the war and the direct and indirect impact on energy prices will likely push the latest inflation figure to 9.4% in the Eurozone (edging up from 9.1%).

With the pound coming under intense pressure, UK GDP could be another trigger for market selling if the data disappoint.

Asia-Pacific: Thailand Interest rate decision, Australia retail sales, Indonesia inflation data and China PMI

Thailand's central bank will convene where gradual rate hikes are expected. With inflation at a 14-year high a relatively hawkish stance is expected with markets expecting a 75 bp hike. Industrial production data for Thailand will also be released this week.

Elsewhere, S&P Global China manufacturing PMI will provide the first insight into manufacturing conditions on China's mainland. We forecast 3.3% YoY growth for 2022. China industrial profits data on Tuesday should give an indication on the sectors performance.

Also watch out for Australia retail sales data, Japan consumer sentiment, and Indonesia inflation data.

Special reports:

Eurozone | Chris Williamson

Malaysia | Rajiv Biswas

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-september-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-september-2022.html&text=Week+Ahead+Economic+Preview%3a+Week+of+26+September+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-september-2022.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 26 September 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-september-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+26+September+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-september-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}