Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 25, 2020

Week Ahead Economic Preview: Week of 28 September 2020

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

- Worldwide manufacturing PMI releases

- US jobs report

- First presidential debate

Highlights of the coming week includes US non-farm payrolls, worldwide manufacturing PMI surveys and the first of the US presidential debates.

The first presidential election debate between Donald Trump and Joe Biden will help guide market expectations and likely be framed by topics relating to the COVID-19 pandemic and the ensuing economic crisis, as well as the civil protests, Supreme Court nominations and the integrity of the election.

The latest data on the US economy have meanwhile shown a strong rebound in the third quarter, but recent flash PMI numbers have hinted at a slowing in the pace of expansion both in the US and globally. This slowing is expected to be corroborated by a further cooling in the rate of healing of the labour market when non-farm payrolls are updated on Friday. Recent data showed 1.4 million jobs added in August, but that still left the total number in work some 11.5 million below the pre-pandemic peak. Current consensus estimates suggest a further 875k jobs were added in September, with the jobless rate edging down from 8.4% to 8.3%, but that will be the smallest monthly jobs gain seen this side of the pandemic, and will add further to calls for additional support to the recovery (see page 3).

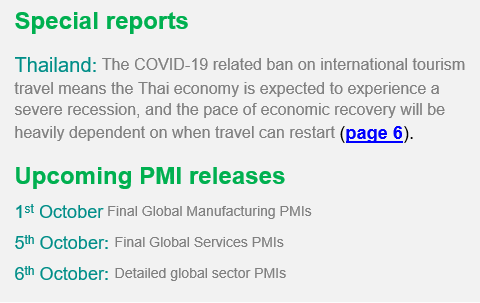

A comprehensive insight into the wider manufacturing recovery will meanwhile be provided by the global PMI surveys. These showed worldwide manufacturing output growth hitting a two-and-a-half year high in August, with global trade now also showing signs of stabilising. However, many countries - notably in Asia - continued to struggle amid still weak export conditions linked to the pandemic. While the flash PMIs for September indicated that further manufacturing gains helped offset a renewed weakening of growth in the service sector, the final data will be eyed in particular for signs that Asian producers outside of China are also starting to recover. China's PMI data will also be important to watch, given China's weight in global manufacturing and its earlier start on the road to recovery from COVID-19 (page 5).

In Europe, the PMIs are accompanied by official unemployment and inflation data, which will be scrutinised closely amid growing expectations of additional stimulus from the ECB (page 4).

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-september-2020.html&text=Week+Ahead+Economic+Preview%3a+Week+of+28+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-september-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 28 September 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+28+September+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}