Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 30, 2023

Week Ahead Economic Preview: Week of 30 October 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Key central bank meetings in the US, UK and Japan will be the highlights next week, alongside worldwide manufacturing and services PMI releases over the next two weeks. Several tier-1 economic releases are also expected, including non-farm payrolls in the US, while GDP figures are due from various parts of the world including the Eurozone, Canada, Taiwan and Hong Kong SAR.

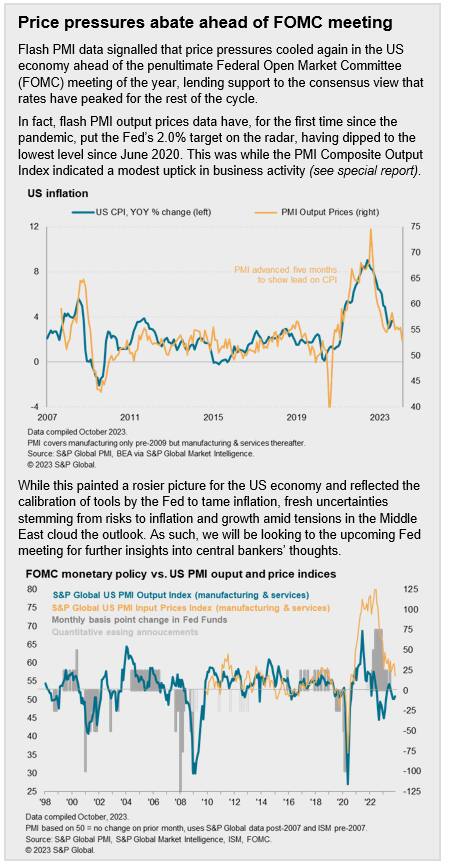

Next week's US FOMC meeting will be the highlight of the week. This comes after convergence between economic indicators and equity market performance took place this week, with the October flash US PMI outlining improvements in economic performance (see special report), while the Q3 earnings season took some air out of the elevated tech sector that had buoyed equity market prices in recent months. Between increased market jitters over the impact of tensions in the Middle East and more positive flash PMI indications of easing price pressures, the Fed's views will be closely watched for guidance on their expected path forward for interest rates. The post-meeting release of the US October labour market report will also add to the equation, with expectations of slowing job additions following signals from the flash PMI. Any acceleration of wage growth will meanwhile complicate the situation.

Separately, the Bank of Japan meeting will also be in the spotlight amid expectations of tweaks to monetary policy settings, specifically the yield-curve control program. While easing price pressures in Japan should help to allay fears of any sooner-than-expected end to its negative interest rate policy, recent bond market volatility adds pressure for the BOJ to act. In contrast, the Bank of England is forecast to hold the bank rate steady at what is regarded as the peak level, according to consensus. This was as flash PMI data signalled further economic contraction, though uncertainties have started to gather again on the inflation front.

Finally, PMI data will be released over the next two weeks for detailed insights into economic conditions at the start of the fourth quarter. Following the flash PMI releases, which highlighted stalling growth in Japan and further downturns in Europe, APAC region performance will be closely watched, especially mainland China's performance.

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-october-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-october-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+30+October+2023+%7c+IHS+Markit+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-october-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 30 October 2023 | IHS Markit &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-october-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+30+October+2023+%7c+IHS+Markit+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-october-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}