Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 02, 2020

Week Ahead Economic Preview: Week of 5 October 2020

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

- Worldwide services PMI releases

- Industrial production and trade updates

- RBA meeting, FOMC minutes

While official data such as trade and industrial production released in the coming week will give important steers as to the strength of economic rebounds around the world midway through the third quarter, service sector PMI surveys will add further insights into how these recoveries have been sustained into September. While manufacturing remained resilient globally in September, the worry is that consumer-facing sectors are being hit once again by tightening COVID-19 restrictions in many countries.

Global detailed sector PMI numbers will also be updated to reveal which industries are being the hardest hit from the continuing virus crisis.

An eye will also be kept on the US presidential election, with the week seeing Pence and Harris face off in the Vice Presidential debate, while monetary policy watchers will monitor the Reserve Bank of Australia meeting and FOMC minutes.

In the US, PMI data will reveal the extent to which the non-manufacturing sector has fared amid the ongoing pandemic and uncertainty caused by an ever-closer presidential election. Flash PMIs showed the economy maintaining robust momentum, but also found future growth expectations to have waned amid growing concerns about the outlook, especially in the service sector. Trade numbers will also be eagerly awaited after the last figures showed the US deficit rising to the highest since 2008, as will the minutes from the last FOMC meeting. The latter follows a meeting in which policymakers showed increased dovishness in relation to long-term low interest rates (see page 3).

In Europe, a picture of robust UK growth has contrasted with a eurozone economy slowing to near stagnation, according to the September flash PMIs. Final service sector PMI numbers will add more colour to the emerging picture, as will industrial production numbers for Germany, Italy, France and Spain, as well as a GDP update for the UK (page 4).

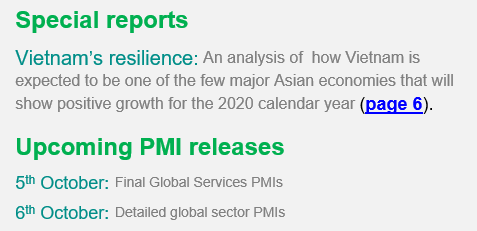

In Asia, we'll be looking for clues as to the strength of the Chinese and Japanese economic recoveries via services PMIs. Detailed PMI numbers for Asia as a whole, export data for a number of countries and Japan's machinery orders are also updated (page 5).

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-5-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-5-october-2020.html&text=Week+Ahead+Economic+Preview%3a+Week+of+5+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-5-october-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 5 October 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-5-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+5+October+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-5-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}