Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 03, 2020

Week Ahead Economic Preview: Week of 6 July 2020

Join us in the PMI by IHS Markit Global Webcast (8 July) to get the latest insights into the economic impact of the COVID-19 pandemic from the world's leading survey data.

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report (including Special Reports) please click on the 'Download Full Report' link.

- Global and US service sector PMI surveys

- Eurozone retail sales and industrial output

- Central bank meetings in Australia and Malaysia

- Global business outlook survey

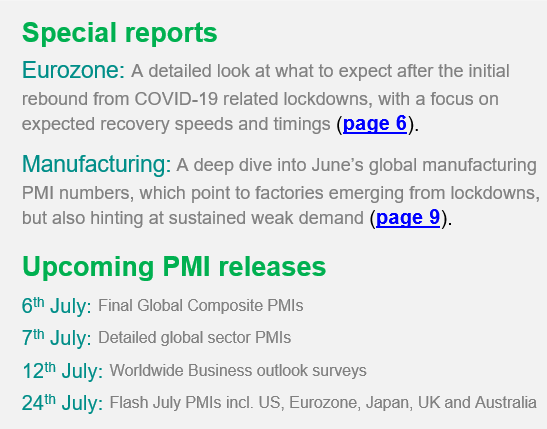

After manufacturing PMIs showed encouraging signs of factories emerging from lockdowns (see page 9), further clues as to economic recovery paths will be sought from various key data releases. These include the global PMI, US non-manufacturing data, eurozone industrial output and retail sales, plus detailed global sector PMIs. The latter have provided unique insights into which companies have seen the strongest downturns during the pandemic, with tourism, recreation and transport so far suffering the most. IHS Markit also updates its business outlook survey, which looks at business expectations for the year ahead across its PMI panels around the world. Central bank action comes from Australia and Malaysia.

In the US, the focus shifts to the services and non-manufacturing PMIs via IHS Markit and ISM respectively. With the flash PMI for the former having already shown signs of improvement in June, and ISM's factory gauge having beaten expectations, markets will be looking for some positive numbers. Jobless claims will also be in the limelight amid worries about the economic impact of lockdowns being reintroduced. Vast swathes of the US have re-instigated lockdowns as COVID-19 infection rates hit new record highs (page 3).

Retail sales and industrial production for the eurozone will be eyed to gauge the extent of the rebound from April's lockdowns. PMI data have already hinted at strong monthly gains in the official gauges, and early indicators such as German and French retail sales have bounced higher. Construction PMI numbers will also give additional clues as to building activity across Europe's largest economies in June (page 4). See our special 'Eurozone: Beyond the Bounce' report (page 6).

In Asia, central bank meetings in Australia and Malaysia will be keenly watched for policymakers' latest assessments of the economic outlook. Both have unleashed stimulus to fight pandemic-fuelled downturns, but the latest economic data are showing improvements which could reduce appetite for further measures just yet. China's credit and money supply data will also be important to watch (page 5).

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-july-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-july-2020.html&text=Week+Ahead+Economic+Preview%3a+Week+of+6+July+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-july-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 6 July 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-july-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+6+July+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-july-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}